- Sweden

- /

- Medical Equipment

- /

- OM:PAX

Reflecting on Paxman's (STO:PAX) Share Price Returns Over The Last Year

Investing in stocks comes with the risk that the share price will fall. And there's no doubt that Paxman AB (publ) (STO:PAX) stock has had a really bad year. The share price has slid 57% in that time. Longer term investors have fared much better, since the share price is up 25% in three years. The falls have accelerated recently, with the share price down 22% in the last three months.

See our latest analysis for Paxman

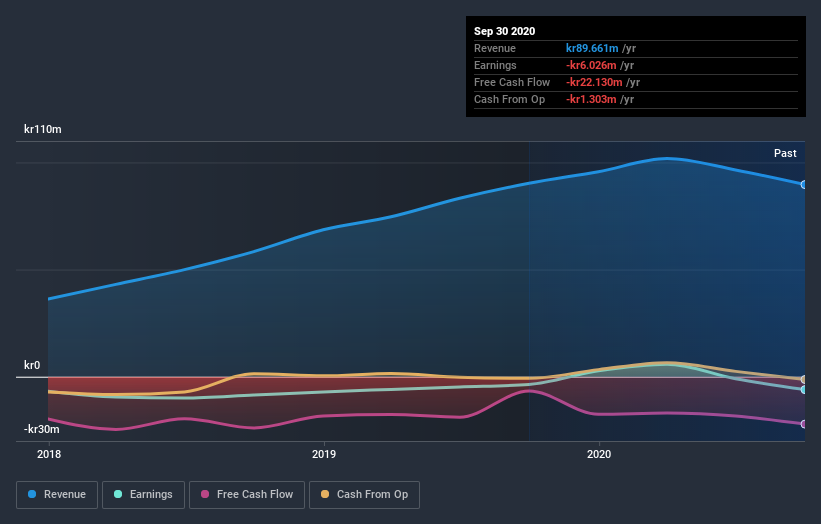

Because Paxman made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Paxman's revenue didn't grow at all in the last year. In fact, it fell 0.7%. That looks pretty grim, at a glance. In the absence of profits, it's not unreasonable that the share price fell 57%. Fingers crossed this is the low ebb for the stock. We don't generally like to own companies with falling revenues and no profits, so we're pretty cautious of this one, at the moment.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

This free interactive report on Paxman's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

The last twelve months weren't great for Paxman shares, which cost holders 57%, while the market was up about 16%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Fortunately the longer term story is brighter, with total returns averaging about 8% per year over three years. Sometimes when a good quality long term winner has a weak period, it's turns out to be an opportunity, but you really need to be sure that the quality is there. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 4 warning signs with Paxman (at least 2 which are significant) , and understanding them should be part of your investment process.

We will like Paxman better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SE exchanges.

If you decide to trade Paxman, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About OM:PAX

Paxman

Develops and sells Paxman scalp cooling system to minimize hair loss in connection with chemotherapy treatment worldwide.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success