European Growth Stocks With High Insider Ownership For September 2025

Reviewed by Simply Wall St

As European markets grapple with concerns over U.S. Federal Reserve independence, renewed tariff uncertainties, and political instability, the pan-European STOXX Europe 600 Index recently ended 1.99% lower. In this environment of heightened volatility and economic uncertainty, growth companies with high insider ownership can be appealing as they often indicate strong internal confidence in the business's future prospects and alignment with shareholder interests.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Pharma Mar (BME:PHM) | 11.8% | 44.2% |

| MilDef Group (OM:MILDEF) | 13.7% | 73.9% |

| Marinomed Biotech (WBAG:MARI) | 29.7% | 20.2% |

| KebNi (OM:KEBNI B) | 38.4% | 63.7% |

| Elliptic Laboratories (OB:ELABS) | 24.4% | 97.5% |

| CTT Systems (OM:CTT) | 17.5% | 37.9% |

| Circus (XTRA:CA1) | 24.5% | 72.6% |

| CD Projekt (WSE:CDR) | 29.7% | 42.7% |

| Bonesupport Holding (OM:BONEX) | 10.4% | 59.7% |

| Bergen Carbon Solutions (OB:BCS) | 12% | 64.6% |

Here's a peek at a few of the choices from the screener.

Medicover (OM:MCOV B)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Medicover AB (publ) offers healthcare and diagnostic services in Poland, Sweden, and internationally, with a market cap of SEK40.99 billion.

Operations: The company's revenue is primarily derived from its Healthcare Services segment, which generated €1.58 billion, and its Diagnostic Services segment, which contributed €703.20 million.

Insider Ownership: 11.2%

Earnings Growth Forecast: 28.7% p.a.

Medicover demonstrates strong growth potential, with earnings forecasted to grow significantly at 28.72% annually, outpacing the Swedish market. Insider ownership remains high with more shares bought than sold recently. The company is actively seeking acquisitions to enhance its strategic position despite a high current ratio. Recent financial results show robust performance, with a notable increase in net income and sales for the first half of 2025 compared to the previous year.

- Take a closer look at Medicover's potential here in our earnings growth report.

- Our comprehensive valuation report raises the possibility that Medicover is priced higher than what may be justified by its financials.

Smart Eye (OM:SEYE)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Smart Eye AB (publ) specializes in developing AI technology solutions that analyze and predict human behavior across various regions, with a market cap of SEK3.11 billion.

Operations: Smart Eye AB's revenue is primarily derived from its Behavioral Research segment, accounting for SEK249.10 million, and its Automotive Solutions segment, contributing SEK112.45 million.

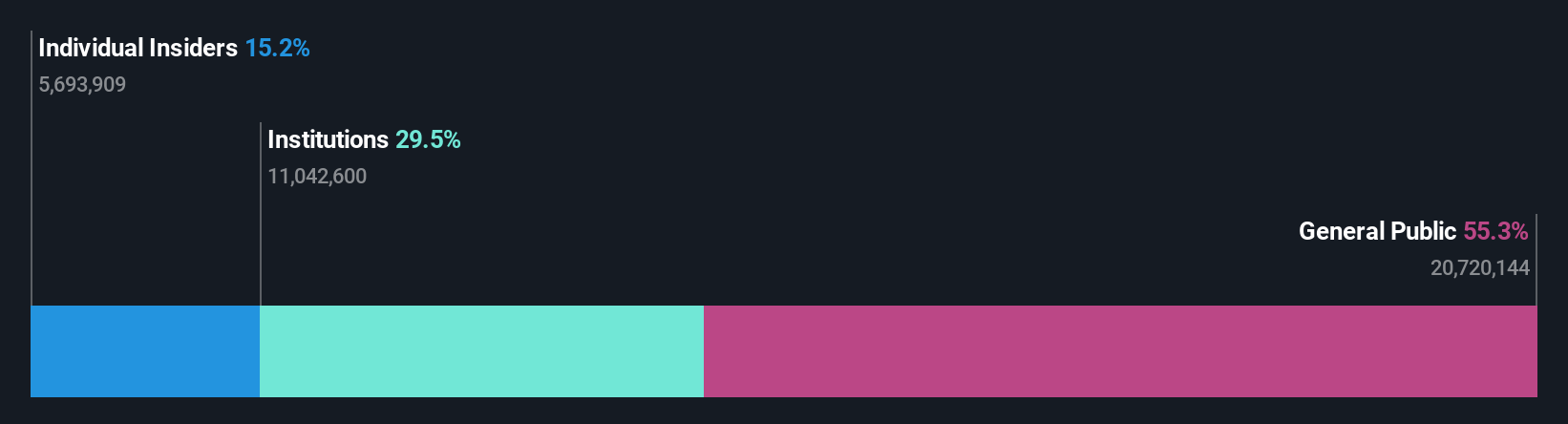

Insider Ownership: 15.2%

Earnings Growth Forecast: 104.2% p.a.

Smart Eye's revenue is forecasted to grow at 46.1% annually, significantly outpacing the Swedish market. The company recently reported a reduced net loss for Q2 2025, reflecting improved financial performance. Recent product innovations like AI ONE and an upgraded AIS system highlight its technological advancements in driver monitoring systems. Despite having less than a year's cash runway, Smart Eye trades at 61% below estimated fair value and aims for profitability within three years, with no recent insider trading activity noted.

- Click here to discover the nuances of Smart Eye with our detailed analytical future growth report.

- Our expertly prepared valuation report Smart Eye implies its share price may be lower than expected.

Stratec (XTRA:SBS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Stratec SE, with a market cap of €320.92 million, provides automation solutions for in-vitro diagnostics and life science companies in Germany, the European Union, and internationally.

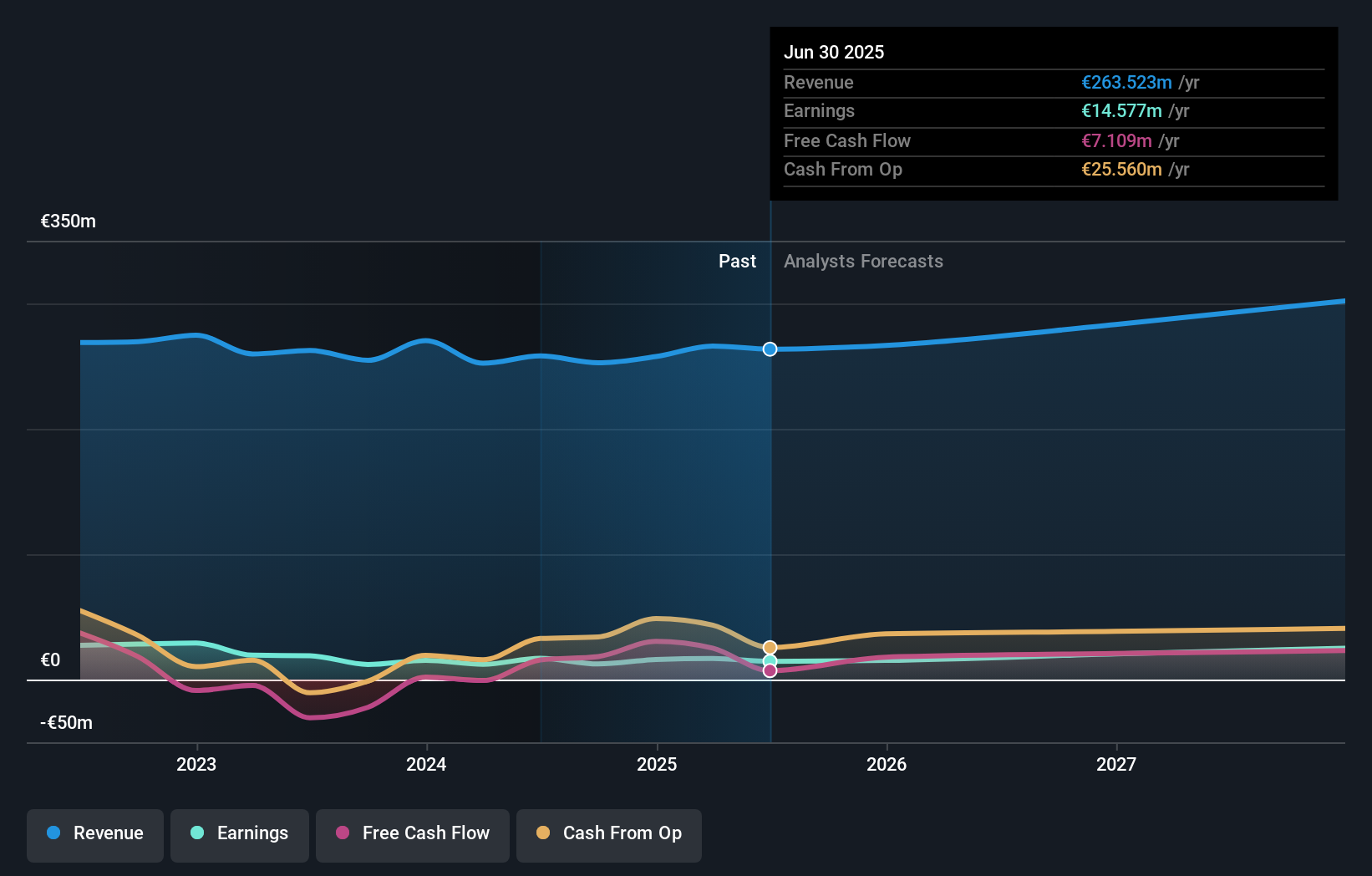

Operations: The company's revenue segment includes €263.52 million from automation solutions for highly regulated laboratories.

Insider Ownership: 30.9%

Earnings Growth Forecast: 21.5% p.a.

Stratec SE's earnings are projected to grow at 21.5% annually, surpassing the German market average. Although revenue growth is forecasted at 6.6% per year, it remains below 20%. The company trades at a significant discount to its estimated fair value but has debt concerns with operating cash flow coverage. Recent earnings showed a decline in net income despite increased sales, and the dividend was raised to €0.60 per share for 2024, reflecting shareholder engagement.

- Get an in-depth perspective on Stratec's performance by reading our analyst estimates report here.

- According our valuation report, there's an indication that Stratec's share price might be on the cheaper side.

Seize The Opportunity

- Click this link to deep-dive into the 216 companies within our Fast Growing European Companies With High Insider Ownership screener.

- Looking For Alternative Opportunities? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:SEYE

Smart Eye

Develops human insight artificial intelligence (AI) technology solutions that understand, support, and predict human behavior in the Nordics countries, the rest of Europe, North America, Asia, and internationally.

High growth potential and fair value.

Similar Companies

Market Insights

Community Narratives