- Sweden

- /

- Healthcare Services

- /

- OM:MCOV B

Does Medicover’s (OM:MCOV B) MRD Assay Data Shift the Innovation Narrative in Cancer Diagnostics?

Reviewed by Sasha Jovanovic

- Medicover recently announced additional results from the ongoing DART clinical study at Oslo University Hospital, highlighting the strength of its hybrid capture-based, tumour-agnostic MRD assay for minimal residual disease detection in unresectable stage III non-small cell lung cancer.

- The study’s findings showed that ctDNA detection could predict disease progression up to 7.4 months earlier than imaging, earning recognition with a Best Poster award at the European Society for Medical Oncology Congress in Berlin.

- We will now examine how the strengthened clinical data for Medicover Genetics’ MRD assay potentially enhances the company's investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Medicover Investment Narrative Recap

To be a shareholder in Medicover today, you need to believe in its ability to capitalize on rising healthcare demand in Central and Eastern Europe while delivering returns from specialized diagnostics like its MRD assay. The recent DART study findings boost the company’s innovation profile but do not materially alter immediate revenue or regulatory catalysts, nor do they outweigh current financial risks tied to expansion and market exposure. The critical short-term catalyst remains Medicover's operational execution and successful integration of new services, while heavy leverage and regional reimbursement risk are present business threats.

Against this backdrop, recent Q2 2025 earnings results stand out, showing strong year-over-year revenue and profit growth. These financial results provide reassurance that Medicover is managing near-term challenges effectively, and any positive momentum from advancements in diagnostics like the MRD assay could further support this operational trajectory.

However, it's important to recognise that in contrast to clinical progress, investor attention should not overlook the implications of Medicover’s high leverage and capital-intensive expansion plans...

Read the full narrative on Medicover (it's free!)

Medicover's outlook anticipates €3.2 billion in revenue and €146.5 million in earnings by 2028. This is based on an assumed 11.8% annual revenue growth rate and a €103.1 million increase in earnings from the current €43.4 million.

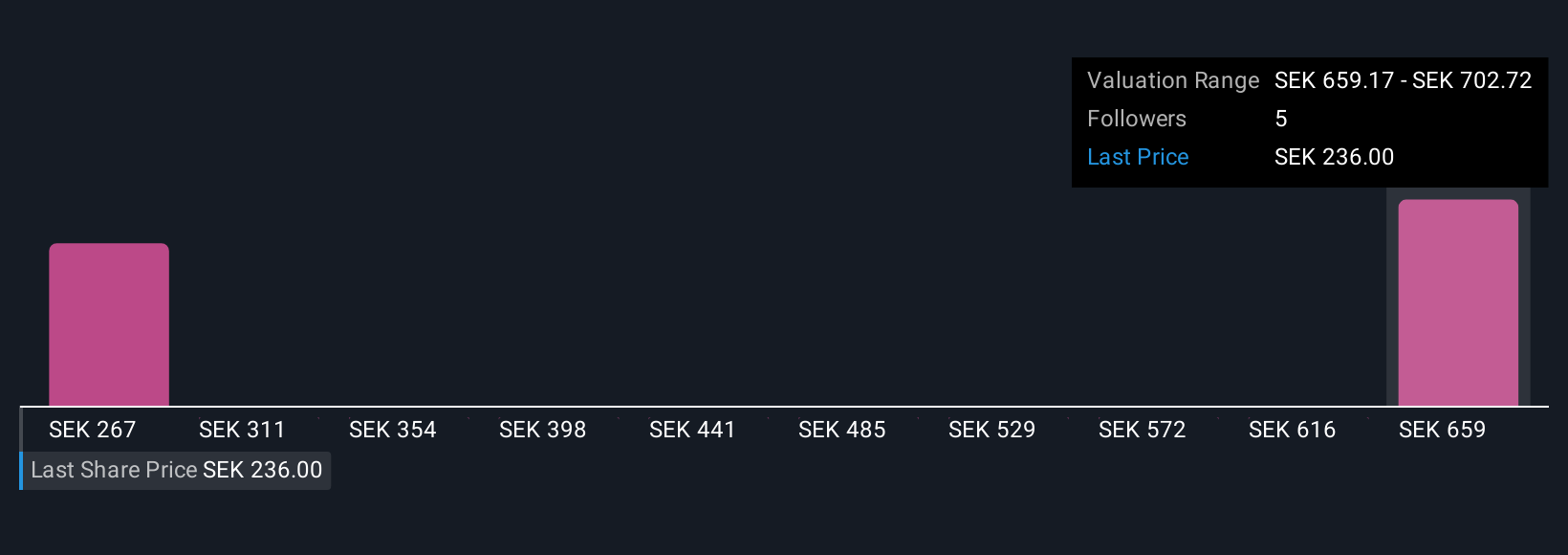

Uncover how Medicover's forecasts yield a SEK267.22 fair value, a 3% upside to its current price.

Exploring Other Perspectives

Fair value estimates from the Simply Wall St Community span from SEK267 to SEK701, reflecting just two distinct retail perspectives. While some see robust long-term growth potential, ongoing regional regulatory changes and reimbursement risks could impact near-term margins and add uncertainty for all investors.

Explore 2 other fair value estimates on Medicover - why the stock might be worth over 2x more than the current price!

Build Your Own Medicover Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Medicover research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Medicover research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Medicover's overall financial health at a glance.

Looking For Alternative Opportunities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:MCOV B

Medicover

Provides healthcare and diagnostic services in Poland, Sweden, and internationally.

High growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives