- Sweden

- /

- Medical Equipment

- /

- OM:IMP A SDB

Can Implantica’s (OM:IMP A SDB) Narrowing Losses Shift the Narrative on Long-Term Sustainability?

Reviewed by Sasha Jovanovic

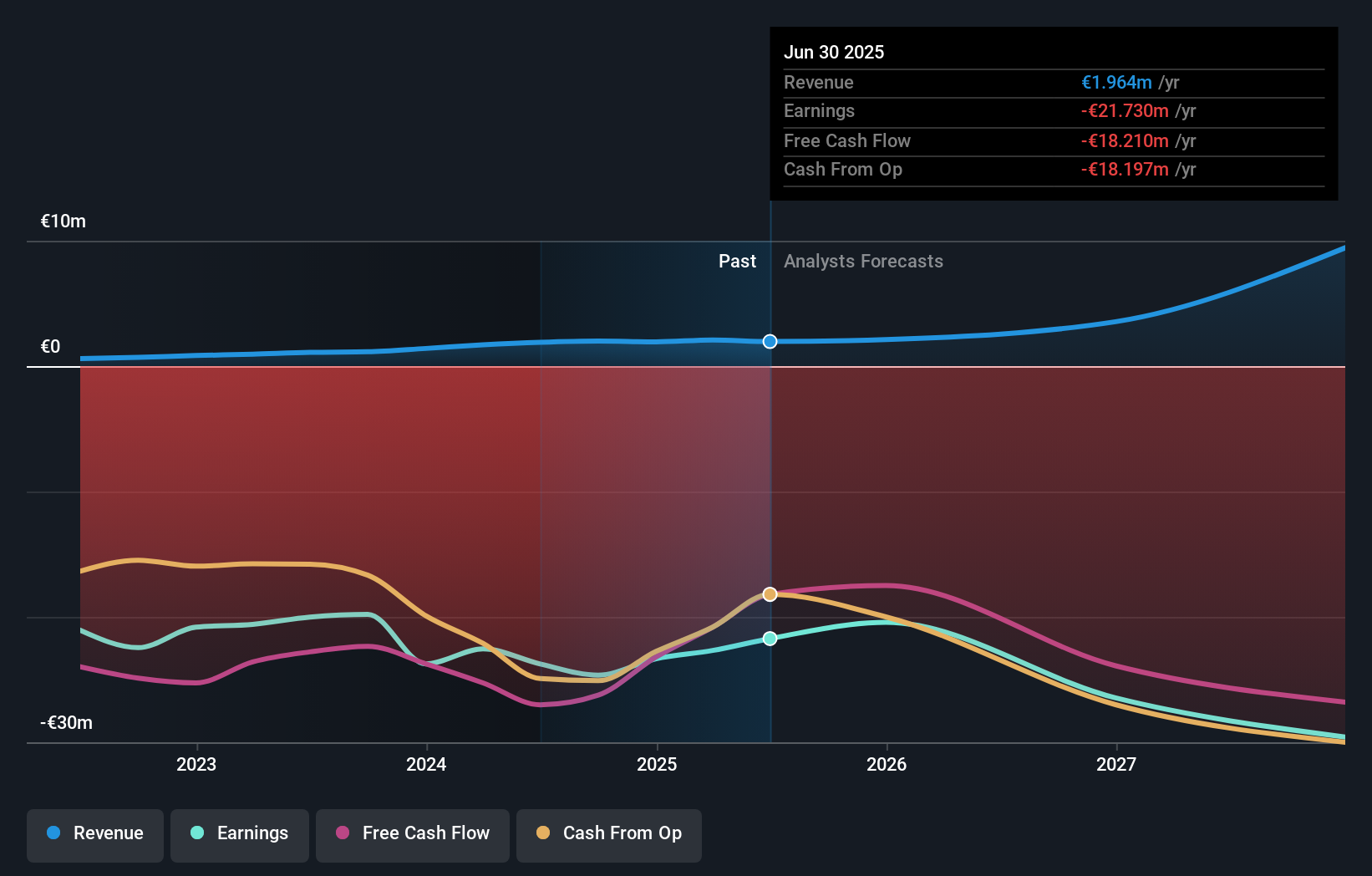

- Implantica AG recently released its third quarter earnings for 2025, reporting sales of €365,000 and a reduced net loss of €4.34 million compared to the same period last year.

- This reduction in losses alongside modest sales growth may indicate progress in the company’s operational efficiency even in a challenging revenue environment.

- Next, we'll explore how narrowing quarterly losses may impact Implantica’s investment narrative and outlook for financial sustainability.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

What Is Implantica's Investment Narrative?

For investors to feel comfortable as shareholders of Implantica, you really have to believe in the commercial potential of its flagship product, RefluxStop®, and trust management’s ability to achieve broad medical adoption while controlling costs. The company’s latest quarterly update showed incremental sales growth and a narrowing net loss, which could signal some operational improvement, but also highlighted the ongoing challenge of meaningful revenue generation given expenses remain high relative to sales. This news likely won't materially change the main short-term catalysts, securing FDA approval for RefluxStop® in the U.S. and broader European adoption both remain key. However, the step down in losses may slightly ease immediate financing risk. That said, risks around unprofitability, high valuation multiples, and volatile share price action are still front and center, even after this earnings release. The recent news fits in as a small but positive sign for operational progress, but doesn’t materially improve the challenge of scaling revenue or achieving break-even in the near term.

In contrast, significant questions remain about cash burn and future funding needs.

Our valuation report unveils the possibility Implantica's shares may be trading at a premium.Exploring Other Perspectives

Explore another fair value estimate on Implantica - why the stock might be worth as much as 42% more than the current price!

Build Your Own Implantica Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Implantica research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free Implantica research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Implantica's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:IMP A SDB

Implantica

Engages in the research and distribution of medical implants in Switzerland.

Flawless balance sheet with slight risk.

Market Insights

Community Narratives