- Sweden

- /

- Healthcare Services

- /

- OM:EQL

EQL Pharma (OM:EQL): 59.6% Earnings Growth Forecast Puts Margin Narrative to the Test

Reviewed by Simply Wall St

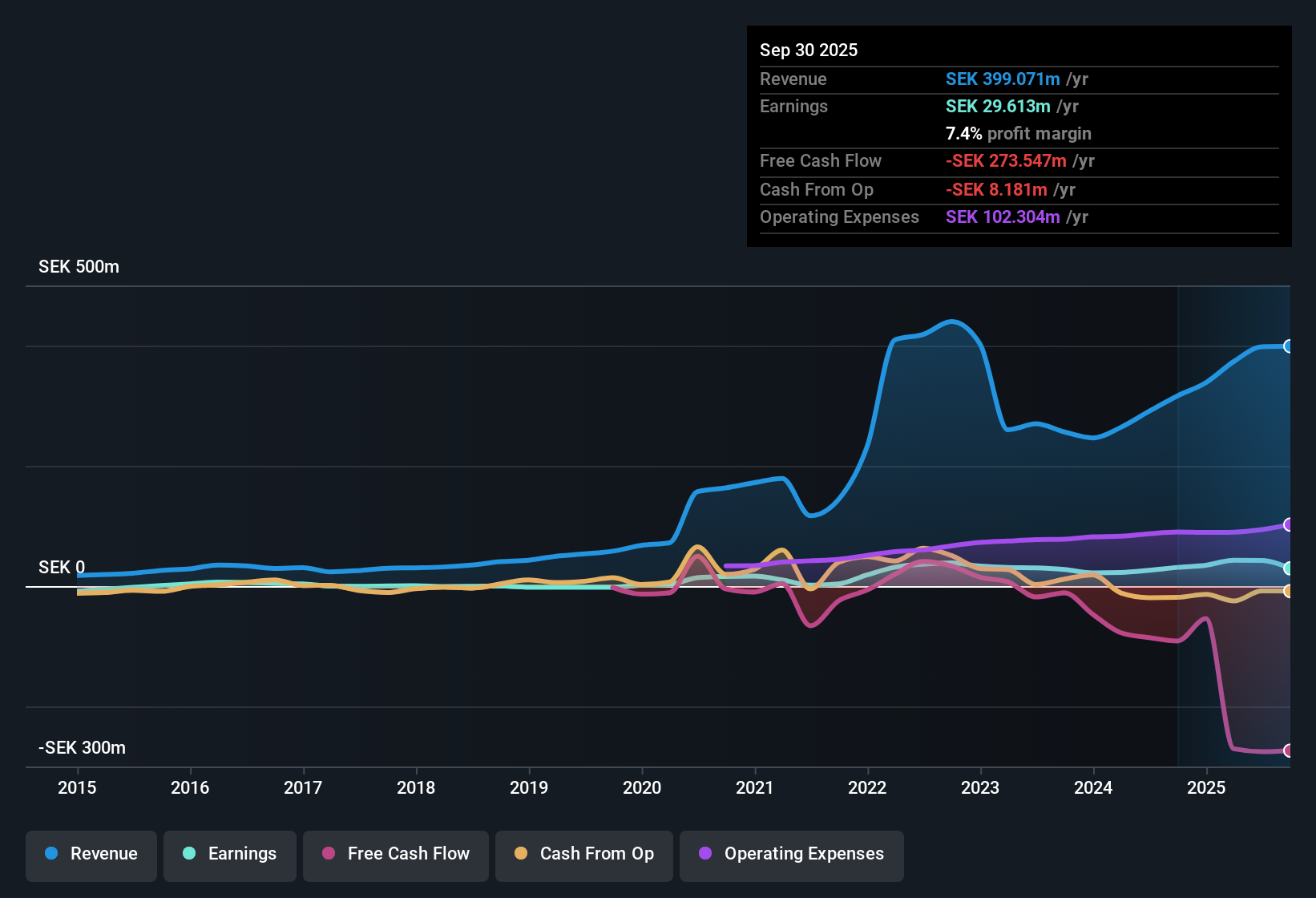

EQL Pharma (OM:EQL) is projecting standout rates, with earnings forecast to climb 59.57% per year and revenue expected to grow 30.4% annually, far outpacing the Swedish market’s 3.7% revenue growth outlook. Over the past five years, the company saw earnings rise by 19.1% each year and currently holds a net profit margin of 7.4%, down from last year’s 9.9%. With a Price-to-Earnings ratio of 54.3x, EQL trades above the broader European healthcare sector but remains slightly below its immediate peer group. This sets up a debate for investors around growth potential versus valuation risk.

See our full analysis for EQL Pharma.Next up, we will see how these headline numbers hold up when measured against the community narrative and prevailing market perspectives. Some expectations may be confirmed, while others could be overturned.

See what the community is saying about EQL Pharma

Margin Guidance Hints at Turnaround

- Analysts expect profit margins to rise from 10.7% today to 14.1% in three years, even though the latest net profit margin of 7.4% is below last year's 9.9% and lags analysts’ near-term outlook.

- Analysts' consensus view points to ongoing operational improvements and product expansion as key levers for margin recovery.

- The planned increase in margins is supported by efficiency gains, such as leveraging lower-cost talent hubs and optimizing partnerships, which consensus sees as critical to sustaining profitability as EQL expands into new markets.

- Consensus narrative highlights that an enhanced pipeline and a disciplined approach to R&D and acquisition integration should provide a cushion for margin recovery. However, the recent drop in net margin highlights the challenge of executing amid rising costs and new geographic risks.

- Momentum in margin improvement faces real-world friction, but the scale of planned gains keeps analysts cautiously optimistic for a reversal.

📊 Read the full EQL Pharma Consensus Narrative.

PE Ratio Still Stands Above Industry

- EQL Pharma’s current Price-to-Earnings ratio of 54.3x is more than three times the European healthcare sector average of 17.6x, though it is slightly below its direct peer average of 60x.

- Analysts' consensus view notes the company’s premium valuation reflects confidence in its strong growth pipeline.

- The consensus argues that robust future profit growth (expected at 59.57% per year) and a broadening European footprint help justify the PE multiple. Even by 2028, if all goes to plan, EQL would be trading at a PE of 25.4x, still above the industry average.

- This means even bullish expectations embed some longer-term valuation risk if growth delivery stumbles, requiring investors to keep a close eye on margin improvement and market traction to support current multiples.

Non-Cash Earnings Skew Quality

- EQL Pharma shows elevated levels of non-cash earnings, which can make reported profit appear stronger than underlying cash flow would warrant.

- Analysts' consensus view underlines that while the company’s expanding generics pipeline is a major reward, the reliance on non-cash profits highlights a key risk.

- If reported profits continue to outpace actual cash generation, analysts caution this could call into question both the durability of projected earnings and the ability to support reinvestment and future acquisition ambitions.

- This contrast keeps quality-of-earnings in focus, reminding investors that growth headlines often mask subtler, longer-term trade-offs built into aggressive expansion strategies.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for EQL Pharma on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Do these figures tell a different story to you? Craft your narrative and share your unique perspective in just a few minutes by clicking here: Do it your way.

A great starting point for your EQL Pharma research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

EQL Pharma’s high valuation and reliance on non-cash earnings create quality-of-earnings concerns, which may outpace actual cash generation.

If you think solid fundamentals matter more, check out these 836 undervalued stocks based on cash flows to focus on companies with stronger underlying value and less pricing risk built in.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EQL Pharma might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:EQL

EQL Pharma

Engages in the development, marketing, and sale of generic medicines to pharmacies and hospitals in Sweden, Denmark, Norway, Finland, and the rest of Europe.

Exceptional growth potential with low risk.

Similar Companies

Market Insights

Community Narratives