- Sweden

- /

- Medical Equipment

- /

- OM:EKTA B

Elekta (OM:EKTA B): Assessing Valuation as Profits Climb Despite Lower Sales in Latest Results

Reviewed by Simply Wall St

Elekta (OM:EKTA B) just released its latest earnings for the second quarter and first half of 2025. While sales dipped compared to last year, investors are paying attention to the company's higher profit and earnings per share.

See our latest analysis for Elekta.

While Elekta’s recent earnings reveal profits are up even as sales slip, the market remains cautious, as seen in a challenging year-to-date share price return of -27.93%. Over the past year, total shareholder return sits at -26.04%, indicating that investor sentiment has yet to turn decisively despite the improved bottom line.

If you’re interested in discovering other leading healthcare innovators making waves right now, check out the latest opportunities in our handpicked list See the full list for free.

With shares down significantly yet profits on the rise, the key question is whether Elekta’s improved earnings have set the stage for a rebound, or if market expectations already reflect the company’s future growth potential.

Most Popular Narrative: 17.2% Undervalued

According to the most popular narrative, Elekta's fair value stands well above its last closing price. This sets up a tension between consensus analyst targets and current market sentiment.

Continued strong momentum and successful launches of Elekta Evo and Elekta ONE software in Europe are driving double-digit sales growth and gross margin improvement in the region. This suggests that further global rollouts of these advanced solutions, aligned with increasing demand for precision radiotherapy, may accelerate overall revenue and margin expansion as adoption broadens.

What’s really powering that bullish fair value? A deeper look reveals surging recurring service revenue, rising software adoption, and bold multi-year profit margin forecasts, as well as harder-to-spot assumptions that could make all the difference. Want to know which numbers underpin this optimistic outlook?

Result: Fair Value of $53.79 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing tariff and currency headwinds, as well as delayed revenue recognition in key regions, could quickly challenge these optimistic projections.

Find out about the key risks to this Elekta narrative.

Another View: Profit Multiple Raises Red Flag

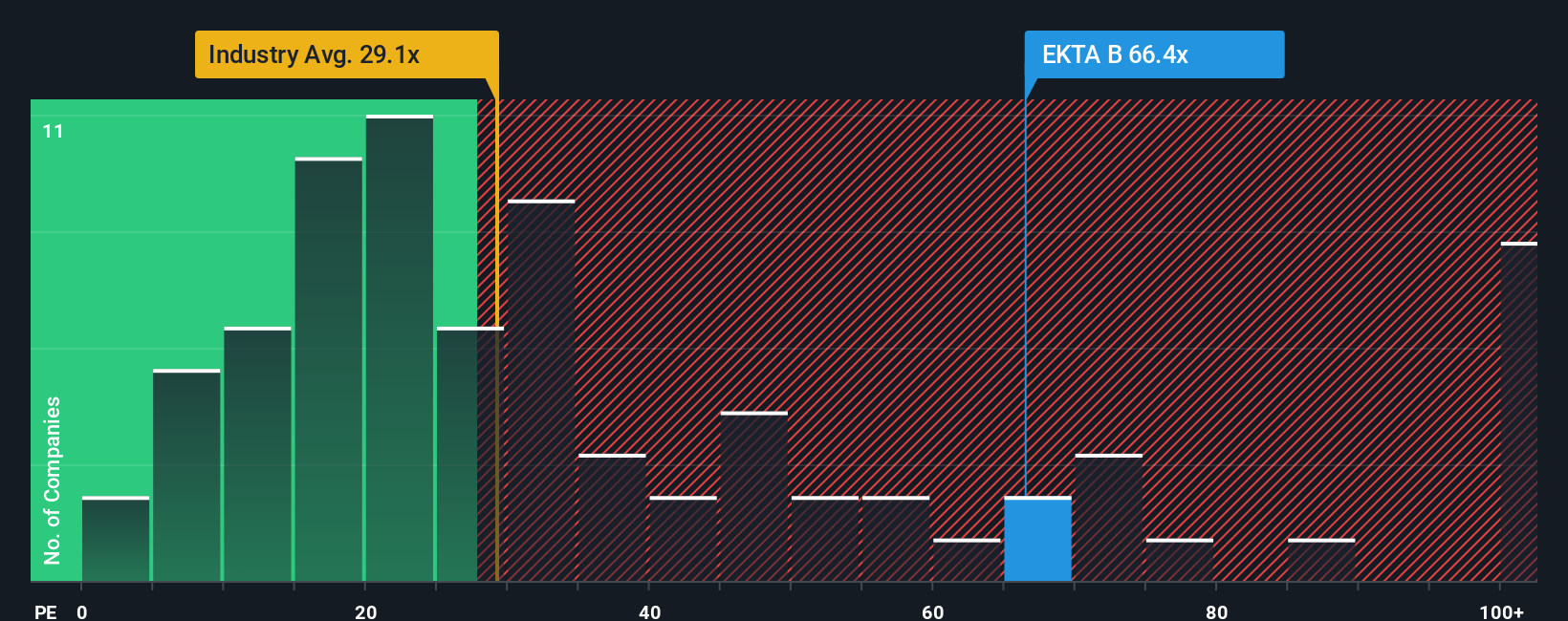

While fair value models suggest Elekta’s shares are undervalued, another approach tells a different story. Elekta’s current price-to-earnings ratio stands at 62.1x, which is much higher than both the industry average (27.9x) and its fair ratio of 38.6x. This premium means investors are paying far more for each unit of profit than the broader market would expect. The question is whether the market truly believes Elekta can grow into this high valuation, or if optimism is running ahead of reality.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Elekta Narrative

If you see things differently, or want to dive into the numbers yourself, you can easily craft your own story in just a few minutes: Do it your way

A great starting point for your Elekta research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

You don’t want to miss out on other promising stocks making moves this year. Set your sights on fresh opportunities and unlock untapped potential using our favorite screeners below.

- Uncover potential big gainers by targeting value opportunities with these 929 undervalued stocks based on cash flows, which highlights companies trading well below their intrinsic worth.

- Capitalize on high-yield returns using these 14 dividend stocks with yields > 3%, where strong income stocks offer attractive yields above 3%.

- Tap into innovation and accelerate your portfolio's growth by focusing on healthcare breakthroughs with these 30 healthcare AI stocks, a tool at the forefront of medical technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Elekta might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:EKTA B

Elekta

A medical technology company, provides clinical solutions for treating cancer and brain disorders in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Excellent balance sheet with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success