The European market has recently experienced a downturn, with the pan-European STOXX Europe 600 Index falling by 2.57% amid dissatisfaction with a trade deal framework between the U.S. and the EU. Despite these challenges, penny stocks—often smaller or newer companies—remain an intriguing area of investment due to their potential for growth at lower price points. In this article, we explore three European penny stocks that exhibit strong financial foundations and could offer promising opportunities for investors seeking hidden value in quality companies.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Mistral Iberia Real Estate SOCIMI (BME:YMIB) | €0.92 | €20.04M | ✅ 2 ⚠️ 4 View Analysis > |

| Lucisano Media Group (BIT:LMG) | €0.97 | €14.41M | ✅ 3 ⚠️ 4 View Analysis > |

| Maps (BIT:MAPS) | €3.45 | €45.82M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €305.94M | ✅ 3 ⚠️ 2 View Analysis > |

| Cellularline (BIT:CELL) | €2.96 | €62.43M | ✅ 4 ⚠️ 2 View Analysis > |

| Fondia Oyj (HLSE:FONDIA) | €4.97 | €18.58M | ✅ 2 ⚠️ 3 View Analysis > |

| Bredband2 i Skandinavien (OM:BRE2) | SEK3.265 | SEK3.12B | ✅ 4 ⚠️ 2 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.19 | €302.36M | ✅ 3 ⚠️ 1 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.95 | €32.04M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 335 stocks from our European Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Ocean Sun (OB:OSUN)

Simply Wall St Financial Health Rating: ★★★★★★

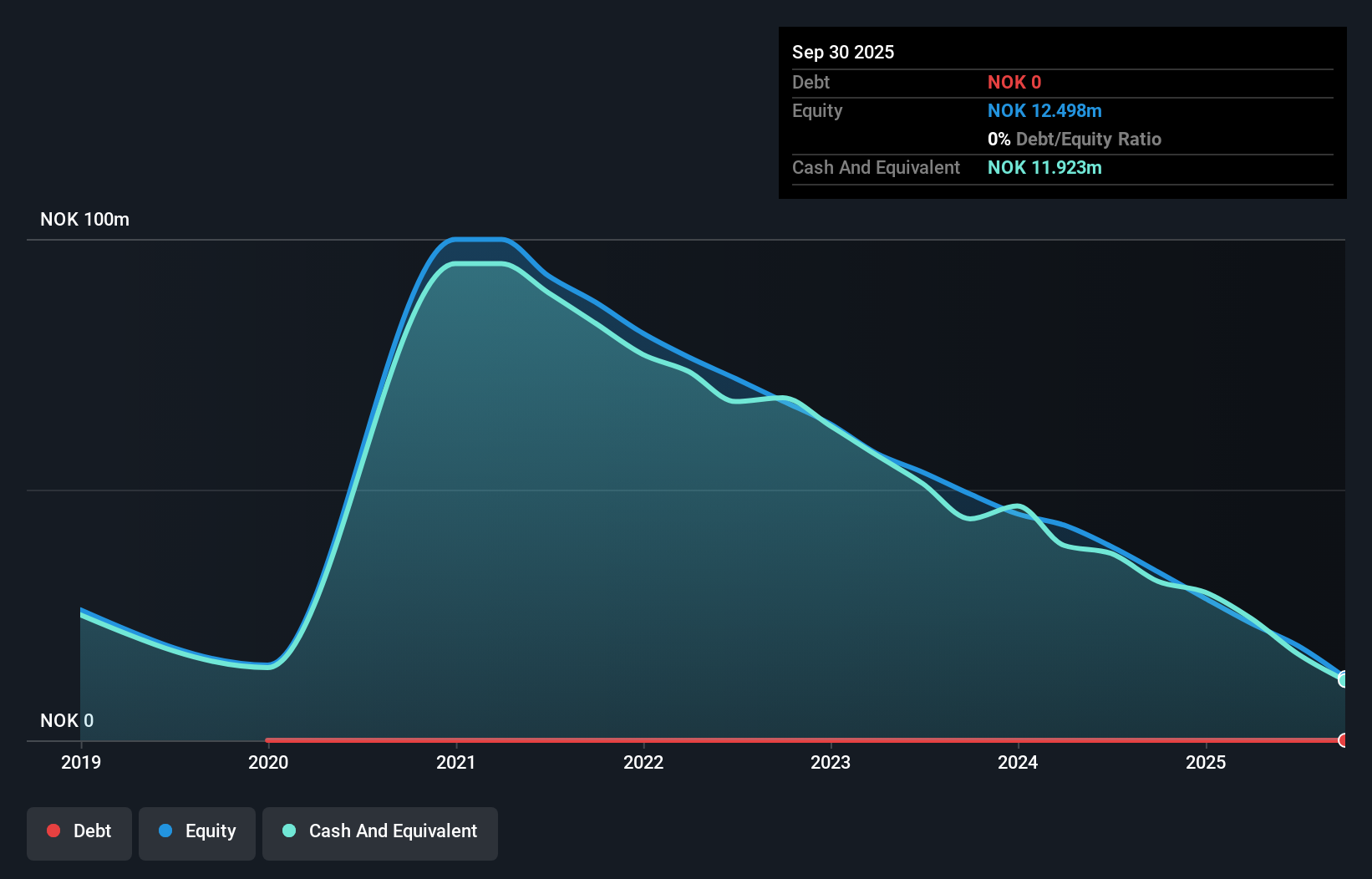

Overview: Ocean Sun AS develops floating solar power systems and has a market cap of NOK66.98 million.

Operations: Ocean Sun AS has not reported any specific revenue segments.

Market Cap: NOK66.98M

Ocean Sun AS, with a market cap of NOK66.98 million, is a pre-revenue company in the floating solar power sector. The company recently signed a Memorandum of Understanding to explore solar projects in Ukraine, which could bolster its strategic positioning despite current financial challenges. Ocean Sun reported declining revenues and increasing losses for Q1 2025 compared to the previous year, highlighting its unprofitability and volatile share price. However, it remains debt-free with sufficient cash runway for over a year and no significant shareholder dilution recently. The management team and board are relatively inexperienced but actively pursuing growth opportunities.

- Click here to discover the nuances of Ocean Sun with our detailed analytical financial health report.

- Review our historical performance report to gain insights into Ocean Sun's track record.

Scandinavian ChemoTech (OM:CMOTEC B)

Simply Wall St Financial Health Rating: ★★★★★☆

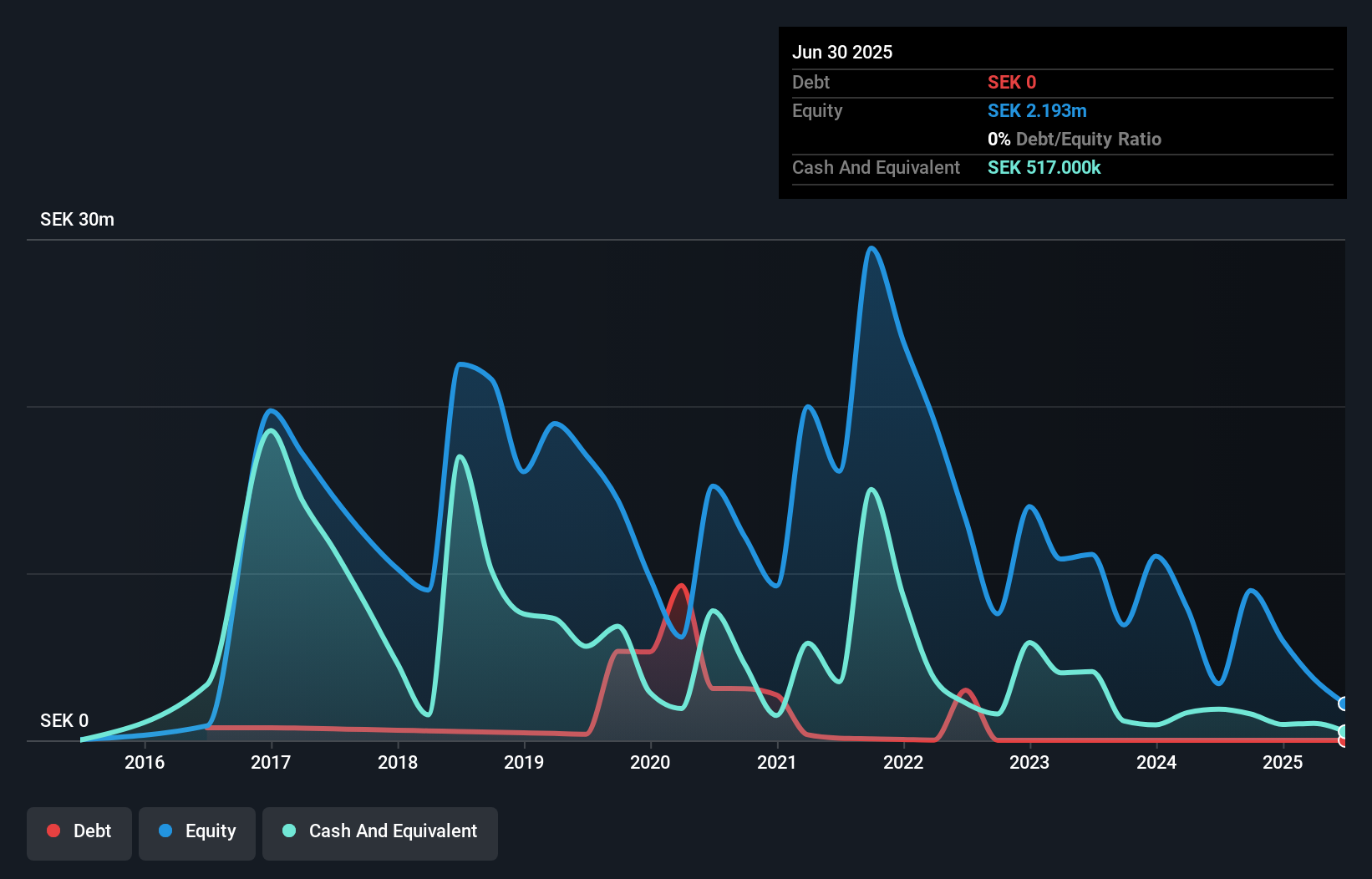

Overview: Scandinavian ChemoTech AB (publ) is a Swedish company that provides cancer care and pain management solutions, with a market capitalization of SEK62.80 million.

Operations: The company generates revenue from its Medical Products segment, amounting to SEK7.69 million.

Market Cap: SEK62.8M

Scandinavian ChemoTech, with a market cap of SEK62.80 million, is pre-revenue and unprofitable, facing increased losses over the past five years. Despite this, it remains debt-free and recently raised SEK4.85 million through private placements to support its strategic vision. The company reported Q1 2025 revenue of SEK2.51 million but still incurred a net loss of SEK3.32 million. Its innovative Tumour Specific Electroporation (TSE) technology recently received validation as an effective cancer treatment for animals, potentially enhancing its market position in oncology solutions despite high share price volatility and limited cash runway stability.

- Get an in-depth perspective on Scandinavian ChemoTech's performance by reading our balance sheet health report here.

- Examine Scandinavian ChemoTech's past performance report to understand how it has performed in prior years.

Nordic LEVEL Group AB (publ.) (OM:LEVEL)

Simply Wall St Financial Health Rating: ★★★★☆☆

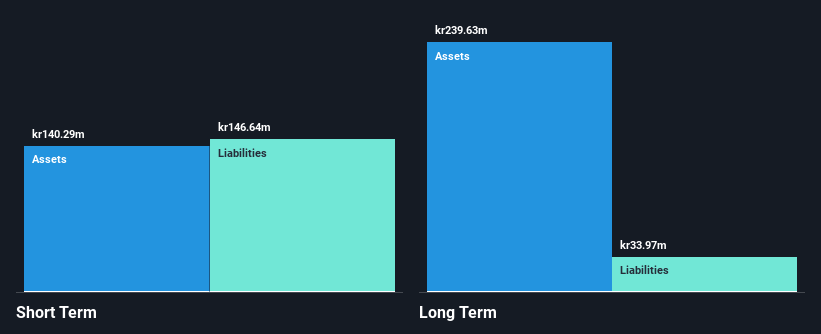

Overview: Nordic LEVEL Group AB (publ.) offers safety and security solutions primarily in Sweden, with a market cap of SEK141.25 million.

Operations: The company's revenue is primarily generated from the Swedish market, amounting to SEK390.88 million.

Market Cap: SEK141.25M

Nordic LEVEL Group AB (publ.) has demonstrated revenue growth, with Q1 2025 sales reaching SEK109.97 million, an increase from SEK90.16 million the previous year. However, it remains unprofitable with a net loss of SEK4.81 million for the quarter and a negative return on equity of -7.95%. The company’s debt to equity ratio has significantly improved over five years to 37.2%, indicating better financial management, yet short-term liabilities exceed assets by SEK14.3 million. Despite high share price volatility and an inexperienced management team, LEVEL is trading at a substantial discount to its estimated fair value.

- Dive into the specifics of Nordic LEVEL Group AB (publ.) here with our thorough balance sheet health report.

- Gain insights into Nordic LEVEL Group AB (publ.)'s outlook and expected performance with our report on the company's earnings estimates.

Make It Happen

- Access the full spectrum of 335 European Penny Stocks by clicking on this link.

- Interested In Other Possibilities? The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nordic LEVEL Group AB (publ.) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:LEVEL

Nordic LEVEL Group AB (publ.)

Provides safety and security solutions primarily in Sweden.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives