Stock Analysis

- Sweden

- /

- Personal Products

- /

- OM:HUMBLE

Swedish Exchange Growth Leaders With Insider Ownership Reaching 22%

Reviewed by Simply Wall St

As global markets exhibit mixed signals with some regions showing robust gains while others navigate through economic softness, the Swedish market presents a unique landscape for investors. In this context, companies with high insider ownership can be particularly compelling, as such ownership often aligns with strong confidence in the company's future prospects and stability amidst broader market volatility.

Top 10 Growth Companies With High Insider Ownership In Sweden

| Name | Insider Ownership | Earnings Growth |

| CTT Systems (OM:CTT) | 16.9% | 21.6% |

| Sun4Energy Group (NGM:SUN4) | 12.6% | 49.6% |

| BioArctic (OM:BIOA B) | 35.1% | 48.2% |

| Spago Nanomedical (OM:SPAGO) | 16.1% | 52.1% |

| Calliditas Therapeutics (OM:CALTX) | 11.6% | 49.9% |

| InCoax Networks (OM:INCOAX) | 14.9% | 104.9% |

| KebNi (OM:KEBNI B) | 37.8% | 90.4% |

| Egetis Therapeutics (OM:EGTX) | 17.6% | 98.4% |

| SaveLend Group (OM:YIELD) | 24.8% | 88.5% |

| Yubico (OM:YUBICO) | 37.5% | 43% |

Let's review some notable picks from our screened stocks.

Attendo (OM:ATT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Attendo AB (publ) operates in the health and care services sector across Scandinavia and Finland, with a market capitalization of approximately SEK 6.91 billion.

Operations: The company generates its revenue primarily from care and health care services, totaling SEK 17.63 billion.

Insider Ownership: 14.9%

Attendo, a Swedish growth company with significant insider ownership, demonstrates robust potential through its strategic share buybacks and consistent dividend payments, signaling confidence in its financial health. Recently reporting a substantial year-over-year earnings increase and outpacing the Swedish market's revenue growth expectations, Attendo shows promising profitability forecasts. However, challenges such as an unstable dividend track record and the upcoming departure of a key executive might affect continuity and investor sentiment.

- Navigate through the intricacies of Attendo with our comprehensive analyst estimates report here.

- The valuation report we've compiled suggests that Attendo's current price could be quite moderate.

Humble Group (OM:HUMBLE)

Simply Wall St Growth Rating: ★★★★☆☆

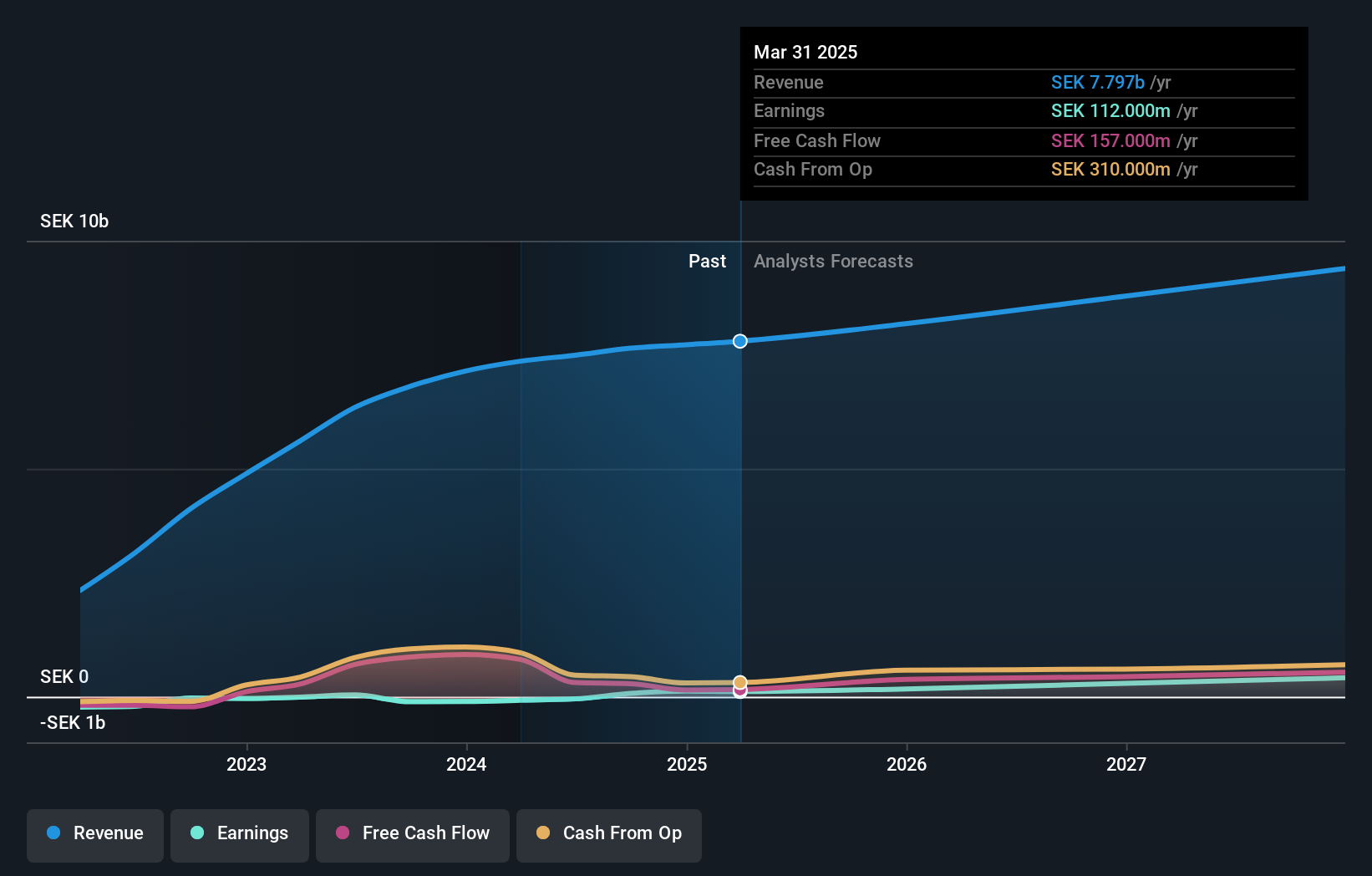

Overview: Humble Group AB, a company based in Sweden, refines, develops, and distributes fast-moving consumer goods both domestically and internationally, with a market capitalization of SEK 4.42 billion.

Operations: The firm operates primarily in the refinement, development, and distribution of fast-moving consumer goods across both Swedish and international markets.

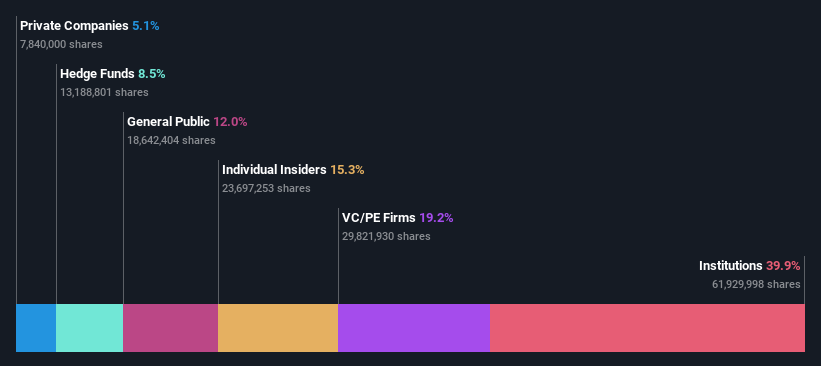

Insider Ownership: 22.2%

Humble Group, a Swedish growth entity with considerable insider transactions, recently showed improved financials with Q1 sales rising to SEK 1.84 billion and a shift to a net income of SEK 23 million from a prior loss. Trading at 45.6% below estimated fair value and expecting revenue growth above market forecasts, the company is poised for profitability within three years despite a forecast of low return on equity at 9.1%. Insider buying trends support positive sentiment without substantial selling reported recently.

- Unlock comprehensive insights into our analysis of Humble Group stock in this growth report.

- Our expertly prepared valuation report Humble Group implies its share price may be lower than expected.

Storytel (OM:STORY B)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Storytel AB (publ) operates as a provider of audiobooks and e-books streaming services, with a market capitalization of approximately SEK 4.31 billion.

Operations: The company generates its revenue primarily through the streaming of audiobooks and e-books.

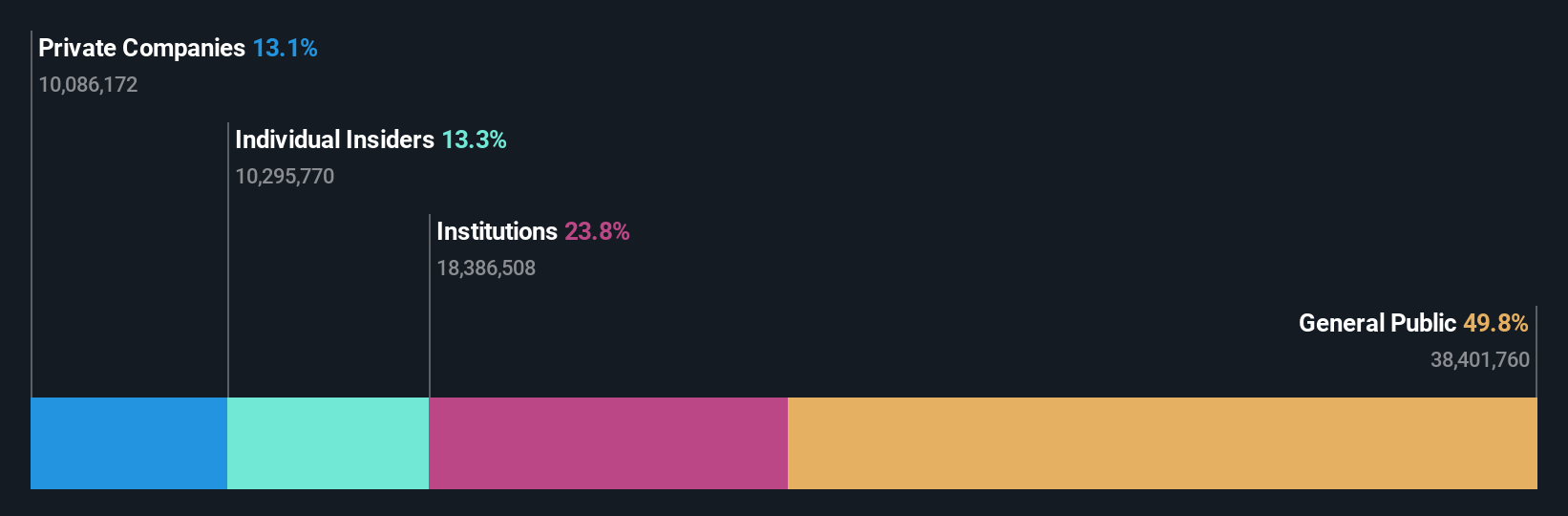

Insider Ownership: 19.7%

Storytel, a Swedish audiobook service, recently reported improved Q1 earnings with sales reaching SEK 891.89 million and a reduced net loss of SEK 24.82 million. Despite significant board changes including a new Chair, the company is navigating leadership transitions as it prepares for a CEO change in fall 2024. Trading significantly below its estimated fair value, Storytel shows promise with expected revenue growth outpacing the Swedish market average and forecasts indicating profitability within three years. Insider buying trends suggest confidence among those closest to the company.

- Click here and access our complete growth analysis report to understand the dynamics of Storytel.

- The analysis detailed in our Storytel valuation report hints at an deflated share price compared to its estimated value.

Where To Now?

- Unlock more gems! Our Fast Growing Swedish Companies With High Insider Ownership screener has unearthed 78 more companies for you to explore.Click here to unveil our expertly curated list of 81 Fast Growing Swedish Companies With High Insider Ownership.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether Humble Group is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:HUMBLE

Humble Group

Humble Group AB (publ) refines, develops, and distributes fast-moving consumer products in Sweden and internationally.

Undervalued with excellent balance sheet.