3 European Stocks Estimated To Be Undervalued By Up To 48.8%

Reviewed by Simply Wall St

As the European market navigates a landscape of mixed stock index performances and cautious central bank policies, investors are keenly observing opportunities that may arise from these fluctuations. In such an environment, identifying undervalued stocks becomes crucial as they can offer potential value by capitalizing on discrepancies between current market prices and intrinsic worth.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| YIT Oyj (HLSE:YIT) | €3.024 | €6.04 | 49.9% |

| Vinext (BIT:VNXT) | €3.38 | €6.63 | 49% |

| tonies (DB:TNIE) | €8.73 | €17.06 | 48.8% |

| Roche Bobois (ENXTPA:RBO) | €36.00 | €70.56 | 49% |

| Prosegur Cash (BME:CASH) | €0.68 | €1.35 | 49.8% |

| Nokian Panimo Oyj (HLSE:BEER) | €2.49 | €4.91 | 49.3% |

| Mo-BRUK (WSE:MBR) | PLN295.50 | PLN587.42 | 49.7% |

| Lingotes Especiales (BME:LGT) | €5.55 | €11.01 | 49.6% |

| Ferrari Group (ENXTAM:FERGR) | €8.11 | €15.88 | 48.9% |

| Allcore (BIT:CORE) | €1.37 | €2.69 | 49% |

We're going to check out a few of the best picks from our screener tool.

tonies (DB:TNIE)

Overview: tonies SE, with a market cap of €1.01 billion, develops, produces, and distributes audio systems in Germany, the United States, the United Kingdom, and internationally through its subsidiaries.

Operations: The company's revenue is segmented into North America (€230.32 million), DACH (Germany, Austria, Switzerland) (€183.21 million), and the Rest of World (€103.76 million).

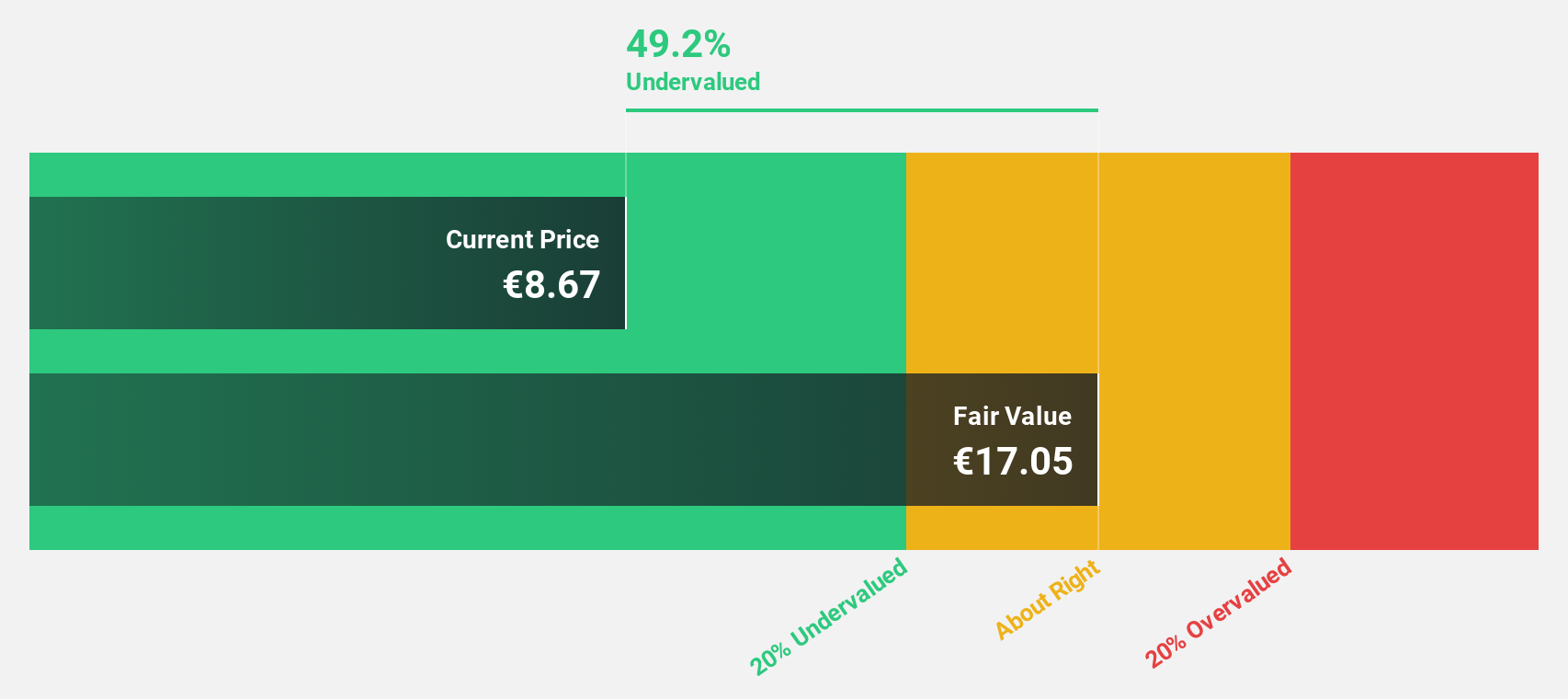

Estimated Discount To Fair Value: 48.8%

Tonies SE is trading at €8.73, significantly below its estimated fair value of €17.06, indicating potential undervaluation based on discounted cash flow analysis. Despite a forecasted low return on equity of 10.4% in three years, tonies has become profitable this year with earnings expected to grow significantly above the German market average. Recent product innovations like Toniebox 2 and expanded licensing agreements with Hasbro could drive future revenue growth and enhance cash flows.

- Our expertly prepared growth report on tonies implies its future financial outlook may be stronger than recent results.

- Click to explore a detailed breakdown of our findings in tonies' balance sheet health report.

Harvia Oyj (HLSE:HARVIA)

Overview: Harvia Oyj operates in the sauna industry and has a market capitalization of €690.61 million.

Operations: The company generates revenue from its Building Materials - HVAC Equipment segment, amounting to €188.89 million.

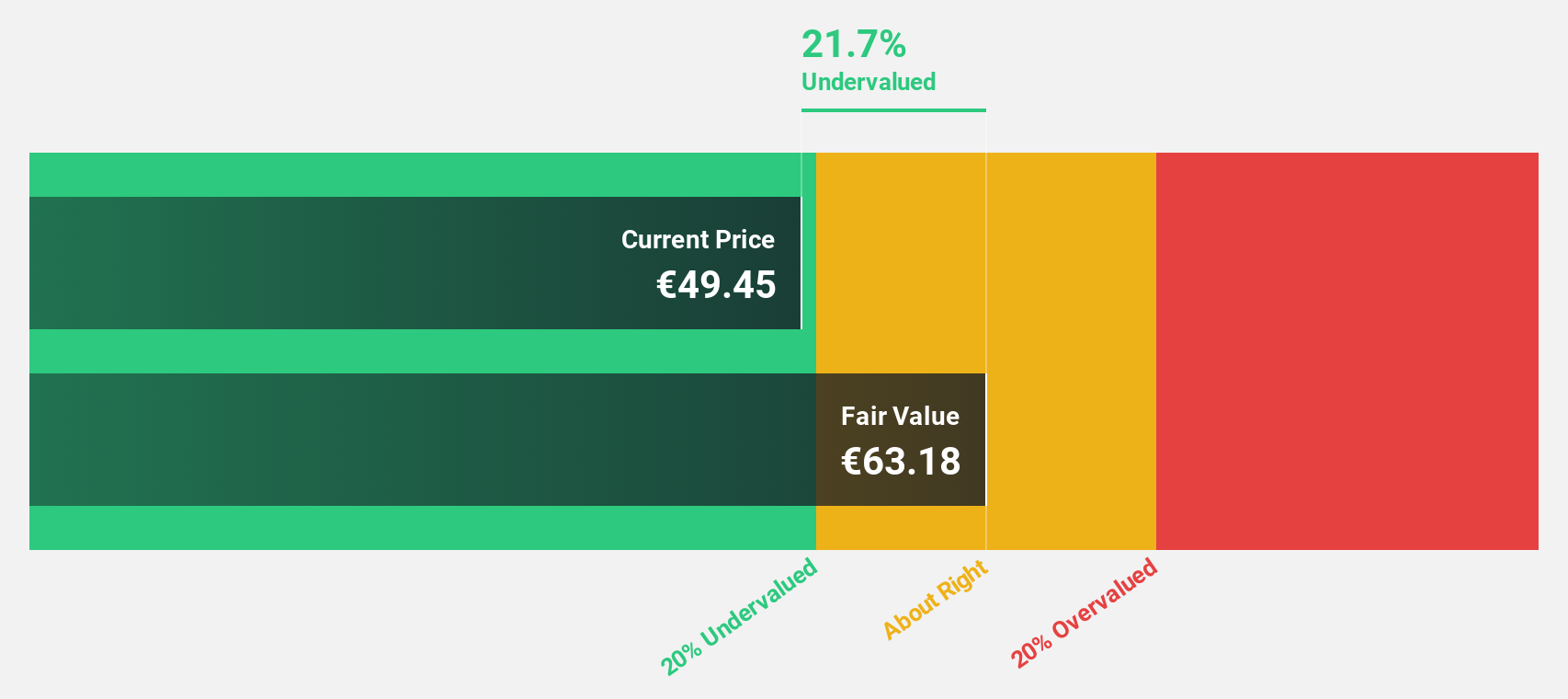

Estimated Discount To Fair Value: 41.7%

Harvia Oyj is trading at €36.95, well below its estimated fair value of €63.39, highlighting potential undervaluation based on discounted cash flow analysis. Despite a high debt level and recent volatility in share price, Harvia's earnings are projected to grow faster than the Finnish market at 17.8% annually. Recent strategic innovations like the Fenix control panel and MyHarvia app aim to enhance user experience and could support revenue growth alongside new leadership in North America.

- Insights from our recent growth report point to a promising forecast for Harvia Oyj's business outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of Harvia Oyj.

Asker Healthcare Group (OM:ASKER)

Overview: Asker Healthcare Group AB supplies medical products and solutions to enhance patient care, with a market cap of SEK33.90 billion.

Operations: The company's revenue is derived from three primary segments: West (SEK7.79 billion), Central (SEK2.82 billion), and North (including East) (SEK5.44 billion).

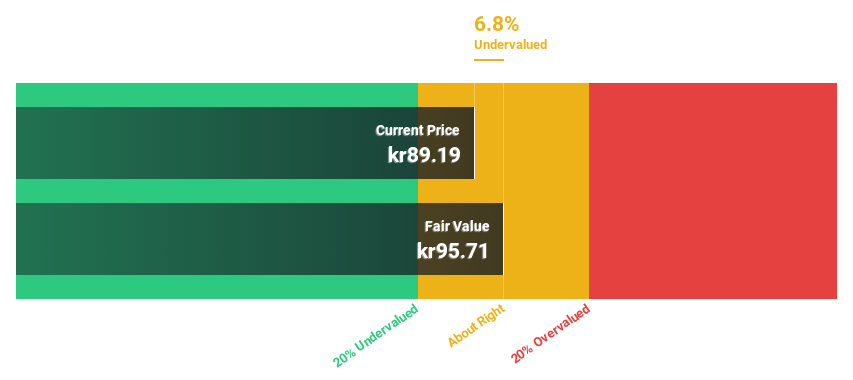

Estimated Discount To Fair Value: 20.5%

Asker Healthcare Group is trading at SEK88.51, significantly below its estimated fair value of SEK111.29, suggesting undervaluation based on discounted cash flow analysis. Despite a high debt level, Asker's earnings are forecast to grow at 24.67% annually, outpacing the Swedish market's growth rate. Recent inclusion in the S&P Global BMI Index and changes in its nomination committee may enhance visibility and governance as it continues to expand revenue faster than the market average.

- In light of our recent growth report, it seems possible that Asker Healthcare Group's financial performance will exceed current levels.

- Delve into the full analysis health report here for a deeper understanding of Asker Healthcare Group.

Taking Advantage

- Gain an insight into the universe of 201 Undervalued European Stocks Based On Cash Flows by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Harvia Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:HARVIA

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives