- Sweden

- /

- Medical Equipment

- /

- OM:ARCOMA

Lacklustre Performance Is Driving Arcoma AB's (STO:ARCOMA) 28% Price Drop

Arcoma AB (STO:ARCOMA) shareholders that were waiting for something to happen have been dealt a blow with a 28% share price drop in the last month. Still, a bad month hasn't completely ruined the past year with the stock gaining 35%, which is great even in a bull market.

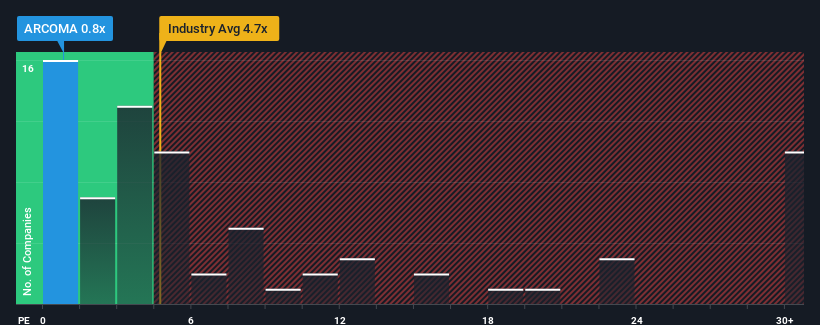

After such a large drop in price, Arcoma's price-to-sales (or "P/S") ratio of 0.8x might make it look like a strong buy right now compared to the wider Medical Equipment industry in Sweden, where around half of the companies have P/S ratios above 4.7x and even P/S above 12x are quite common. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Arcoma

How Arcoma Has Been Performing

Recent times haven't been great for Arcoma as its revenue has been rising slower than most other companies. It seems that many are expecting the uninspiring revenue performance to persist, which has repressed the growth of the P/S ratio. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Arcoma.Do Revenue Forecasts Match The Low P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as depressed as Arcoma's is when the company's growth is on track to lag the industry decidedly.

Retrospectively, the last year delivered a decent 12% gain to the company's revenues. Pleasingly, revenue has also lifted 36% in aggregate from three years ago, partly thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenues over that time.

Looking ahead now, revenue is anticipated to climb by 11% during the coming year according to the only analyst following the company. With the industry predicted to deliver 40% growth, the company is positioned for a weaker revenue result.

With this in consideration, its clear as to why Arcoma's P/S is falling short industry peers. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What Does Arcoma's P/S Mean For Investors?

Having almost fallen off a cliff, Arcoma's share price has pulled its P/S way down as well. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we suspected, our examination of Arcoma's analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Having said that, be aware Arcoma is showing 1 warning sign in our investment analysis, you should know about.

If you're unsure about the strength of Arcoma's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:ARCOMA

Arcoma

Develops, produces, and provides radiology solutions and digital x-ray systems worldwide.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives