- Sweden

- /

- Medical Equipment

- /

- OM:ADDV A

ADDvise Group AB (publ)'s (STO:ADDV A) 26% Dip In Price Shows Sentiment Is Matching Earnings

The ADDvise Group AB (publ) (STO:ADDV A) share price has fared very poorly over the last month, falling by a substantial 26%. To make matters worse, the recent drop has wiped out a year's worth of gains with the share price now back where it started a year ago.

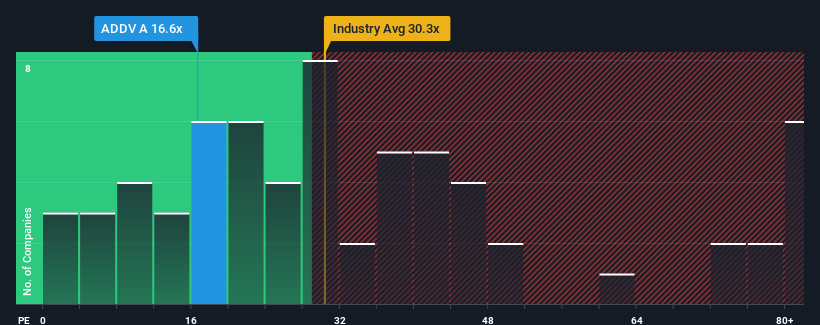

After such a large drop in price, given about half the companies in Sweden have price-to-earnings ratios (or "P/E's") above 24x, you may consider ADDvise Group as an attractive investment with its 16.6x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

ADDvise Group certainly has been doing a good job lately as it's been growing earnings more than most other companies. One possibility is that the P/E is low because investors think this strong earnings performance might be less impressive moving forward. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

See our latest analysis for ADDvise Group

What Are Growth Metrics Telling Us About The Low P/E?

There's an inherent assumption that a company should underperform the market for P/E ratios like ADDvise Group's to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 30% last year. The strong recent performance means it was also able to grow EPS by 587% in total over the last three years. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 12% per year during the coming three years according to the two analysts following the company. That's shaping up to be materially lower than the 18% per year growth forecast for the broader market.

With this information, we can see why ADDvise Group is trading at a P/E lower than the market. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Final Word

ADDvise Group's P/E has taken a tumble along with its share price. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that ADDvise Group maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

And what about other risks? Every company has them, and we've spotted 2 warning signs for ADDvise Group (of which 1 is a bit concerning!) you should know about.

If you're unsure about the strength of ADDvise Group's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:ADDV A

ADDvise Group

Supplies medical devices, equipment, and consumables to public and private laboratories and research facilities, healthcare, and pharmaceuticals in North America, Europe, South America, Sweden, and internationally.

Medium-low risk and undervalued.

Market Insights

Community Narratives