- Sweden

- /

- Medical Equipment

- /

- NGM:PRLD

We Think Prolight Diagnostics (NGM:PRLD) Can Easily Afford To Drive Business Growth

We can readily understand why investors are attracted to unprofitable companies. For example, biotech and mining exploration companies often lose money for years before finding success with a new treatment or mineral discovery. But while the successes are well known, investors should not ignore the very many unprofitable companies that simply burn through all their cash and collapse.

So, the natural question for Prolight Diagnostics (NGM:PRLD) shareholders is whether they should be concerned by its rate of cash burn. For the purposes of this article, cash burn is the annual rate at which an unprofitable company spends cash to fund its growth; its negative free cash flow. First, we'll determine its cash runway by comparing its cash burn with its cash reserves.

View our latest analysis for Prolight Diagnostics

When Might Prolight Diagnostics Run Out Of Money?

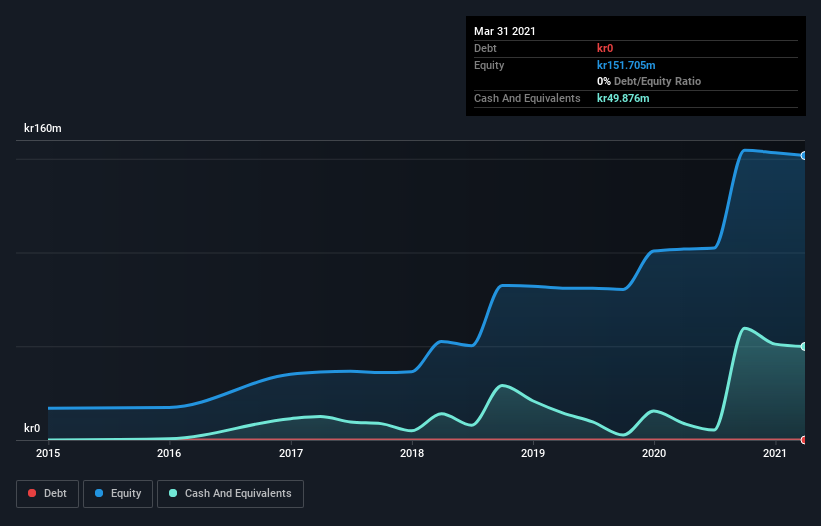

A company's cash runway is calculated by dividing its cash hoard by its cash burn. In March 2021, Prolight Diagnostics had kr50m in cash, and was debt-free. Importantly, its cash burn was kr16m over the trailing twelve months. That means it had a cash runway of about 3.2 years as of March 2021. A runway of this length affords the company the time and space it needs to develop the business. Depicted below, you can see how its cash holdings have changed over time.

How Is Prolight Diagnostics' Cash Burn Changing Over Time?

Although Prolight Diagnostics reported revenue of kr825k last year, it didn't actually have any revenue from operations. That means we consider it a pre-revenue business, and we will focus our growth analysis on cash burn, for now. Even though it doesn't get us excited, the 45% reduction in cash burn year on year does suggest the company can continue operating for quite some time. Admittedly, we're a bit cautious of Prolight Diagnostics due to its lack of significant operating revenues. We prefer most of the stocks on this list of stocks that analysts expect to grow.

How Hard Would It Be For Prolight Diagnostics To Raise More Cash For Growth?

While Prolight Diagnostics is showing a solid reduction in its cash burn, it's still worth considering how easily it could raise more cash, even just to fuel faster growth. Companies can raise capital through either debt or equity. Many companies end up issuing new shares to fund future growth. We can compare a company's cash burn to its market capitalisation to get a sense for how many new shares a company would have to issue to fund one year's operations.

Since it has a market capitalisation of kr182m, Prolight Diagnostics' kr16m in cash burn equates to about 8.6% of its market value. Given that is a rather small percentage, it would probably be really easy for the company to fund another year's growth by issuing some new shares to investors, or even by taking out a loan.

How Risky Is Prolight Diagnostics' Cash Burn Situation?

As you can probably tell by now, we're not too worried about Prolight Diagnostics' cash burn. In particular, we think its cash runway stands out as evidence that the company is well on top of its spending. And even its cash burn reduction was very encouraging. After taking into account the various metrics mentioned in this report, we're pretty comfortable with how the company is spending its cash, as it seems on track to meet its needs over the medium term. On another note, Prolight Diagnostics has 5 warning signs (and 3 which are concerning) we think you should know about.

If you would prefer to check out another company with better fundamentals, then do not miss this free list of interesting companies, that have HIGH return on equity and low debt or this list of stocks which are all forecast to grow.

If you’re looking to trade Prolight Diagnostics, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NGM:PRLD

Prolight Diagnostics

Develops diagnostic systems used in point of care testing systems in Sweden.

Moderate risk with adequate balance sheet.

Market Insights

Community Narratives