- Sweden

- /

- Medical Equipment

- /

- NGM:GTAB B

European Penny Stocks To Watch In October 2025

Reviewed by Simply Wall St

As European markets continue to show resilience, with major indices such as the STOXX Europe 600 Index and Germany's DAX posting gains, investors are keenly observing opportunities in various sectors. Penny stocks, although an older term, remain relevant for those seeking value in smaller or less-established companies that may offer significant growth potential. By focusing on robust financials and clear growth prospects, these stocks can present a compelling opportunity for investors looking to explore promising avenues within the market.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Ariston Holding (BIT:ARIS) | €3.638 | €1.26B | ✅ 5 ⚠️ 2 View Analysis > |

| DigiTouch (BIT:DGT) | €1.985 | €27.43M | ✅ 3 ⚠️ 2 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €224.95M | ✅ 2 ⚠️ 2 View Analysis > |

| Hove (CPSE:HOVE) | DKK4.58 | DKK117.31M | ✅ 2 ⚠️ 2 View Analysis > |

| Nurminen Logistics Oyj (HLSE:NLG1V) | €0.944 | €76.18M | ✅ 2 ⚠️ 4 View Analysis > |

| Faes Farma (BME:FAE) | €4.46 | €1.39B | ✅ 4 ⚠️ 1 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.03 | €280.59M | ✅ 4 ⚠️ 1 View Analysis > |

| Dovre Group (HLSE:DOV1V) | €0.0772 | €8.16M | ✅ 2 ⚠️ 3 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.906 | €30.34M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 277 stocks from our European Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Glycorex Transplantation (NGM:GTAB B)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Glycorex Transplantation AB (publ) is a medical technology company specializing in transplantation, blood transfusion, and autoimmune diseases, with a market cap of SEK148.64 million.

Operations: The company generates SEK37.78 million in revenue from its organ transplantation segment.

Market Cap: SEK148.64M

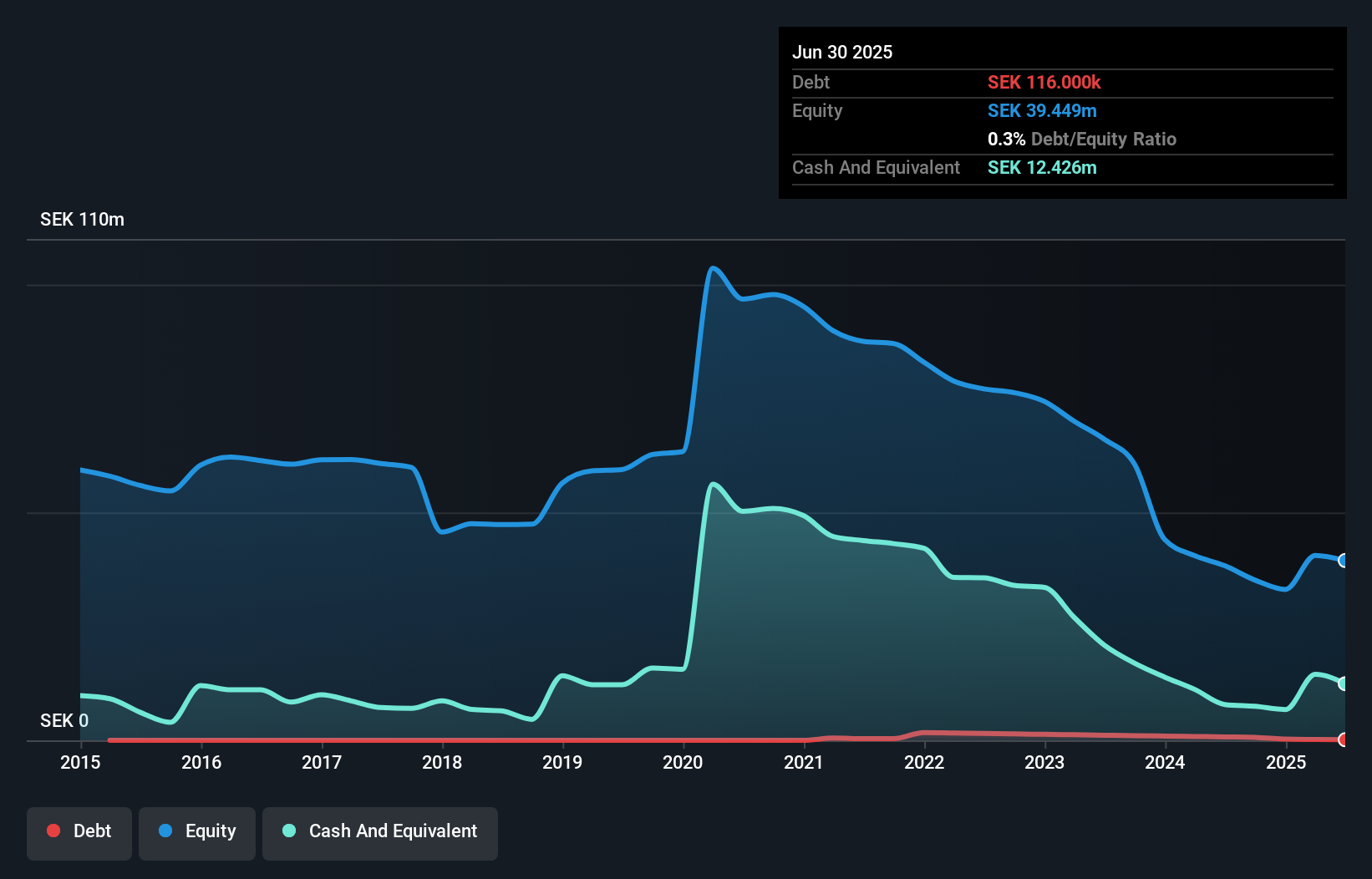

Glycorex Transplantation AB, with a market cap of SEK148.64 million, has shown incremental revenue growth in its organ transplantation segment, reporting SEK22.02 million for the first half of 2025. Despite being unprofitable, the company has reduced its net loss from previous periods and maintains a robust cash position that exceeds both short- and long-term liabilities. This financial stability provides Glycorex with a cash runway exceeding three years if it continues managing free cash flow effectively. However, the board's limited experience and ongoing losses pose challenges to future profitability and operational maturity in this volatile penny stock landscape.

- Dive into the specifics of Glycorex Transplantation here with our thorough balance sheet health report.

- Gain insights into Glycorex Transplantation's historical outcomes by reviewing our past performance report.

RomReal (OB:ROM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: RomReal Limited, along with its subsidiaries, focuses on property investment and development in Romania and has a market capitalization of NOK101.65 million.

Operations: The company's revenue is generated from its property investments and development activities, totaling €0.05 million.

Market Cap: NOK101.65M

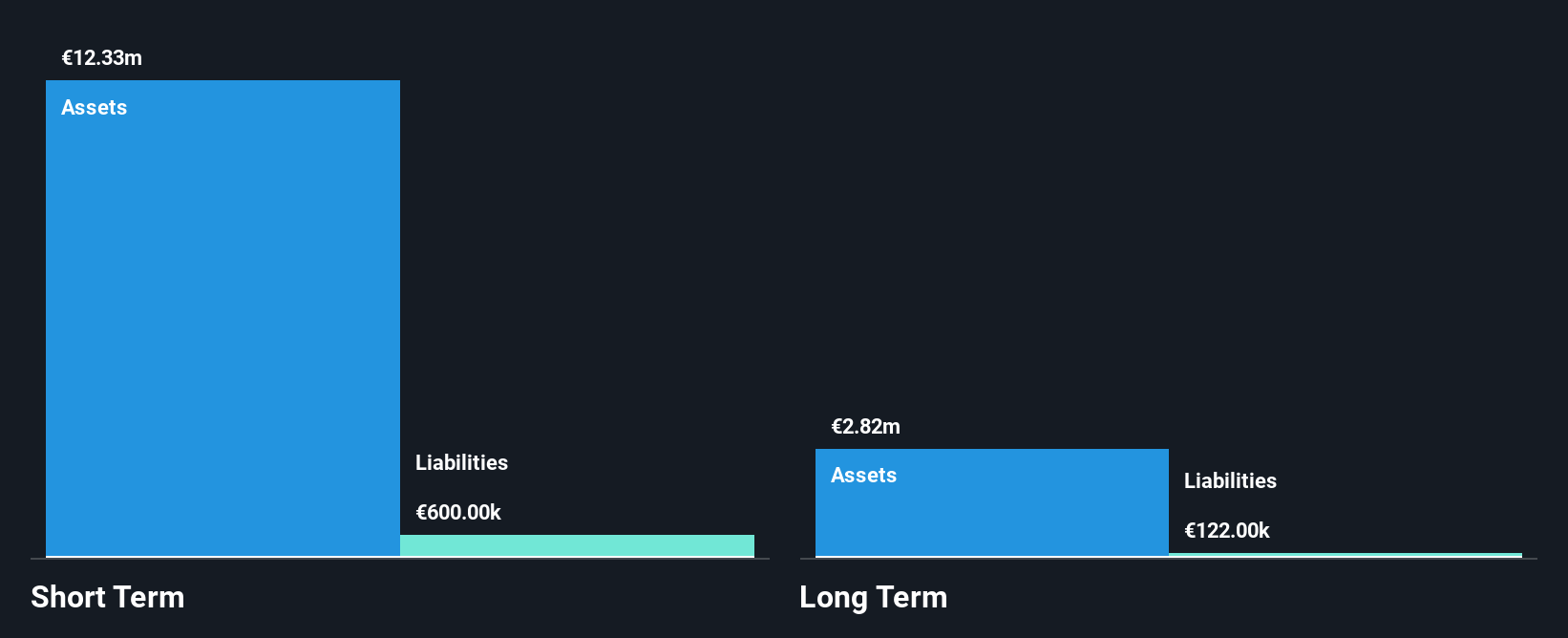

RomReal Limited, with a market cap of NOK101.65 million, operates in the property investment sector in Romania and is pre-revenue with only €0.05 million generated from its activities. Despite being unprofitable, RomReal has managed to reduce losses by 19.7% annually over five years and recently reported a net income of €0.586 million for Q2 2025, reversing last year's loss of €0.169 million for the same period. The company benefits from strong financial health, with short-term assets significantly exceeding liabilities and no debt burden, supported by an experienced management team averaging 9.4 years in tenure.

- Take a closer look at RomReal's potential here in our financial health report.

- Evaluate RomReal's historical performance by accessing our past performance report.

Cherry (XTRA:C3RY)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Cherry SE, along with its subsidiaries, manufactures and sells computer input devices in Germany and has a market cap of €13.68 million.

Operations: The company's revenue is primarily derived from its Gaming & Office Peripherals segment (€64.42 million), followed by Digital Health & Solutions (€24.22 million) and Components (€10.87 million).

Market Cap: €13.68M

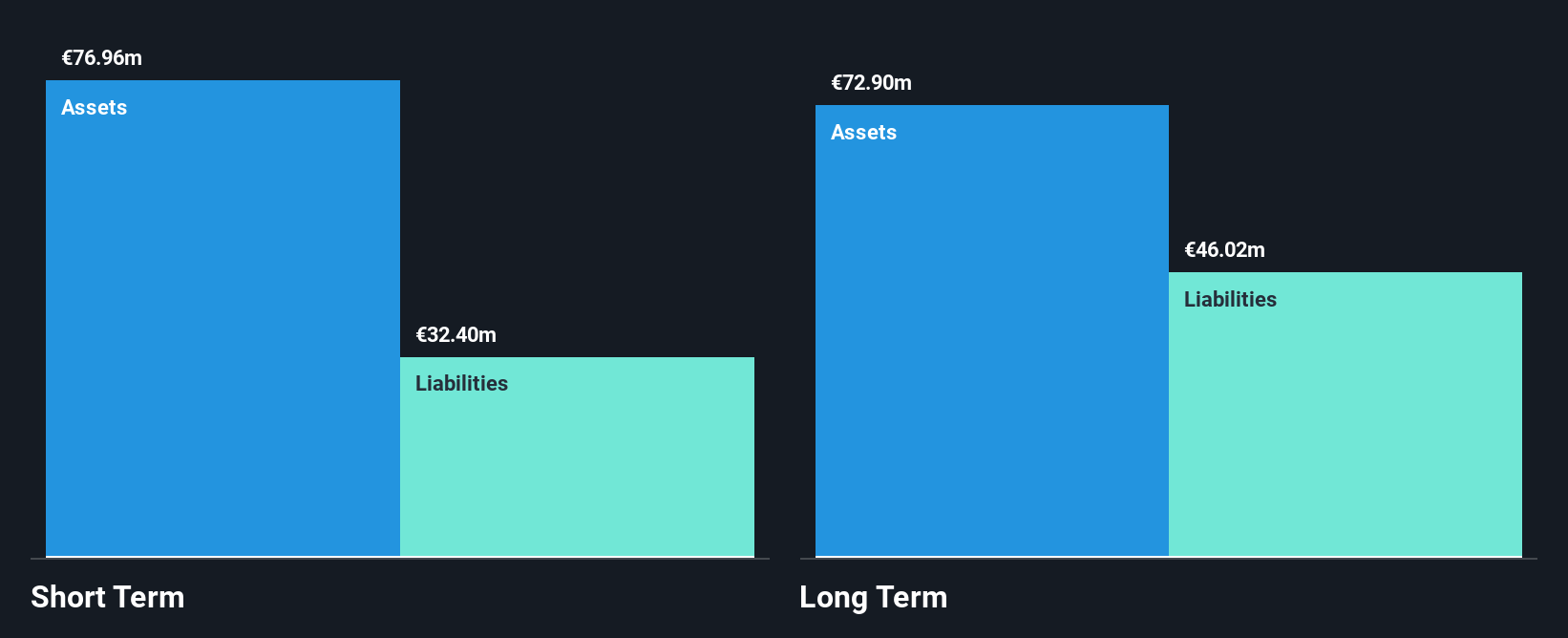

Cherry SE, with a market cap of €13.68 million, faces challenges as it remains unprofitable and its losses have widened over the past year. The company has a satisfactory net debt to equity ratio of 28.6%, but its cash runway is less than a year, indicating potential liquidity concerns. Despite these hurdles, Cherry's recent approval for the TI Messenger in digital healthcare marks progress in innovation and diversification beyond gaming peripherals. Revenue guidance suggests modest growth, yet volatility persists with share prices fluctuating significantly over recent months. An experienced management team aims to navigate these complexities effectively.

- Jump into the full analysis health report here for a deeper understanding of Cherry.

- Examine Cherry's earnings growth report to understand how analysts expect it to perform.

Where To Now?

- Access the full spectrum of 277 European Penny Stocks by clicking on this link.

- Interested In Other Possibilities? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NGM:GTAB B

Glycorex Transplantation

A medical technology company, focuses on transplantation, blood transfusion, and autoimmune diseases.

Excellent balance sheet with low risk.

Market Insights

Community Narratives