As European markets navigate the challenges of new U.S. trade tariffs and fluctuating consumer sentiment, investors are keenly observing potential opportunities amidst economic uncertainty. Penny stocks, often representing smaller or newer companies, continue to capture attention for their potential to offer growth at lower price points. Despite being seen as a throwback term, these stocks can present valuable opportunities when backed by strong financials and solid fundamentals.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Bredband2 i Skandinavien (OM:BRE2) | SEK2.00 | SEK1.91B | ✅ 4 ⚠️ 0 View Analysis > |

| Transferator (NGM:TRAN A) | SEK2.21 | SEK206.08M | ✅ 2 ⚠️ 3 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.55 | SEK266.2M | ✅ 4 ⚠️ 3 View Analysis > |

| Hifab Group (OM:HIFA B) | SEK3.88 | SEK236.05M | ✅ 2 ⚠️ 2 View Analysis > |

| IMS (WSE:IMS) | PLN3.42 | PLN115.92M | ✅ 3 ⚠️ 2 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.986 | €33.02M | ✅ 4 ⚠️ 3 View Analysis > |

| High (ENXTPA:HCO) | €3.00 | €58.93M | ✅ 2 ⚠️ 3 View Analysis > |

| Arcure (ENXTPA:ALCUR) | €4.50 | €26.05M | ✅ 3 ⚠️ 3 View Analysis > |

| Nurminen Logistics Oyj (HLSE:NLG1V) | €1.04 | €83.78M | ✅ 3 ⚠️ 3 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.115 | €292.01M | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 421 stocks from our European Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Wulff-Yhtiöt Oyj (HLSE:WUF1V)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Wulff-Yhtiöt Oyj, with a market cap of €20.39 million, operates through its subsidiaries to offer workplace products, IT supplies, ergonomics, printing services, and international exhibition and event services across Finland, Sweden, Norway, Denmark, other European countries and internationally.

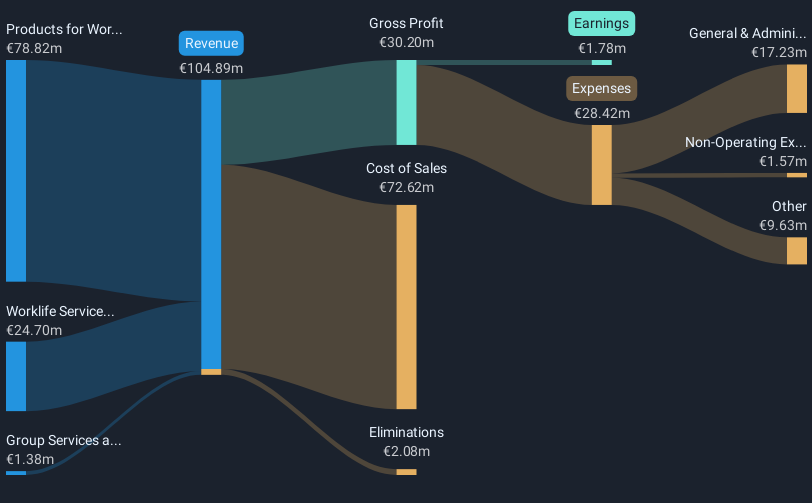

Operations: The company generates revenue primarily from its Products for Work Environments Segment, amounting to €78.82 million, and its Worklife Services Segment, which contributes €24.70 million.

Market Cap: €20.39M

Wulff-Yhtiöt Oyj, with a market cap of €20.39 million, is navigating challenges typical of penny stocks. The company has experienced declining profit margins and negative earnings growth over the past year, but it remains in a stable financial position with short-term assets exceeding liabilities. Despite high debt levels, interest payments are well covered by EBIT and operating cash flow. Recent organizational restructuring aims to enhance efficiency and profitability by an estimated €0.7 million annually. Although dividends have been unstable historically, the board proposed a dividend increase for 2024, reflecting cautious optimism about future performance amidst market shifts.

- Dive into the specifics of Wulff-Yhtiöt Oyj here with our thorough balance sheet health report.

- Assess Wulff-Yhtiöt Oyj's future earnings estimates with our detailed growth reports.

Glycorex Transplantation (NGM:GTAB B)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Glycorex Transplantation AB (publ) is a medical technology company specializing in transplantation, blood transfusion, and autoimmune diseases, with a market cap of SEK160.86 million.

Operations: The company's revenue is derived entirely from its Organ Transplantation segment, totaling SEK35.16 million.

Market Cap: SEK160.86M

Glycorex Transplantation AB, with a market cap of SEK160.86 million, is navigating the complexities of penny stocks in the medical technology sector. The company reported sales of SEK35.16 million for 2024, showing modest revenue growth despite ongoing unprofitability and increased losses over five years. Its short-term assets cover liabilities comfortably, and it maintains a stable cash runway exceeding three years. Recent strategic moves include a distribution agreement with Rontis Hellas SA for Glycosorb® ABO in Greece, potentially expanding its market presence in transfusion products amidst high share price volatility and an inexperienced board of directors.

- Click here to discover the nuances of Glycorex Transplantation with our detailed analytical financial health report.

- Evaluate Glycorex Transplantation's historical performance by accessing our past performance report.

onesano (WSE:ONO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Onesano S.A. operates in Poland, focusing on research and development in dietetics, animal nutrition, bioremediation, and agrotechnological processes, with a market cap of PLN66.21 million.

Operations: The company generates revenue of PLN11.05 billion from its Vitamins & Nutrition Products segment.

Market Cap: PLN66.21M

Onesano S.A., operating in Poland, faces challenges typical of penny stocks with limited financial stability. Despite generating PLN11.05 billion in revenue from its Vitamins & Nutrition Products segment, the company remains unprofitable and has seen losses increase by 27.2% annually over five years. With less than a year of cash runway and no debt, Onesano's short-term assets exceed liabilities, providing some financial cushion. However, its share price is highly volatile and management lacks experience with an average tenure of 0.3 years, raising concerns about strategic direction amidst the company's ongoing struggles to achieve profitability.

- Click to explore a detailed breakdown of our findings in onesano's financial health report.

- Understand onesano's track record by examining our performance history report.

Turning Ideas Into Actions

- Gain an insight into the universe of 421 European Penny Stocks by clicking here.

- Curious About Other Options? Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 20 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if onesano might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:ONO

onesano

Engages in the research and development in the areas of dietetics, animal nutrition, bioremediation, and agrotechnological processes in Poland.

Adequate balance sheet with slight risk.

Market Insights

Community Narratives