We Think Shareholders Are Less Likely To Approve A Large Pay Rise For AAK AB (publ.)'s (STO:AAK) CEO For Now

Key Insights

- AAK AB (publ.)'s Annual General Meeting to take place on 8th of May

- Salary of kr12.0m is part of CEO Johan Westman's total remuneration

- The overall pay is 56% above the industry average

- AAK AB (publ.)'s total shareholder return over the past three years was 61% while its EPS grew by 32% over the past three years

CEO Johan Westman has done a decent job of delivering relatively good performance at AAK AB (publ.) (STO:AAK) recently. This is something shareholders will keep in mind as they cast their votes on company resolutions such as executive remuneration in the upcoming AGM on 8th of May. However, some shareholders may still be hesitant of being overly generous with CEO compensation.

See our latest analysis for AAK AB (publ.)

How Does Total Compensation For Johan Westman Compare With Other Companies In The Industry?

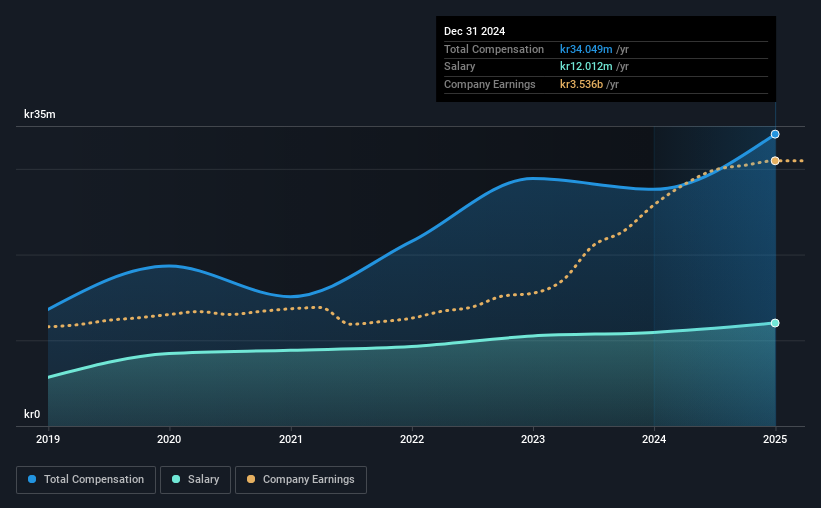

Our data indicates that AAK AB (publ.) has a market capitalization of kr66b, and total annual CEO compensation was reported as kr34m for the year to December 2024. We note that's an increase of 23% above last year. We think total compensation is more important but our data shows that the CEO salary is lower, at kr12m.

On examining similar-sized companies in the Swedish Food industry with market capitalizations between kr39b and kr117b, we discovered that the median CEO total compensation of that group was kr22m. Hence, we can conclude that Johan Westman is remunerated higher than the industry median. What's more, Johan Westman holds kr16m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | kr12m | kr11m | 35% |

| Other | kr22m | kr17m | 65% |

| Total Compensation | kr34m | kr28m | 100% |

Talking in terms of the industry, salary represented approximately 37% of total compensation out of all the companies we analyzed, while other remuneration made up 63% of the pie. There isn't a significant difference between AAK AB (publ.) and the broader market, in terms of salary allocation in the overall compensation package. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

A Look at AAK AB (publ.)'s Growth Numbers

AAK AB (publ.)'s earnings per share (EPS) grew 32% per year over the last three years. It achieved revenue growth of 2.0% over the last year.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. It's also good to see modest revenue growth, suggesting the underlying business is healthy. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has AAK AB (publ.) Been A Good Investment?

We think that the total shareholder return of 61%, over three years, would leave most AAK AB (publ.) shareholders smiling. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

In Summary...

The company's decent performance might have made most shareholders happy, possibly making CEO remuneration the least of the concerns to be discussed in the upcoming AGM. However, if the board proposes to increase the compensation, some shareholders might have questions given that the CEO is already being paid higher than the industry.

CEO compensation can have a massive impact on performance, but it's just one element. That's why we did some digging and identified 1 warning sign for AAK AB (publ.) that investors should think about before committing capital to this stock.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:AAK

AAK AB (publ.)

Develops and sells plant-based oils and fats in Sweden and internationally.

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives