Stock Analysis

- Sweden

- /

- Diversified Financial

- /

- OM:LUND B

Take Care Before Diving Into The Deep End On L E Lundbergföretagen AB (publ) (STO:LUND B)

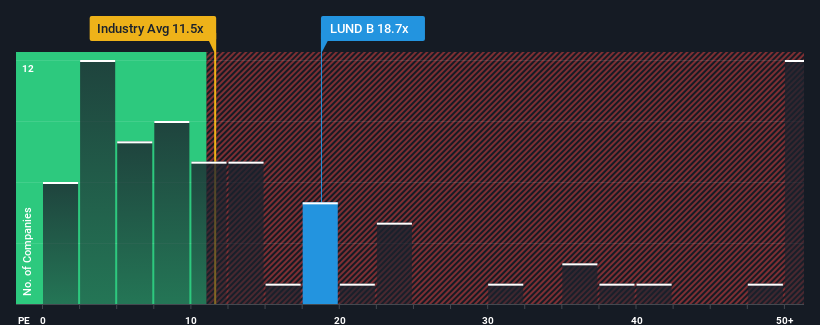

When close to half the companies in Sweden have price-to-earnings ratios (or "P/E's") above 23x, you may consider L E Lundbergföretagen AB (publ) (STO:LUND B) as an attractive investment with its 18.7x P/E ratio. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Recent times have been quite advantageous for L E Lundbergföretagen as its earnings have been rising very briskly. One possibility is that the P/E is low because investors think this strong earnings growth might actually underperform the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

See our latest analysis for L E Lundbergföretagen

Is There Any Growth For L E Lundbergföretagen?

The only time you'd be truly comfortable seeing a P/E as low as L E Lundbergföretagen's is when the company's growth is on track to lag the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 380% last year. Pleasingly, EPS has also lifted 102% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing earnings over that time.

Comparing that to the market, which is only predicted to deliver 23% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised earnings results.

With this information, we find it odd that L E Lundbergföretagen is trading at a P/E lower than the market. It looks like most investors are not convinced the company can maintain its recent growth rates.

What We Can Learn From L E Lundbergföretagen's P/E?

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of L E Lundbergföretagen revealed its three-year earnings trends aren't contributing to its P/E anywhere near as much as we would have predicted, given they look better than current market expectations. There could be some major unobserved threats to earnings preventing the P/E ratio from matching this positive performance. It appears many are indeed anticipating earnings instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with L E Lundbergföretagen, and understanding should be part of your investment process.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're helping make it simple.

Find out whether L E Lundbergföretagen is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:LUND B

L E Lundbergföretagen

Manufactures and sells paperboard, paper, and sawn timber products worldwide.

Adequate balance sheet with acceptable track record.