- Sweden

- /

- Diversified Financial

- /

- OM:KINV B

Kinnevik (OM:KINV B): Assessing Valuation After Recent Share Price Gains

Reviewed by Kshitija Bhandaru

Kinnevik (OM:KINV B) shares have been catching the eye of investors recently, especially as the stock has quietly posted solid gains over the past quarter. There isn’t a headline-grabbing event driving the shift, but the move itself is enough to spark questions among those watching the Nordic investment group. Does this signal a broader trend or is it just noise? When a company with a storied track record drifts upward like this, it’s only natural to wonder if something under the surface has changed.

Looking at the past year, Kinnevik’s stock is up 8.6%, and momentum has been building this spring, with the price up about 12% in the past three months. Of course, the path hasn’t been a straight line. The last month saw a 3% dip, reminding everyone that volatility still lingers. Long-term investors will also note the stock remains well below its levels from previous years, despite a recent rebound. In the background, the company continues to post negative revenue and net income growth, which complicates the story further for anyone trying to gauge fair value.

After this mix of steady gains and lingering challenges, is Kinnevik presenting an undervalued entry point, or is the recent run a sign that the market is already anticipating future turnaround?

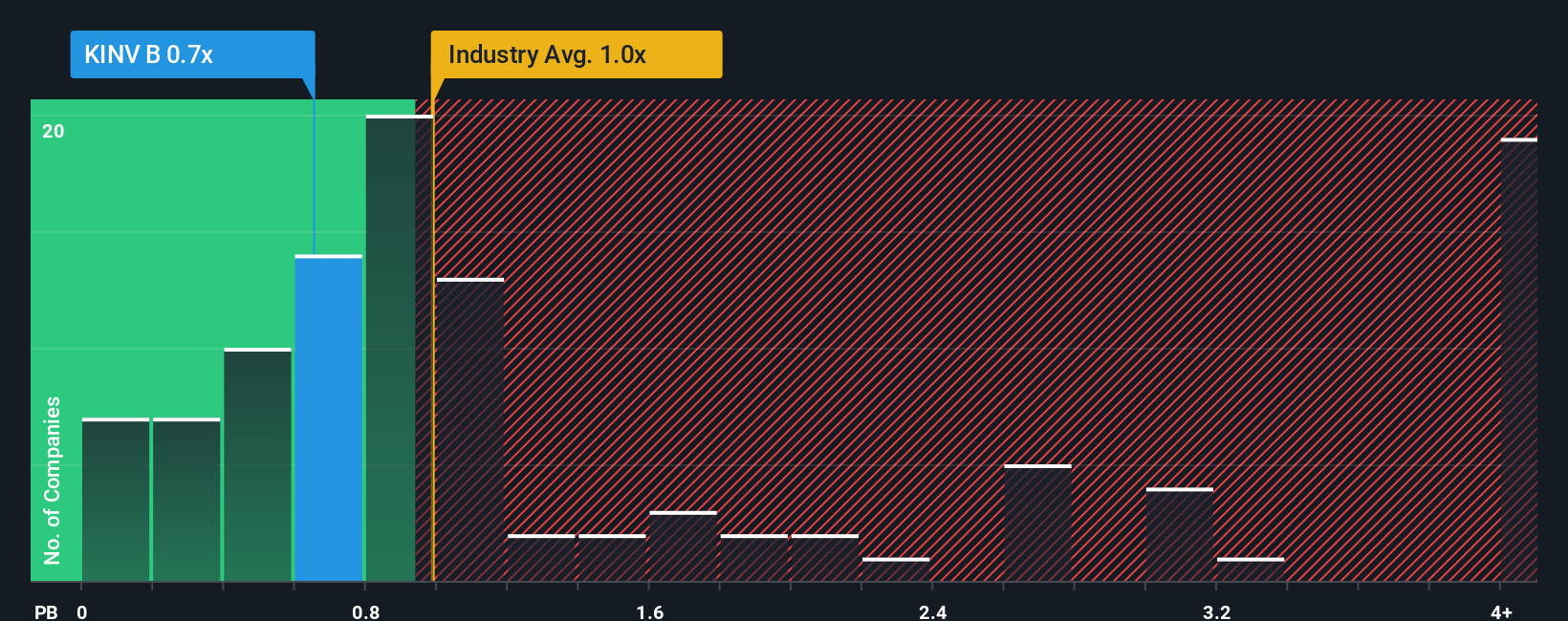

Price-to-Book Ratio of 0.7x: Is it justified?

The current valuation places Kinnevik’s shares at a price-to-book (P/B) ratio of 0.7x, noticeably lower than both the Swedish and broader European diversified financial industry averages, which stand at approximately 1x. This suggests that Kinnevik may be trading at a discount compared to its peers in terms of the value the market is placing on the company’s net assets.

The price-to-book ratio gauges how much investors are willing to pay for each unit of a company’s net assets. It is a commonly used measure for financial firms and investment companies like Kinnevik, where asset values can play a key role in determining future returns. A lower P/B ratio can indicate potential undervaluation, particularly if the underlying assets are expected to grow or become more profitable.

In Kinnevik’s case, this discount may reflect a more cautious view from investors due to recent losses and low profitability. Alternatively, it could signal an opportunity if future performance meets expectations. With analysts forecasting a return to profitability and high revenue growth, the current multiple could prove to be attractive if those projections are realized.

Result: Fair Value of $104.17 (UNDERVALUED)

See our latest analysis for Kinnevik.However, persistent negative revenue and net income growth remain significant risks. These factors could potentially outweigh the current valuation discount if trends fail to improve.

Find out about the key risks to this Kinnevik narrative.Another Angle: What Do Other Valuation Methods Say?

Relying solely on asset-based measures like the price-to-book may not give the complete picture. A look at similar companies across Europe shows Kinnevik’s shares are also attractively valued by this standard, but is that enough?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Kinnevik Narrative

If you think there’s more to the story, or want to dig into the numbers yourself, building a personal view is fast and straightforward. Do it your way.

A great starting point for your Kinnevik research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t let your next opportunity slip by. Scan the market for top picks that match your goals and boost your research with actionable insights from our unique stock screeners:

- Capture potential in the fast-growing world of digital assets by tapping into cryptocurrency and blockchain stocks, which highlights breakthrough companies in cryptocurrency and blockchain innovation.

- Target steady income streams by browsing dividend stocks with yields > 3%, featuring businesses known for dividend yields above 3% and proven payout records.

- Spot stocks trading beneath their intrinsic value by leveraging undervalued stocks based on cash flows to uncover quality bargains based on solid cash flow analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kinnevik might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:KINV B

Kinnevik

A venture capital firm specializing in investments in early to late venture and growth capital.

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives