- Sweden

- /

- Capital Markets

- /

- NGM:BTCX

Goobit Group AB (publ)'s (NGM:BTCX) Shares Leap 57% Yet They're Still Not Telling The Full Story

Goobit Group AB (publ) (NGM:BTCX) shareholders have had their patience rewarded with a 57% share price jump in the last month. Longer-term shareholders would be thankful for the recovery in the share price since it's now virtually flat for the year after the recent bounce.

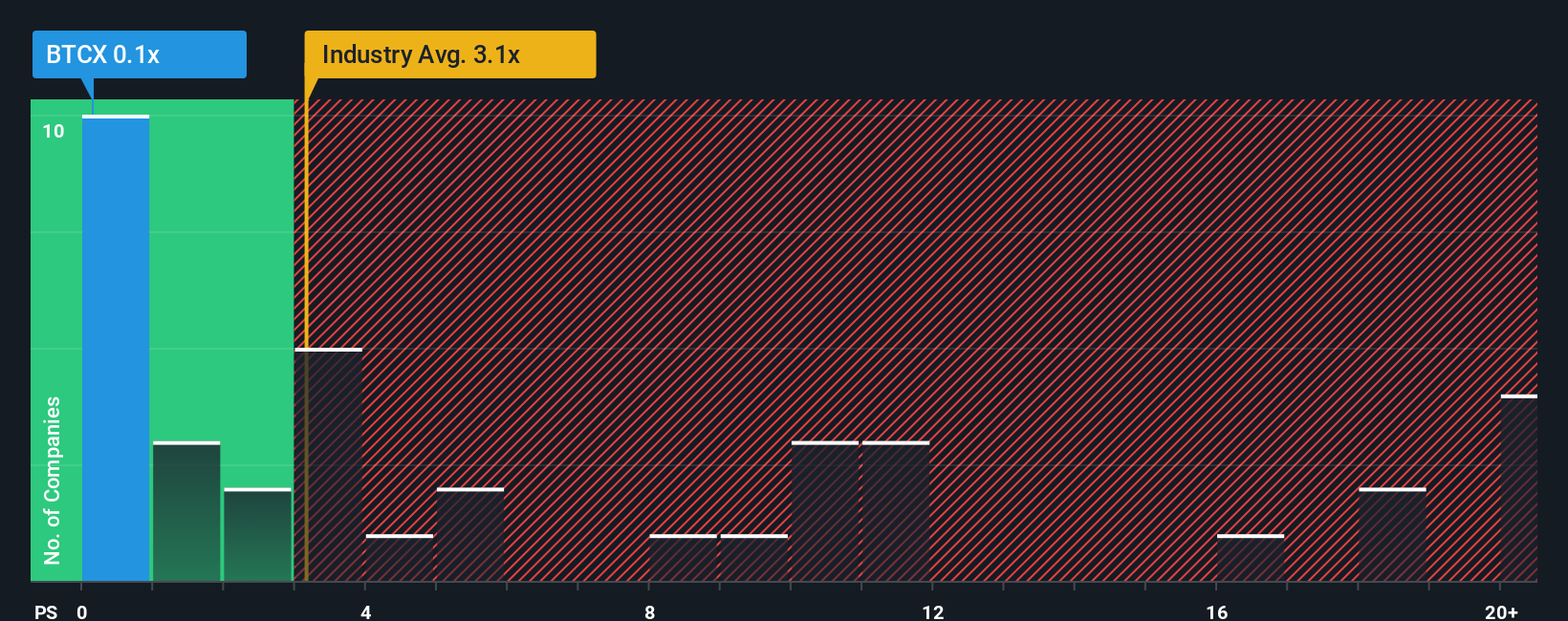

Even after such a large jump in price, Goobit Group's price-to-sales (or "P/S") ratio of 0.1x might still make it look like a strong buy right now compared to the wider Capital Markets industry in Sweden, where around half of the companies have P/S ratios above 3.1x and even P/S above 12x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

View our latest analysis for Goobit Group

What Does Goobit Group's Recent Performance Look Like?

Recent times have been quite advantageous for Goobit Group as its revenue has been rising very briskly. One possibility is that the P/S ratio is low because investors think this strong revenue growth might actually underperform the broader industry in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Although there are no analyst estimates available for Goobit Group, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Goobit Group's Revenue Growth Trending?

Goobit Group's P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 186%. However, this wasn't enough as the latest three year period has seen the company endure a nasty 6.6% drop in revenue in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

It's interesting to note that the rest of the industry is similarly expected to decline by 1.1% over the next year, which is just as bad as the company's recent medium-term revenue decline.

In light of this, the fact Goobit Group's P/S sits below the majority of other companies is unanticipated but certainly not shocking. With revenue going in reverse, it's not guaranteed that the P/S has found a floor yet, despite the industry heading down in unison. There is still potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth, which would be difficult to do with the current industry outlook.

The Bottom Line On Goobit Group's P/S

Goobit Group's recent share price jump still sees fails to bring its P/S alongside the industry median. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Goobit Group currently trades on a lower than expected P/S since its recent three-year revenue growth is no worse than the forecasts for a struggling industry. When we see a revenue growth decline that is on par with its peers, we can only assume potential risks are what might be causing the P/S ratio to be lower than average. One major risk is whether the company can maintain its 'middle of the road' medium-termrevenue growth under these tough industry conditions. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

It is also worth noting that we have found 3 warning signs for Goobit Group that you need to take into consideration.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NGM:BTCX

Excellent balance sheet with low risk.

Market Insights

Community Narratives