- Sweden

- /

- Hospitality

- /

- OM:KAMBI

Kambi Group (OM:KAMBI) Margin Decline Challenges Growth-Focused Investor Narratives

Reviewed by Simply Wall St

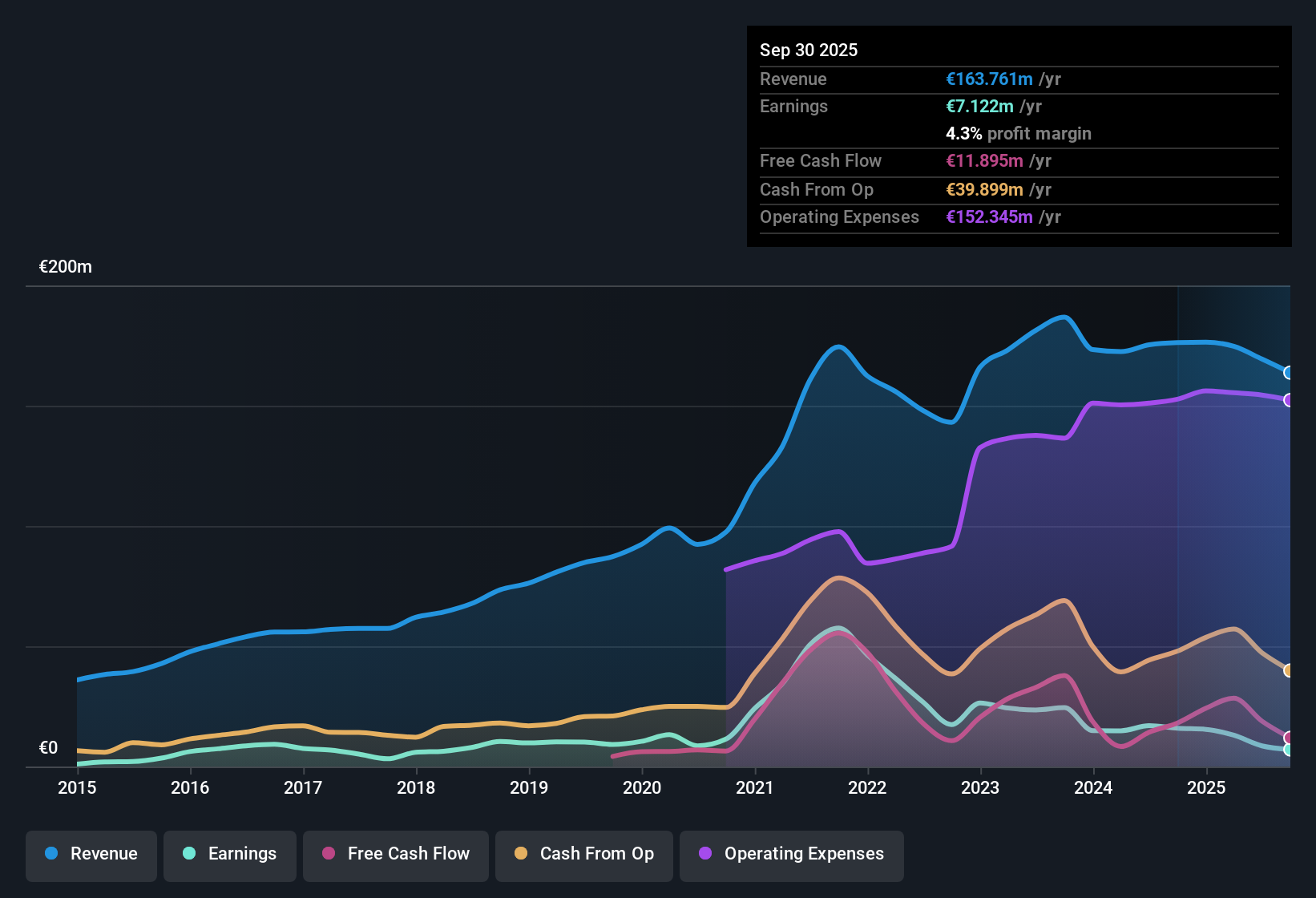

Kambi Group (OM:KAMBI) reported a 23.7% annual decline in earnings over the past five years, with its latest net profit margin narrowing to 4.3% from 9% a year ago. Despite the recent margin compression, forecasts point to a striking projected earnings growth of 57.35% per year. This rate would outpace both the market’s 12.8% expected profit growth and a strong 6.8% annual revenue growth outlook. These figures set the stage for a company that is wrestling with profitability pressures, yet still offering significant growth potential that could shift investor sentiment.

See our full analysis for Kambi Group.Next, we will see how this fresh set of numbers matches up with the most widely held narratives about Kambi. Here is where the story gains strength, and where it might require a closer look.

See what the community is saying about Kambi Group

Margins Poised for Expansion by 2027

- Analysts believe Kambi's profit margins could jump from 5.1% today to 14.5% in three years, which would be a dramatic turnaround in profitability even as margins have recently declined.

- According to the analysts' consensus view,

- ongoing efficiency efforts like AI adoption are expected to lift margins and create more stable earnings,

- yet the last year saw net profit margin slip from 9% to 4.3%, putting pressure on these forecasts and pointing to the challenge of executing cost-savings rapidly enough.

- To see how analysts tie margin expansion to Kambi's long-term value, check the full consensus narrative for a closer look at this pivotal trend. 📊 Read the full Kambi Group Consensus Narrative.

Revenue Diversification and Regulated Market Push

- Revenue is projected to grow at 4.4% annually over the next three years, supported by global expansion efforts, especially in Latin America and through new product rollouts like Odds Feed+.

- The consensus narrative highlights that

- Kambi’s venture into newly regulated markets and broader product reach is anticipated to strengthen recurring revenues and client stickiness,

- but slower-than-expected growth in Brazil and heightened regulatory headwinds (such as higher taxes and deposit limits) expose the business to ongoing market-specific risks.

Premium Price Tag Despite Discounted Cash Flow Gap

- Kambi trades at a price-to-earnings ratio of 40.5x, which is more than double the European Hospitality industry average of 16.3x. Its current share price of SEK115 sits well below its DCF fair value of SEK487.11, and at a discount to the analyst price target of SEK154.36.

- Consensus narrative suggests

- strong projected profit and revenue growth help justify a valuation premium, with analysts expecting earnings to rise to €28 million by 2028,

- but the company's reliance on future high margins and successful global expansion must materialize for this value gap to close; otherwise, its current premium could be difficult to defend.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Kambi Group on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Want to look at the stats from a new angle? In just a few minutes, you can build your own perspective and narrative using Do it your way.

A great starting point for your Kambi Group research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Kambi’s profitability is heavily dependent on future margin gains and international expansion. However, recent margin compression and regulatory uncertainties put these goals at risk.

If you want to target companies trading at more attractive valuations with clear upside, start your search with these 836 undervalued stocks based on cash flows to find opportunities that better align with your investment objectives.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kambi Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:KAMBI

Kambi Group

Provides sports betting technology and services to the betting and gaming industry in Europe, the Americas, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives