Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

In contrast to all that, I prefer to spend time on companies like Evolution (STO:EVO), which has not only revenues, but also profits. Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

View our latest analysis for Evolution

Evolution's Improving Profits

In the last three years Evolution's earnings per share took off like a rocket; fast, and from a low base. So the actual rate of growth doesn't tell us much. As a result, I'll zoom in on growth over the last year, instead. Like the last firework on New Year's Eve accelerating into the sky, Evolution's EPS shot from €1.38 to €2.39, over the last year. You don't see 73% year-on-year growth like that, very often. That could be a sign that the business has reached a true inflection point.

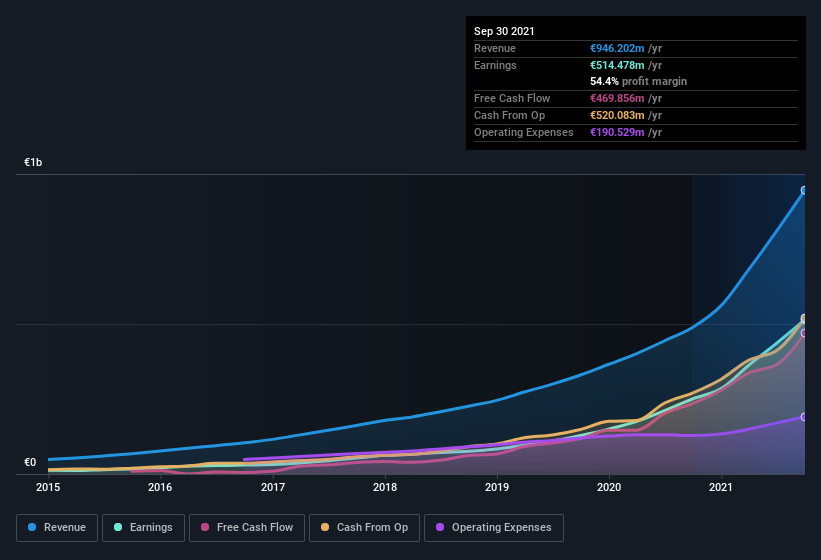

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. The good news is that Evolution is growing revenues, and EBIT margins improved by 4.8 percentage points to 59%, over the last year. Ticking those two boxes is a good sign of growth, in my book.

In the chart below, you can see how the company has grown earnings, and revenue, over time. For finer detail, click on the image.

Fortunately, we've got access to analyst forecasts of Evolution's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Evolution Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

We do note that, in the last year, insiders sold -€7.0m worth of shares. But that's far less than the €27m insiders spend purchasing stock. This makes me even more interested in Evolution because it suggests that those who understand the company best, are optimistic. We also note that it was the Group Chief Executive Officer, Martin Carlesund, who made the biggest single acquisition, paying kr25m for shares at about kr1,406 each.

The good news, alongside the insider buying, for Evolution bulls is that insiders (collectively) have a meaningful investment in the stock. Notably, they have an enormous stake in the company, worth €17b. I would find that kind of skin in the game quite encouraging, if I owned shares, since it would ensure that the leaders of the company would also experience my success, or failure, with the stock.

While insiders already own a significant amount of shares, and they have been buying more, the good news for ordinary shareholders does not stop there. The cherry on top is that the CEO, Martin Carlesund is paid comparatively modestly to CEOs at similar sized companies. I discovered that the median total compensation for the CEOs of companies like Evolution, with market caps over €7.1b, is about €2.0m.

The Evolution CEO received €1.8m in compensation for the year ending . That comes in below the average for similar sized companies, and seems pretty reasonable to me. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of a culture of integrity, in a broader sense.

Should You Add Evolution To Your Watchlist?

Evolution's earnings have taken off like any random crypto-currency did, back in 2017. Just as heartening; insiders both own and are buying more stock. Because of the potential that it has reached an inflection point, I'd suggest Evolution belongs on the top of your watchlist. However, before you get too excited we've discovered 1 warning sign for Evolution that you should be aware of.

As a growth investor I do like to see insider buying. But Evolution isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Evolution might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:EVO

Evolution

Develops, produces, markets, and licenses online casino systems to gaming operators in Europe, Asia, North America, Latin America, and internationally.

Flawless balance sheet and undervalued.