- Sweden

- /

- Hospitality

- /

- OM:ATIC

It's Down 26% But Actic Group AB (publ) (STO:ATIC) Could Be Riskier Than It Looks

Actic Group AB (publ) (STO:ATIC) shares have retraced a considerable 26% in the last month, reversing a fair amount of their solid recent performance. The good news is that in the last year, the stock has shone bright like a diamond, gaining 113%.

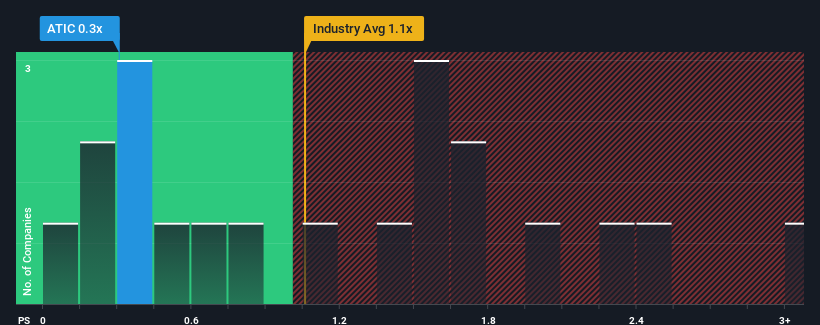

Since its price has dipped substantially, when close to half the companies operating in Sweden's Hospitality industry have price-to-sales ratios (or "P/S") above 0.9x, you may consider Actic Group as an enticing stock to check out with its 0.3x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Actic Group

What Does Actic Group's P/S Mean For Shareholders?

We'd have to say that with no tangible growth over the last year, Actic Group's revenue has been unimpressive. It might be that many expect the uninspiring revenue performance to worsen, which has repressed the P/S. If not, then existing shareholders may be feeling optimistic about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Actic Group will help you shine a light on its historical performance.Is There Any Revenue Growth Forecasted For Actic Group?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Actic Group's to be considered reasonable.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. Fortunately, a few good years before that means that it was still able to grow revenue by 12% in total over the last three years. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Comparing that to the industry, which is predicted to deliver 4.3% growth in the next 12 months, the company's momentum is pretty similar based on recent medium-term annualised revenue results.

In light of this, it's peculiar that Actic Group's P/S sits below the majority of other companies. It may be that most investors are not convinced the company can maintain recent growth rates.

The Final Word

Actic Group's recently weak share price has pulled its P/S back below other Hospitality companies. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our examination of Actic Group revealed its three-year revenue trends looking similar to current industry expectations hasn't given the P/S the boost we expected, given that it's lower than the wider industry P/S, When we see industry-like revenue growth but a lower than expected P/S, we assume potential risks are what might be placing downward pressure on the share price. At least the risk of a price drop looks to be subdued if recent medium-term revenue trends continue, but investors seem to think future revenue could see some volatility.

Having said that, be aware Actic Group is showing 2 warning signs in our investment analysis, and 1 of those is significant.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:ATIC

Actic Group

Operates gyms and wellness facilities in Sweden, Norway, and Germany.

Good value with acceptable track record.

Market Insights

Community Narratives