Stock Analysis

- Sweden

- /

- Aerospace & Defense

- /

- OM:MILDEF

June 2024 Insights Into Three Swedish Stocks Estimated Below Value

Reviewed by Simply Wall St

Amidst a backdrop of political uncertainty and fluctuating markets across Europe, Sweden's equities market presents a unique landscape for investors seeking value. This article explores three Swedish stocks that appear undervalued in the current economic climate, offering potential opportunities for those looking to diversify their portfolios with international assets.

Top 10 Undervalued Stocks Based On Cash Flows In Sweden

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Björn Borg (OM:BORG) | SEK55.00 | SEK101.85 | 46% |

| Boule Diagnostics (OM:BOUL) | SEK10.60 | SEK20.95 | 49.4% |

| Alleima (OM:ALLEI) | SEK69.55 | SEK138.36 | 49.7% |

| Nordic Waterproofing Holding (OM:NWG) | SEK161.80 | SEK296.14 | 45.4% |

| Net Insight (OM:NETI B) | SEK5.05 | SEK9.84 | 48.7% |

| Nolato (OM:NOLA B) | SEK58.85 | SEK111.99 | 47.4% |

| MilDef Group (OM:MILDEF) | SEK70.70 | SEK132.15 | 46.5% |

| Humble Group (OM:HUMBLE) | SEK9.85 | SEK19.39 | 49.2% |

| Sinch (OM:SINCH) | SEK22.06 | SEK40.52 | 45.6% |

| Gigasun (OM:GIGA) | SEK3.79 | SEK7.49 | 49.4% |

Let's uncover some gems from our specialized screener

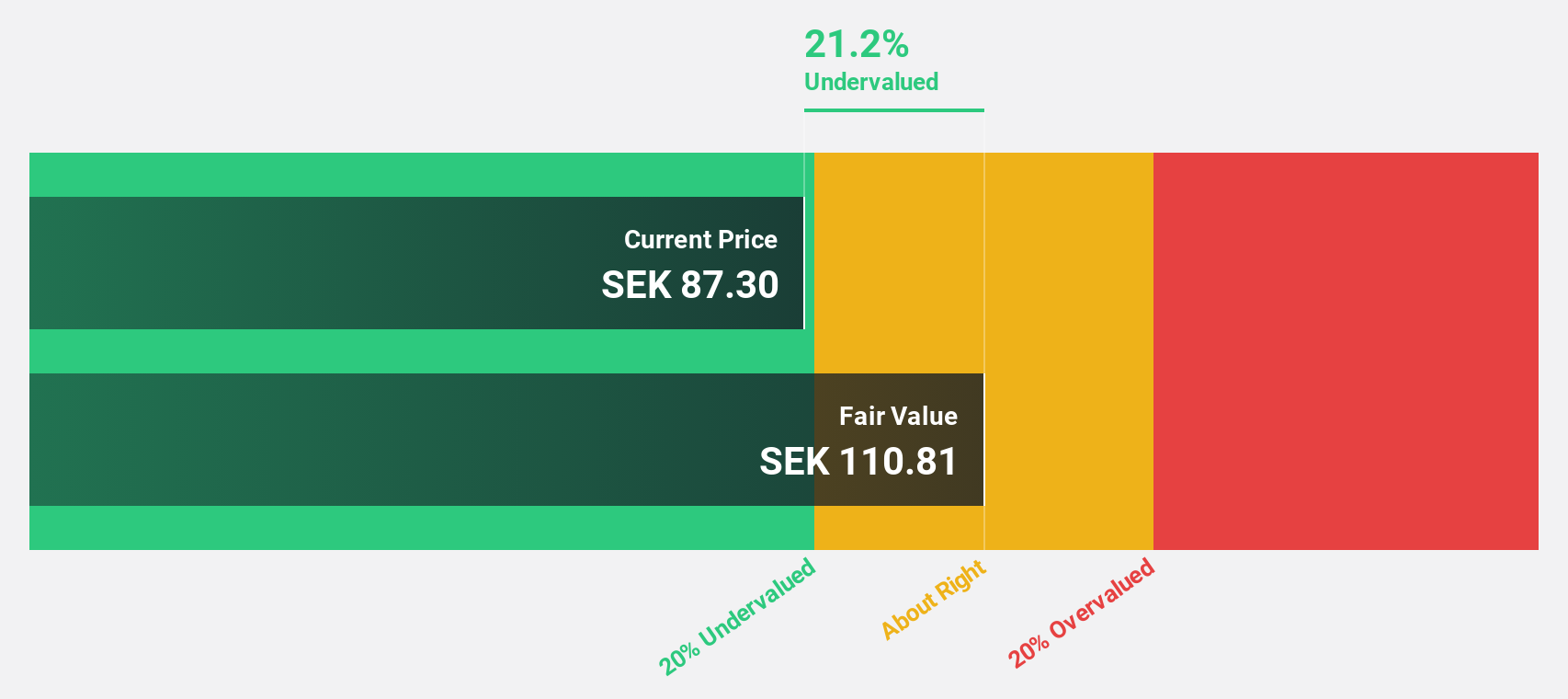

AcadeMedia (OM:ACAD)

Overview: AcadeMedia AB (publ) is an independent education provider operating in Sweden, Norway, the Netherlands, and Germany with a market capitalization of SEK 5.43 billion.

Operations: The company generates revenue from several educational services, with SEK 6.20 billion from Upper Secondary Schools, SEK 6.07 billion from Preschool & International, SEK 4.25 billion in Compulsory School, and SEK 1.79 billion in Adult Education.

Estimated Discount To Fair Value: 29.7%

AcadeMedia, valued at SEK 53.5, is trading below its estimated fair value of SEK 76.11, indicating a potential undervaluation by 29.7%. The company's earnings and revenue growth are outpacing the Swedish market, with earnings expected to rise significantly over the next three years and revenue forecasted to grow at 9.5% annually compared to the market's 1.8%. However, it has an unstable dividend track record and its forecasted Return on Equity is low at 13.5%. Recent financials show a strong performance with year-over-year increases in sales and net income for both quarterly and nine-month periods.

- Insights from our recent growth report point to a promising forecast for AcadeMedia's business outlook.

- Unlock comprehensive insights into our analysis of AcadeMedia stock in this financial health report.

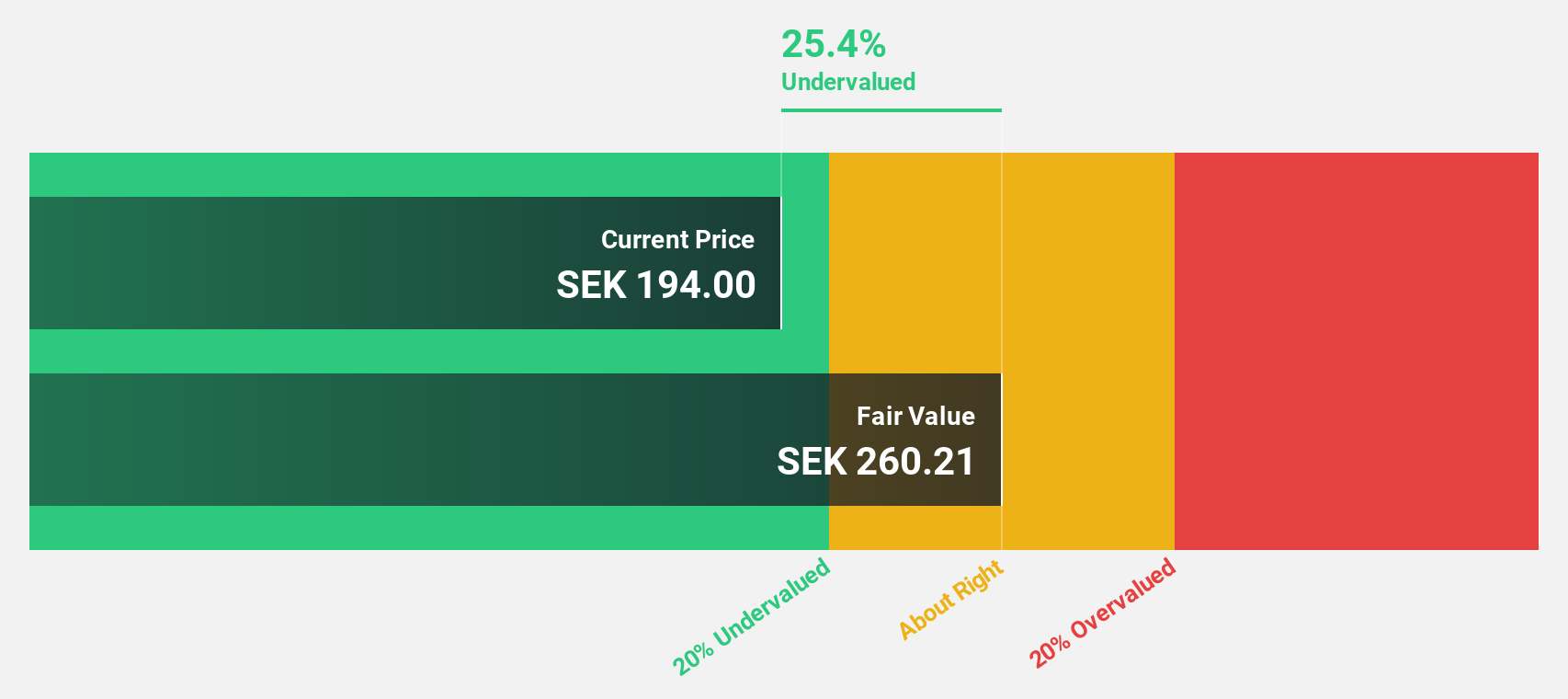

CellaVision (OM:CEVI)

Overview: CellaVision AB (publ) specializes in developing and selling instruments, software, and reagents for the analysis of blood and body fluids, operating both in Sweden and internationally, with a market capitalization of SEK 6.05 billion.

Operations: The company generates SEK 708.28 million from its automated microscopy systems and reagents in the field of hematology.

Estimated Discount To Fair Value: 17.7%

CellaVision, priced at SEK 253.5, is trading under its fair value of SEK 308.09, suggesting a modest undervaluation. Recent financials reveal robust growth with Q1 sales and net income significantly higher than the previous year, alongside a dividend affirmation in May. The company's earnings are projected to grow by 24% annually over the next three years, outstripping the Swedish market prediction of 14% per year, supported by a strong forecasted Return on Equity of 23.9%.

- In light of our recent growth report, it seems possible that CellaVision's financial performance will exceed current levels.

- Click here to discover the nuances of CellaVision with our detailed financial health report.

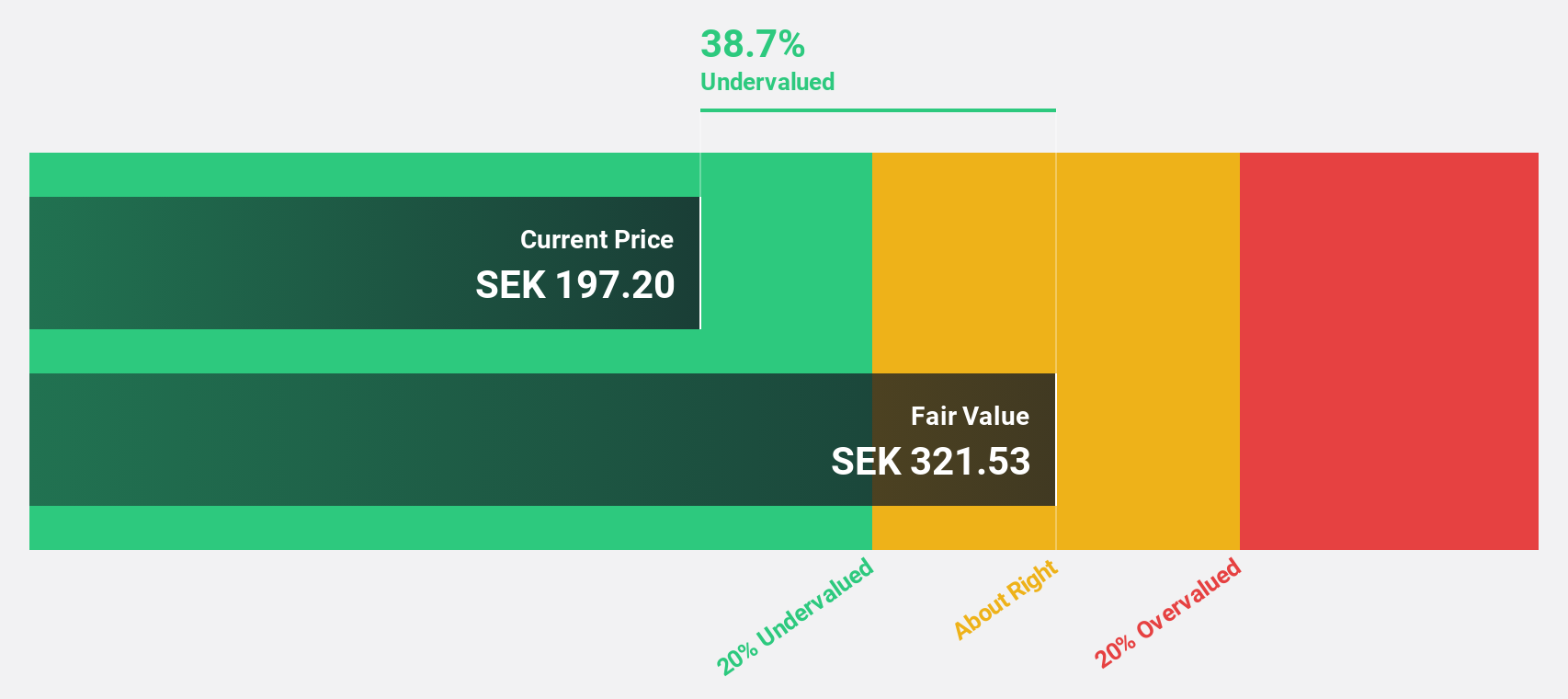

MilDef Group (OM:MILDEF)

Overview: MilDef Group AB (publ) specializes in developing, manufacturing, and selling rugged IT solutions and special electronics mainly for the security and defense sectors, with a market capitalization of approximately SEK 2.82 billion.

Operations: The company generates its revenue primarily from the sale of computer hardware, totaling SEK 1.10 billion.

Estimated Discount To Fair Value: 46.5%

MilDef Group, currently priced at SEK 70.7, is trading significantly below its estimated fair value of SEK 132.15, indicating a deep undervaluation based on discounted cash flow metrics. Despite recent challenges including a Q1 net loss of SEK 11.4 million and decreased sales from the previous year, MilDef's earnings are expected to grow by 44.69% annually. Strategic contracts in Estonia and with BAE Systems highlight potential revenue streams, although its forecasted Return on Equity remains modest at 12.2%.

- Our comprehensive growth report raises the possibility that MilDef Group is poised for substantial financial growth.

- Delve into the full analysis health report here for a deeper understanding of MilDef Group.

Key Takeaways

- Click here to access our complete index of 45 Undervalued Swedish Stocks Based On Cash Flows.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether MilDef Group is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:MILDEF

MilDef Group

Through its subsidiaries, develops, manufactures, and sells rugged IT solutions and special electronics primarily to customers in the security and defense sectors.

Solid track record with reasonable growth potential.