- Sweden

- /

- Consumer Services

- /

- OM:ACAD

It's Unlikely That AcadeMedia AB (publ)'s (STO:ACAD) CEO Will See A Huge Pay Rise This Year

CEO Marcus Strömberg has done a decent job of delivering relatively good performance at AcadeMedia AB (publ) (STO:ACAD) recently. In light of this performance, CEO compensation will probably not be the main focus for shareholders as they go into the AGM on 30 November 2022. However, some shareholders may still be hesitant of being overly generous with CEO compensation.

Check out the opportunities and risks within the SE Consumer Services industry.

Comparing AcadeMedia AB (publ)'s CEO Compensation With The Industry

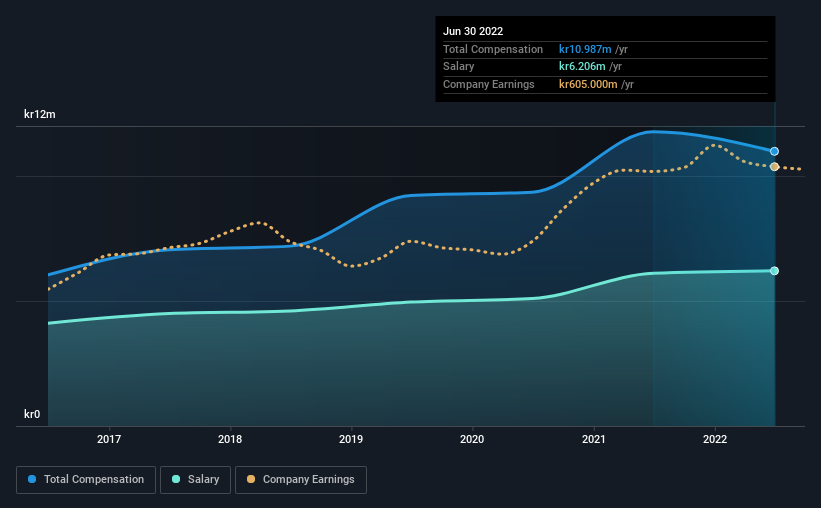

According to our data, AcadeMedia AB (publ) has a market capitalization of kr5.1b, and paid its CEO total annual compensation worth kr11m over the year to June 2022. We note that's a small decrease of 6.6% on last year. Notably, the salary which is kr6.21m, represents a considerable chunk of the total compensation being paid.

On comparing similar companies from the same industry with market caps ranging from kr2.1b to kr8.4b, we found that the median CEO total compensation was kr5.8m. This suggests that Marcus Strömberg is paid more than the median for the industry. What's more, Marcus Strömberg holds kr7.6m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2022 | 2021 | Proportion (2022) |

| Salary | kr6.2m | kr6.1m | 56% |

| Other | kr4.8m | kr5.7m | 44% |

| Total Compensation | kr11m | kr12m | 100% |

Speaking on an industry level, nearly 56% of total compensation represents salary, while the remainder of 44% is other remuneration. AcadeMedia is largely mirroring the industry average when it comes to the share a salary enjoys in overall compensation. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

AcadeMedia AB (publ)'s Growth

AcadeMedia AB (publ) has seen its earnings per share (EPS) increase by 13% a year over the past three years. It achieved revenue growth of 6.8% over the last year.

Shareholders would be glad to know that the company has improved itself over the last few years. It's nice to see revenue heading northwards, as this is consistent with healthy business conditions. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has AcadeMedia AB (publ) Been A Good Investment?

AcadeMedia AB (publ) has generated a total shareholder return of 2.2% over three years, so most shareholders wouldn't be too disappointed. Although, there's always room to improve. As a result, investors in the company might be reluctant about agreeing to increase CEO pay in the future, before seeing an improvement on their returns.

To Conclude...

The company's decent performance might have made most shareholders happy, possibly making CEO remuneration the least of the concerns to be discussed in the upcoming AGM. However, if the board proposes to increase the compensation, some shareholders might have questions given that the CEO is already being paid higher than the industry.

CEO compensation can have a massive impact on performance, but it's just one element. That's why we did some digging and identified 1 warning sign for AcadeMedia that investors should think about before committing capital to this stock.

Important note: AcadeMedia is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:ACAD

AcadeMedia

Operates as an independent education provider in Sweden, Norway, the Netherlands, and Germany.

Undervalued with solid track record.

Market Insights

Community Narratives