- United Kingdom

- /

- Hospitality

- /

- LSE:BOWL

European Small Caps With Insider Buying Highlighting Undervalued Opportunities

Reviewed by Simply Wall St

In recent weeks, European markets have experienced mixed performances, with the pan-European STOXX Europe 600 Index slightly declining after reaching new highs, as expectations for further interest rate cuts from the European Central Bank diminished. Amid these fluctuating market conditions and a stable economic backdrop with inflation near target levels, investors are increasingly focusing on small-cap stocks that may offer unique opportunities. Identifying promising small-cap companies often involves looking for those with strong fundamentals and potential resilience in changing economic landscapes.

Top 10 Undervalued Small Caps With Insider Buying In Europe

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Cairn Homes | 12.0x | 1.5x | 31.23% | ★★★★★★ |

| Bytes Technology Group | 16.6x | 4.0x | 23.01% | ★★★★★☆ |

| Foxtons Group | 10.3x | 0.9x | 42.31% | ★★★★★☆ |

| Speedy Hire | NA | 0.3x | 31.68% | ★★★★★☆ |

| BEWI | NA | 0.4x | 35.57% | ★★★★★☆ |

| J D Wetherspoon | 10.4x | 0.3x | 3.93% | ★★★★☆☆ |

| Senior | 25.2x | 0.8x | 25.04% | ★★★★☆☆ |

| Social Housing REIT | NA | 6.9x | 37.96% | ★★★★☆☆ |

| Fastighets AB Trianon | 14.0x | 4.6x | -217.94% | ★★★★☆☆ |

| Fiskars Oyj Abp | 39.4x | 0.9x | 25.38% | ★★★☆☆☆ |

Let's uncover some gems from our specialized screener.

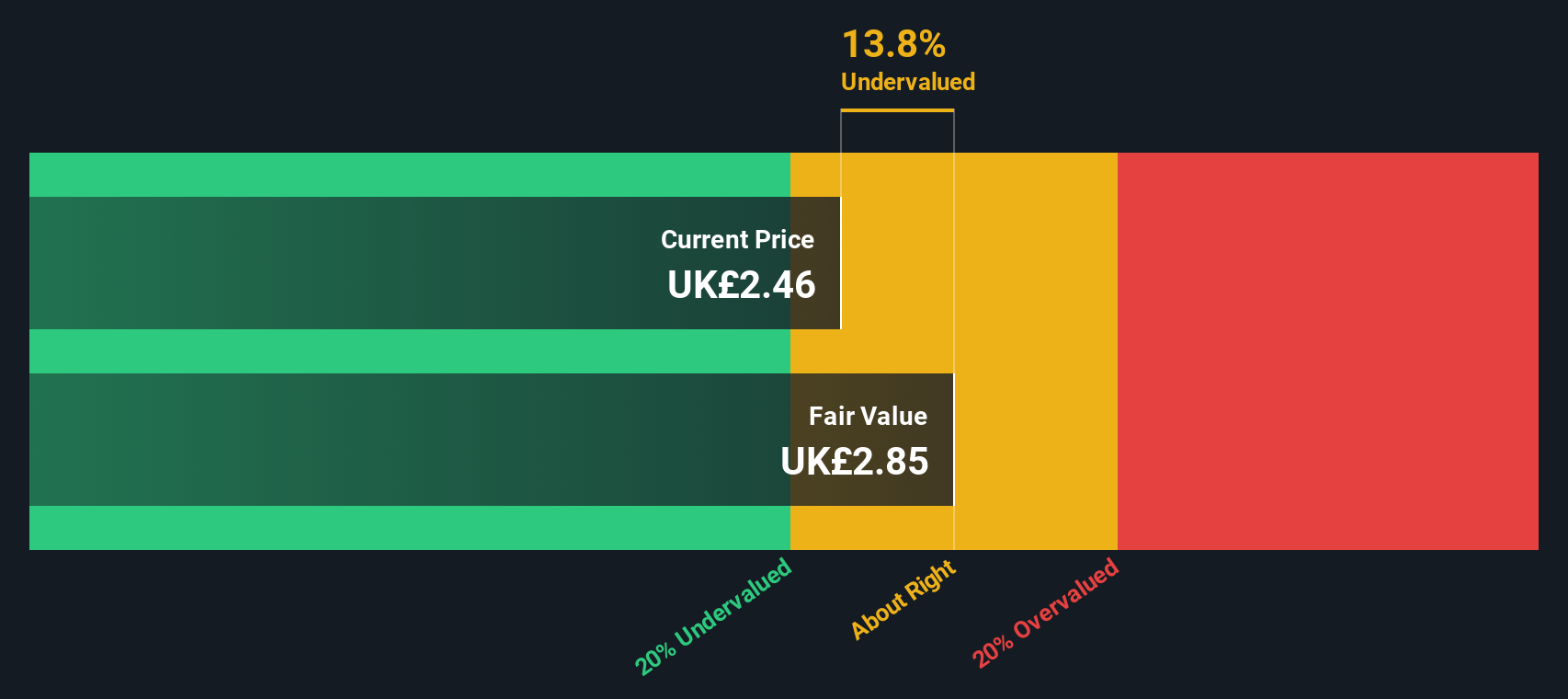

Hollywood Bowl Group (LSE:BOWL)

Simply Wall St Value Rating: ★★★★★☆

Overview: Hollywood Bowl Group operates a chain of ten-pin bowling centers, focusing on providing family-friendly entertainment experiences, with a market cap of approximately £0.5 billion.

Operations: Revenue primarily comes from recreational activities, with the latest figure at £240.46 million. The cost of goods sold (COGS) is noted at £89.63 million, contributing to a gross profit margin of 62.73%. Operating expenses are significant, totaling £89.41 million, which impacts net income figures and results in a net income margin of 11.89%.

PE: 16.0x

Hollywood Bowl Group, a notable player in the leisure industry, is capturing attention with its potential for growth and insider confidence. Recently, insiders have shown their faith by purchasing shares from January to October 2025. The company forecasts earnings growth of 13% annually, though it relies entirely on external borrowing for funding. An Analyst Day on November 3rd highlighted expansion opportunities in Canada, suggesting promising avenues for future revenue streams despite current financial risks.

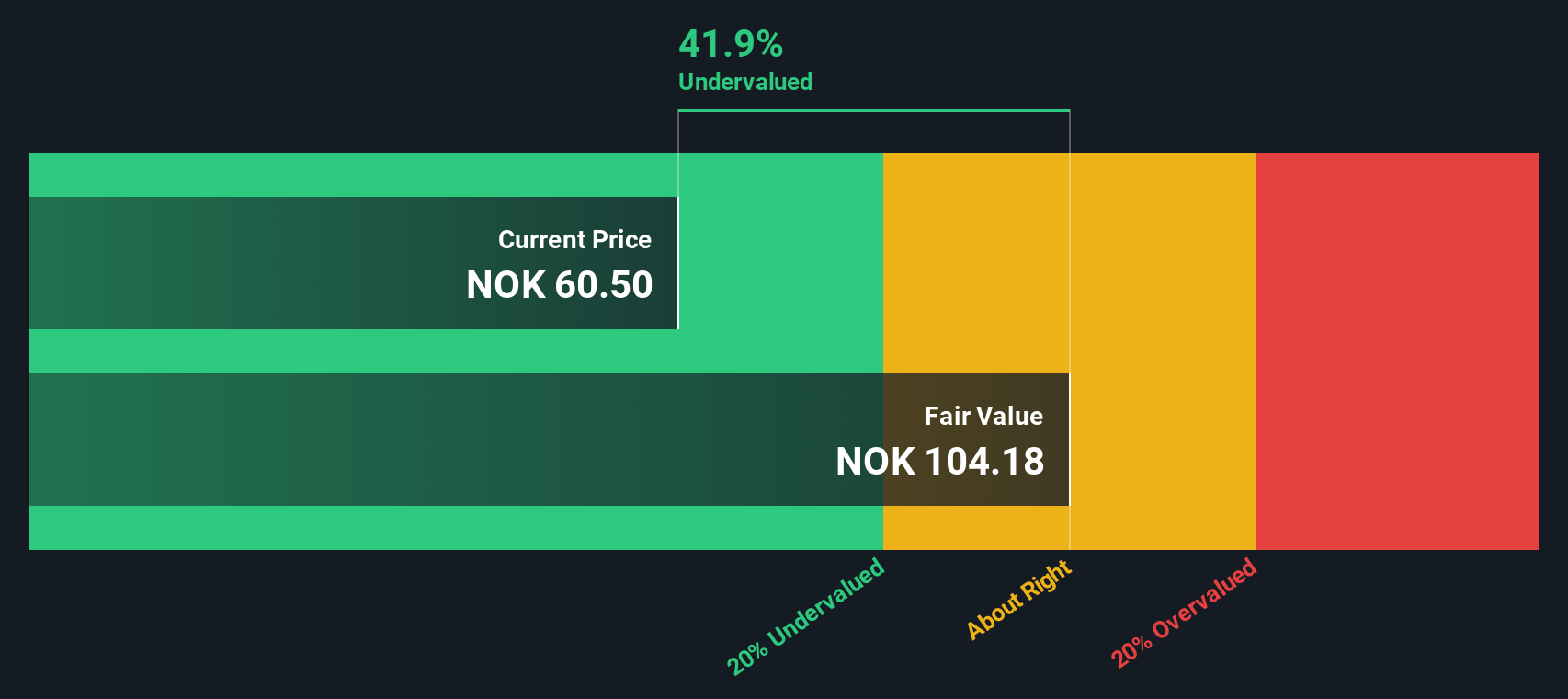

Pexip Holding (OB:PEXIP)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Pexip Holding provides video communication and collaboration services, with a market capitalization of NOK 1.52 billion.

Operations: The company's revenue primarily comes from the sale of collaboration services, with recent figures reaching NOK 1.19 billion. Over time, the gross profit margin has shown fluctuations, recently standing at 41.38%. Operating expenses have been a significant component of costs, with depreciation and amortization also contributing notably to financial outcomes. The net income margin has varied widely across periods but recently improved to 14.76%.

PE: 36.0x

Pexip Holding, a European company with a smaller market cap, has shown promising financial growth. For the second quarter of 2025, sales increased to NOK 281 million from NOK 266 million the previous year, while net income surged to NOK 44 million from NOK 7 million. Insider confidence is evident as insiders purchased shares in recent months. Additionally, Pexip completed a share repurchase program worth NOK 99.9 million by August 2025. Earnings are projected to grow over 20% annually despite reliance on external borrowing for funding.

- Get an in-depth perspective on Pexip Holding's performance by reading our valuation report here.

Understand Pexip Holding's track record by examining our Past report.

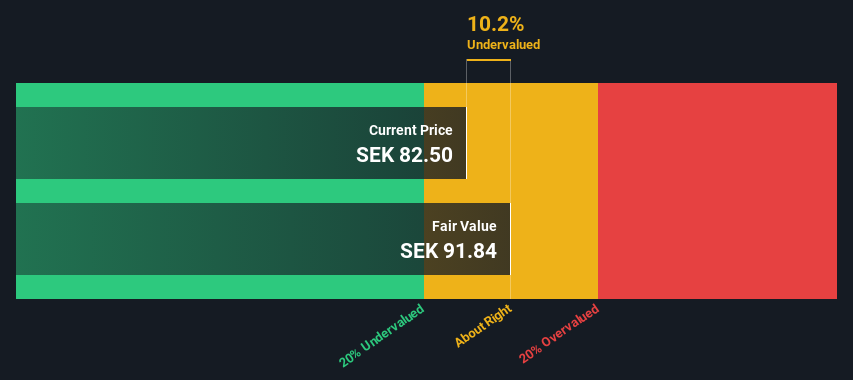

AcadeMedia (OM:ACAD)

Simply Wall St Value Rating: ★★★★★☆

Overview: AcadeMedia is a leading education provider in Northern Europe, offering a wide range of educational services from preschool to adult education, with a market cap of approximately SEK 5.72 billion.

Operations: AcadeMedia generates revenue primarily through its educational services, with a significant portion of costs attributed to COGS and operating expenses. The company's net income margin has shown variability, reaching 4.32% in the most recent period. Over time, AcadeMedia's gross profit margin has demonstrated fluctuations, recently recorded at 31.14%.

PE: 12.3x

AcadeMedia, a key player in education services, has shown promising financial performance with first-quarter sales of SEK 4.1 billion, up from SEK 3.8 billion the previous year. Their net income rose slightly to SEK 82 million. Insider confidence is evident as recent share purchases suggest belief in future growth prospects. The company's expansion into Germany's preschool market highlights strategic growth opportunities amid high demand and a significant shortage of preschool places.

- Unlock comprehensive insights into our analysis of AcadeMedia stock in this valuation report.

Gain insights into AcadeMedia's historical performance by reviewing our past performance report.

Taking Advantage

- Click through to start exploring the rest of the 56 Undervalued European Small Caps With Insider Buying now.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hollywood Bowl Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:BOWL

Hollywood Bowl Group

Operates ten-pin bowling and mini-golf centers in the United Kingdom and internationally.

Undervalued with adequate balance sheet.

Market Insights

Community Narratives