- Sweden

- /

- Hospitality

- /

- NGM:ANGL

Shareholders of Angler Gaming (NGM:ANGL) Must Be Delighted With Their 842% Total Return

For many, the main point of investing in the stock market is to achieve spectacular returns. While not every stock performs well, when investors win, they can win big. To wit, the Angler Gaming plc (NGM:ANGL) share price has soared 681% over five years. This just goes to show the value creation that some businesses can achieve. It's also good to see the share price up 15% over the last quarter.

Anyone who held for that rewarding ride would probably be keen to talk about it.

Check out our latest analysis for Angler Gaming

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

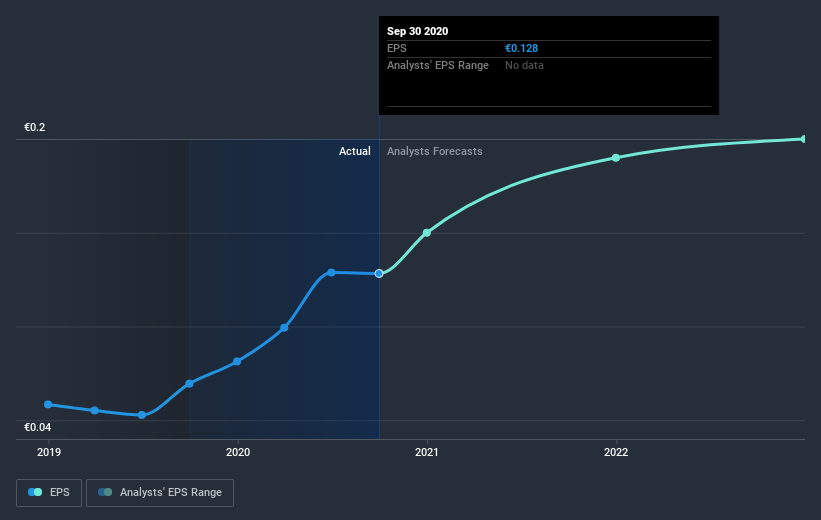

Over half a decade, Angler Gaming managed to grow its earnings per share at 117% a year. This EPS growth is higher than the 51% average annual increase in the share price. Therefore, it seems the market has become relatively pessimistic about the company.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

We know that Angler Gaming has improved its bottom line over the last three years, but what does the future have in store? Take a more thorough look at Angler Gaming's financial health with this free report on its balance sheet.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, Angler Gaming's TSR for the last 5 years was 842%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

We're pleased to report that Angler Gaming shareholders have received a total shareholder return of 151% over one year. Of course, that includes the dividend. Since the one-year TSR is better than the five-year TSR (the latter coming in at 57% per year), it would seem that the stock's performance has improved in recent times. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. It's always interesting to track share price performance over the longer term. But to understand Angler Gaming better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with Angler Gaming (at least 1 which is a bit concerning) , and understanding them should be part of your investment process.

We will like Angler Gaming better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SE exchanges.

If you decide to trade Angler Gaming, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NGM:ANGL

Angler Gaming

Invests in companies that offer gaming services through the internet in Malta.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives