What Thule Group (OM:THULE)'s Mixed 2025 Earnings Reveal About Its Resilience for Shareholders

Reviewed by Sasha Jovanovic

- Thule Group AB announced its third quarter and nine-month results for 2025, with third quarter sales reaching SEK 2,528 million and net income of SEK 314 million, both higher than the previous year.

- An interesting detail is that while third quarter profits increased year-on-year, the company's nine-month net income declined to SEK 1,092 million versus SEK 1,159 million a year earlier, highlighting mixed performance over different periods.

- With Thule reporting higher third quarter profits but weaker nine-month earnings, we will explore how this affects the company's investment outlook.

This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

Thule Group Investment Narrative Recap

To be a Thule Group shareholder, you need to have confidence in its ability to expand gross margins and capitalize on product innovation, despite persistent challenges in North America and inconsistent earnings trends. The most recent quarterly results, while showing higher profits versus last year, do not materially alter the key short-term catalyst of gross margin improvement, though they bring the ongoing risk of continued soft performance across regions into greater focus. Among recent announcements, Thule's dividend declaration (SEK 8.30 per share for 2024) stands out. While this signals management’s intent to reward shareholders, its relevance to short-term catalysts is mainly in supporting investor sentiment rather than addressing the core risks around North American revenue and retailer inventory caution. Yet, despite positive signals on margin growth, investors should be aware that North American market weakness continues to cast a shadow over...

Read the full narrative on Thule Group (it's free!)

Thule Group's outlook points to SEK12.4 billion in revenue and SEK1.9 billion in earnings by 2028. This scenario assumes a 7.2% annual revenue growth rate and a SEK0.9 billion increase in earnings from the current SEK1.0 billion.

Uncover how Thule Group's forecasts yield a SEK288.00 fair value, a 18% upside to its current price.

Exploring Other Perspectives

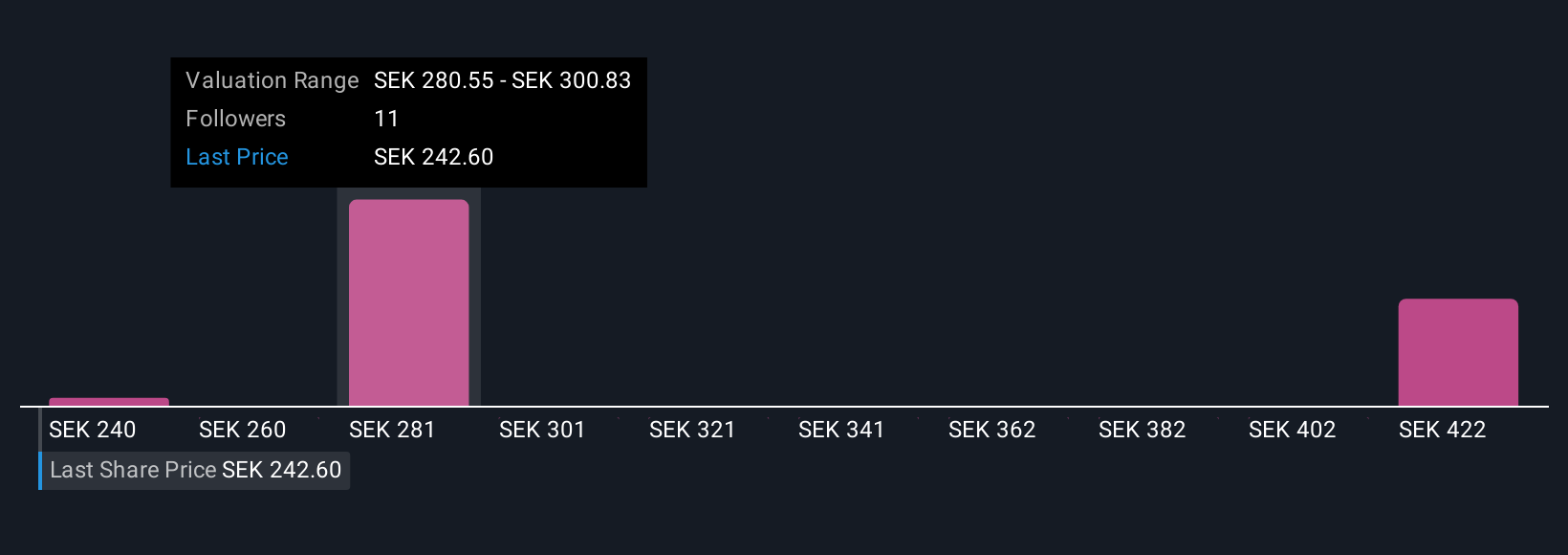

Three Simply Wall St Community members valued Thule Group shares between SEK 240 and SEK 441.77, reflecting a wide spectrum of opinions. With North American revenue weakness still top of mind, you can compare a variety of outlooks to inform your own view.

Explore 3 other fair value estimates on Thule Group - why the stock might be worth as much as 81% more than the current price!

Build Your Own Thule Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Thule Group research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Thule Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Thule Group's overall financial health at a glance.

Contemplating Other Strategies?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Thule Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:THULE

Good value average dividend payer.

Similar Companies

Market Insights

Community Narratives