Thule Group (STO:THULE) Will Pay A Larger Dividend Than Last Year At SEK4.75

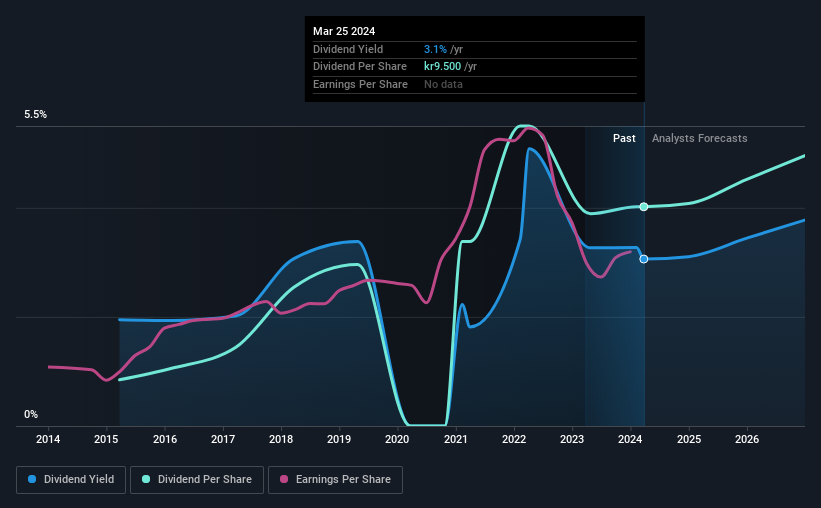

Thule Group AB (publ) (STO:THULE) has announced that it will be increasing its dividend from last year's comparable payment on the 6th of May to SEK4.75. This takes the dividend yield to 3.1%, which shareholders will be pleased with.

Check out our latest analysis for Thule Group

Thule Group's Payment Has Solid Earnings Coverage

If the payments aren't sustainable, a high yield for a few years won't matter that much. Prior to this announcement, Thule Group's dividend made up quite a large proportion of earnings but only 63% of free cash flows. This leaves plenty of cash for reinvestment into the business.

Over the next year, EPS is forecast to expand by 53.0%. Under the assumption that the dividend will continue along recent trends, we think the payout ratio could be 69% which would be quite comfortable going to take the dividend forward.

Thule Group's Dividend Has Lacked Consistency

Thule Group has been paying dividends for a while, but the track record isn't stellar. If the company cuts once, it definitely isn't argument against the possibility of it cutting in the future. Since 2015, the annual payment back then was SEK2.00, compared to the most recent full-year payment of SEK9.50. This works out to be a compound annual growth rate (CAGR) of approximately 19% a year over that time. It is great to see strong growth in the dividend payments, but cuts are concerning as it may indicate the payout policy is too ambitious.

The Dividend Has Growth Potential

Growing earnings per share could be a mitigating factor when considering the past fluctuations in the dividend. We are encouraged to see that Thule Group has grown earnings per share at 5.0% per year over the past five years. Recently, the company has been able to grow earnings at a decent rate, but with the payout ratio on the higher end we don't think the dividend has many prospects for growth.

In Summary

Overall, this is probably not a great income stock, even though the dividend is being raised at the moment. The company is generating plenty of cash, which could maintain the dividend for a while, but the track record hasn't been great. We would be a touch cautious of relying on this stock primarily for the dividend income.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. However, there are other things to consider for investors when analysing stock performance. For instance, we've picked out 1 warning sign for Thule Group that investors should take into consideration. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

Valuation is complex, but we're here to simplify it.

Discover if Thule Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:THULE

Undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives