- Sweden

- /

- Hospitality

- /

- OM:BETS B

3 Swedish Dividend Stocks Yielding Up To 5.7%

Reviewed by Simply Wall St

As European inflation nears the central bank's target, the Swedish market has shown resilience with investors looking for stable returns amidst economic fluctuations. With this backdrop, dividend stocks have become an attractive option for those seeking regular income and potential growth. In this article, we will explore three Swedish dividend stocks yielding up to 5.7%, highlighting what makes them stand out in today's market conditions.

Top 10 Dividend Stocks In Sweden

| Name | Dividend Yield | Dividend Rating |

| Bredband2 i Skandinavien (OM:BRE2) | 4.44% | ★★★★★★ |

| Betsson (OM:BETS B) | 5.70% | ★★★★★☆ |

| Nordea Bank Abp (OM:NDA SE) | 8.68% | ★★★★★☆ |

| Zinzino (OM:ZZ B) | 3.89% | ★★★★★☆ |

| HEXPOL (OM:HPOL B) | 3.56% | ★★★★★☆ |

| Axfood (OM:AXFO) | 3.08% | ★★★★★☆ |

| Duni (OM:DUNI) | 4.93% | ★★★★★☆ |

| Skandinaviska Enskilda Banken (OM:SEB A) | 5.47% | ★★★★★☆ |

| Avanza Bank Holding (OM:AZA) | 4.91% | ★★★★★☆ |

| Bahnhof (OM:BAHN B) | 3.72% | ★★★★☆☆ |

Click here to see the full list of 20 stocks from our Top Swedish Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Bahnhof (OM:BAHN B)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bahnhof AB (publ) operates in the Internet and telecommunications sector across Sweden and Europe, with a market cap of SEK5.78 billion.

Operations: Bahnhof AB (publ) generates revenue through its Internet and telecommunications services in Sweden and Europe.

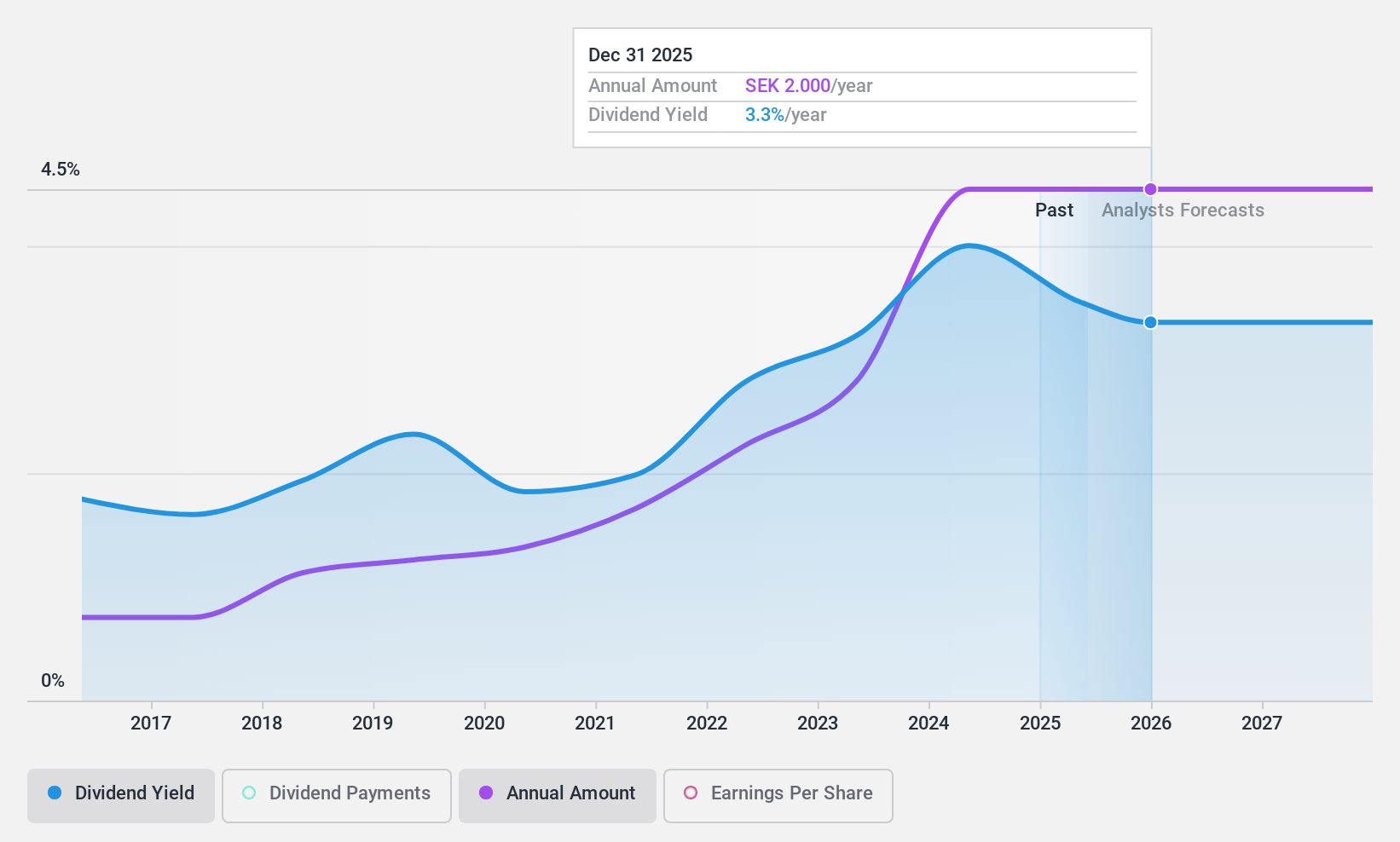

Dividend Yield: 3.7%

Bahnhof's dividend yield of 3.72% is lower than the top 25% of Swedish dividend payers, and its high payout ratio (94.4%) indicates dividends are not well covered by earnings. However, dividends have been stable and growing over the past decade, supported by a cash payout ratio of 85.3%. Recent earnings growth of 21% and solid revenue increases suggest potential for continued financial health despite current coverage concerns.

- Get an in-depth perspective on Bahnhof's performance by reading our dividend report here.

- Our valuation report unveils the possibility Bahnhof's shares may be trading at a premium.

Betsson (OM:BETS B)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Betsson AB (publ) operates and manages online gaming businesses across various regions including the Nordic countries, Latin America, Western Europe, Central and Eastern Europe, Central Asia, and internationally with a market cap of SEK17.82 billion.

Operations: Betsson AB (publ) generates its revenue primarily from its Casinos & Resorts segment, which amounted to €1.01 billion.

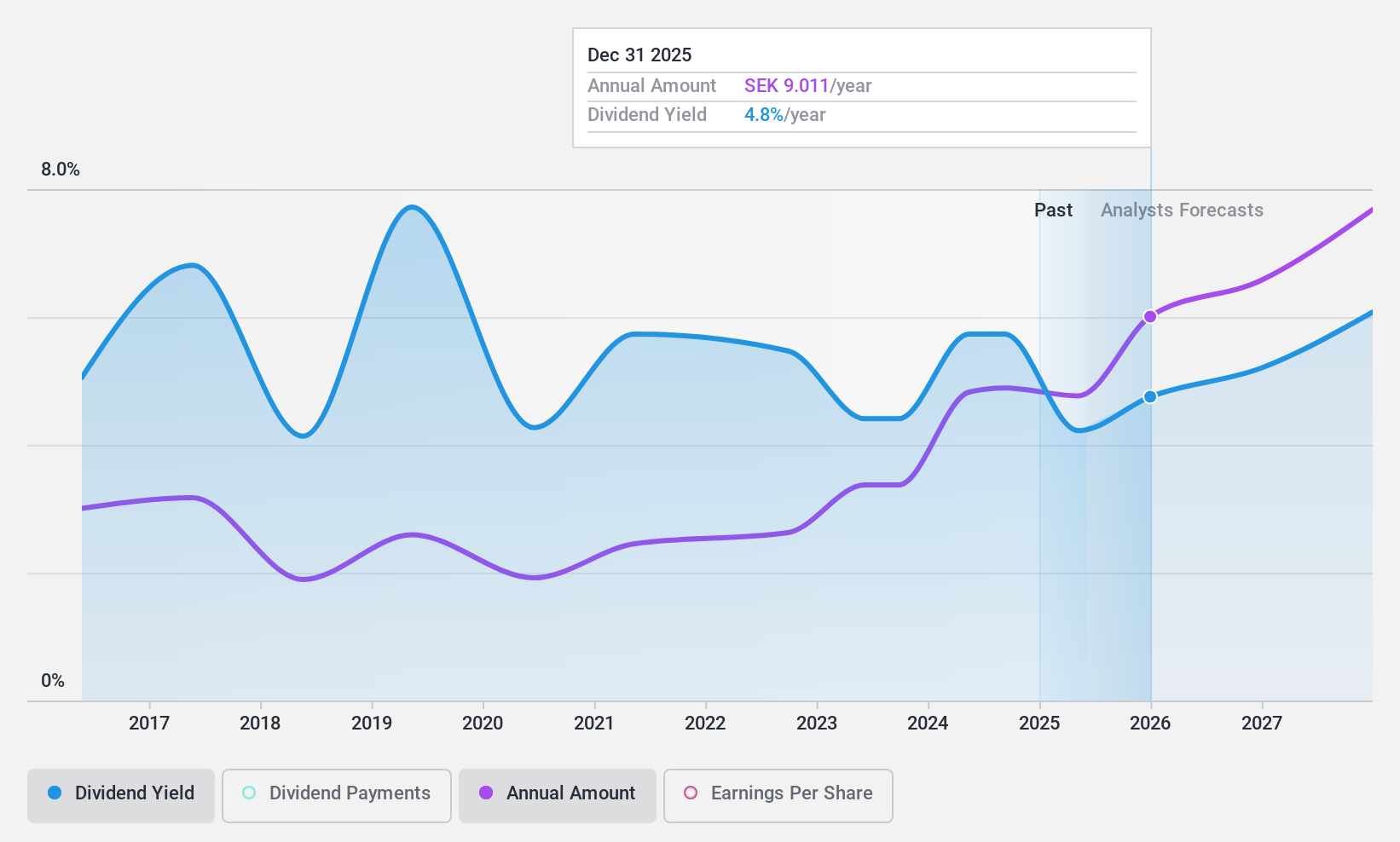

Dividend Yield: 5.7%

Betsson's dividend yield of 5.7% places it in the top 25% of Swedish dividend payers, with dividends covered by both earnings and cash flows, each at around 50%. Despite a volatile dividend history over the past decade, recent earnings growth (12.2%) and revenue increases suggest resilience. The company’s expansion into Peru with new licenses is a positive development, although net income slightly decreased year-on-year in recent reports.

- Dive into the specifics of Betsson here with our thorough dividend report.

- Our valuation report here indicates Betsson may be undervalued.

New Wave Group (OM:NEWA B)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: New Wave Group AB (publ) designs, acquires, and develops brands and products in the corporate, sports, gifts, and home furnishings sectors across Sweden, the United States, Central Europe, other Nordic countries, Southern Europe, and internationally with a market cap of SEK 14.66 billion.

Operations: New Wave Group AB generates revenue from three main segments: Corporate (SEK 4.68 billion), Sports & Leisure (SEK 3.91 billion), and Gifts & Home Furnishings (SEK 877.40 million).

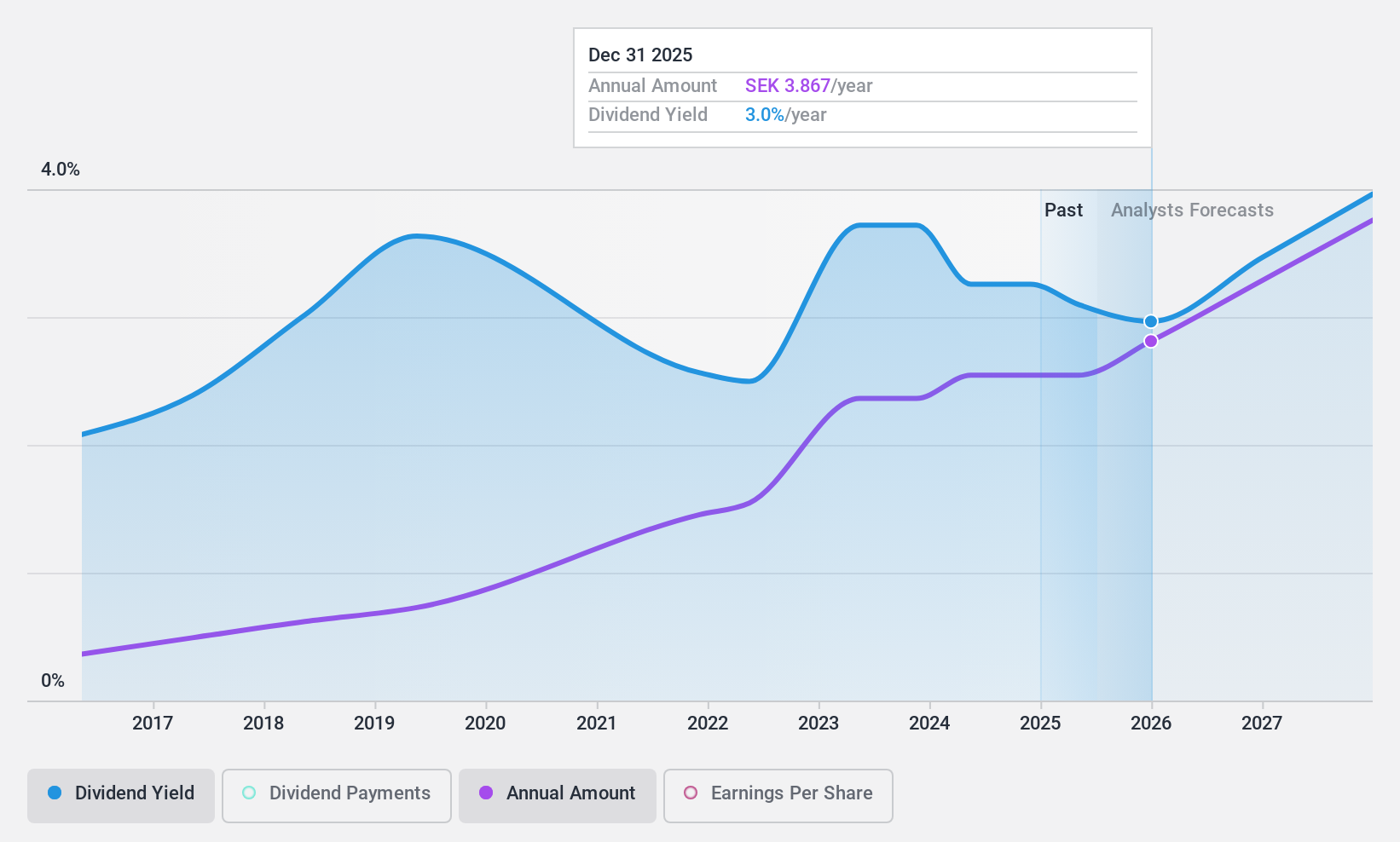

Dividend Yield: 3.2%

New Wave Group's dividend payments have been volatile over the past decade, though they have increased overall. The current payout ratio of 47.9% and cash payout ratio of 37.8% indicate dividends are well covered by both earnings and cash flows. Recent financial results show a slight decline in net income year-on-year, with Q2 sales at SEK 2.40 billion and net income at SEK 210.4 million, alongside upcoming CFO changes which may impact future stability.

- Click to explore a detailed breakdown of our findings in New Wave Group's dividend report.

- Our expertly prepared valuation report New Wave Group implies its share price may be lower than expected.

Make It Happen

- Click through to start exploring the rest of the 17 Top Swedish Dividend Stocks now.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Betsson might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:BETS B

Betsson

Through its subsidiaries, invests in and manages online gaming business primarily in the Nordic countries, Latin America, Western Europe, Central and Eastern Europe, Central Asia, and internationally.

Flawless balance sheet, undervalued and pays a dividend.