- Sweden

- /

- Consumer Durables

- /

- OM:NBZ

Northbaze Group AB (publ) (STO:NBZ) Soars 32% But It's A Story Of Risk Vs Reward

Northbaze Group AB (publ) (STO:NBZ) shareholders would be excited to see that the share price has had a great month, posting a 32% gain and recovering from prior weakness. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 33% over that time.

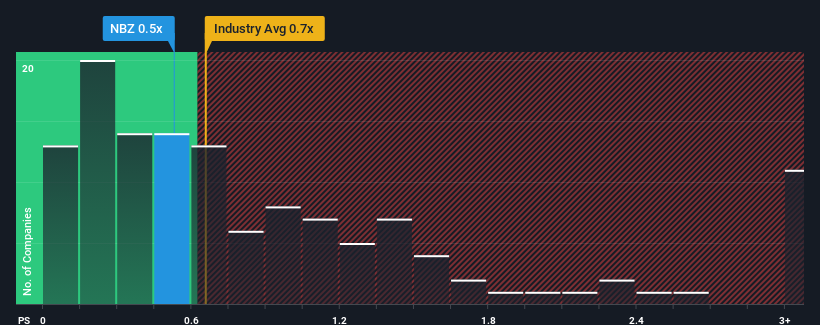

Although its price has surged higher, you could still be forgiven for feeling indifferent about Northbaze Group's P/S ratio of 0.5x, since the median price-to-sales (or "P/S") ratio for the Consumer Durables industry in Sweden is also close to 0.7x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Northbaze Group

How Northbaze Group Has Been Performing

Northbaze Group hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Northbaze Group will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The P/S?

In order to justify its P/S ratio, Northbaze Group would need to produce growth that's similar to the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 30%. As a result, revenue from three years ago have also fallen 14% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next three years should demonstrate the company's robustness, generating growth of 30% each year as estimated by the one analyst watching the company. Meanwhile, the broader industry is forecast to contract by 0.9% per annum, which would indicate the company is doing very well.

In light of this, it's peculiar that Northbaze Group's P/S sits in-line with the majority of other companies. Apparently some shareholders are skeptical of the contrarian forecasts and have been accepting lower selling prices.

What Does Northbaze Group's P/S Mean For Investors?

Northbaze Group appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Northbaze Group's analyst forecasts revealed that its superior revenue outlook against a shaky industry isn't resulting in the company trading at a higher P/S, as per our expectations. There could be some unobserved threats to revenue preventing the P/S ratio from matching the positive outlook. One such risk is that the company may not live up to analysts' revenue trajectories in tough industry conditions. It appears some are indeed anticipating revenue instability, because the company's current prospects should normally provide a boost to the share price.

Plus, you should also learn about these 2 warning signs we've spotted with Northbaze Group.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Northbaze Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:NBZ

Northbaze Group

Designs, develops, produces, and markets audio and sound equipment in Nordic, Europe, Asia, the Middle East, and internationally.

Good value with adequate balance sheet.

Market Insights

Community Narratives