- Sweden

- /

- Commercial Services

- /

- OM:LOOMIS

Exploring Avanza Bank Holding And Two Other Leading Dividend Stocks In Sweden

Reviewed by Simply Wall St

As global markets exhibit mixed signals with some regions facing economic uncertainties, Sweden's market remains a focal point for investors looking for stability and consistent returns. Dividend stocks, such as Avanza Bank Holding, often attract attention in such climates due to their potential for steady income and resilience against market volatility.

Top 10 Dividend Stocks In Sweden

| Name | Dividend Yield | Dividend Rating |

| Betsson (OM:BETS B) | 6.07% | ★★★★★☆ |

| Zinzino (OM:ZZ B) | 3.75% | ★★★★★☆ |

| Loomis (OM:LOOMIS) | 4.21% | ★★★★★☆ |

| HEXPOL (OM:HPOL B) | 3.07% | ★★★★★☆ |

| Duni (OM:DUNI) | 4.60% | ★★★★★☆ |

| Nordea Bank Abp (OM:NDA SE) | 8.19% | ★★★★★☆ |

| Skandinaviska Enskilda Banken (OM:SEB A) | 5.77% | ★★★★★☆ |

| Bilia (OM:BILI A) | 4.44% | ★★★★☆☆ |

| Husqvarna (OM:HUSQ B) | 3.37% | ★★★★☆☆ |

| Bahnhof (OM:BAHN B) | 3.93% | ★★★★☆☆ |

Click here to see the full list of 21 stocks from our Top Dividend Stocks screener.

We'll examine a selection from our screener results.

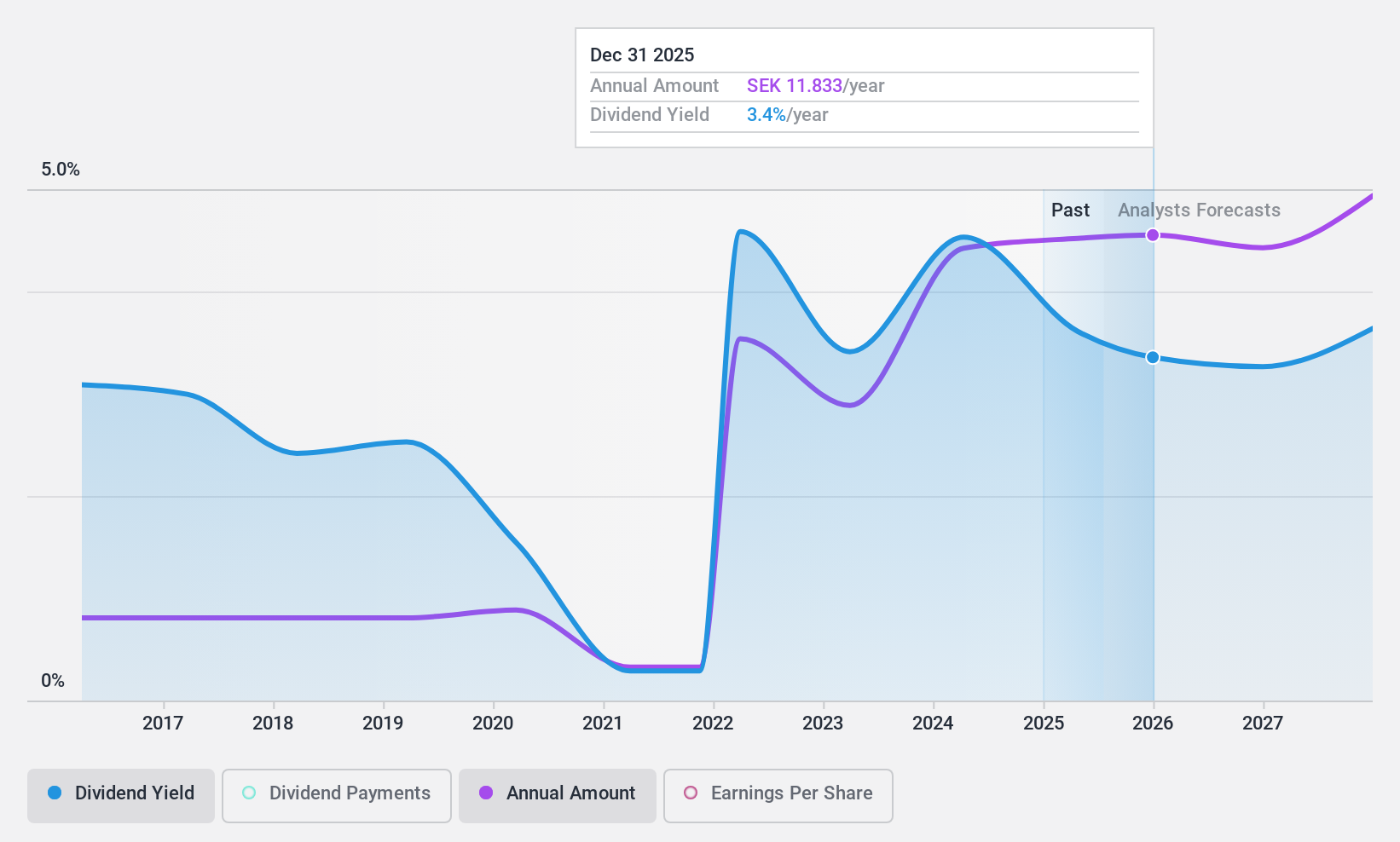

Avanza Bank Holding (OM:AZA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Avanza Bank Holding AB, along with its subsidiaries, provides various savings, pension, and mortgage products in Sweden and has a market capitalization of approximately SEK 43.66 billion.

Operations: Avanza Bank Holding AB generates its revenue primarily through commercial operations, which amounted to SEK 3.84 billion.

Dividend Yield: 4.1%

Avanza Bank Holding's recent earnings show a modest increase, with net income rising to SEK 555 million in Q1 2024 from SEK 501 million the previous year. Despite an unstable dividend track record over the last decade, the company increased its dividend to SEK 11.50 recently. Avanza's dividends appear sustainable with a low cash payout ratio of 18.5% and an earnings coverage at 88.6%. However, its dividend yield slightly trails behind Sweden’s top dividend payers at 4.14%.

- Unlock comprehensive insights into our analysis of Avanza Bank Holding stock in this dividend report.

- Our valuation report here indicates Avanza Bank Holding may be overvalued.

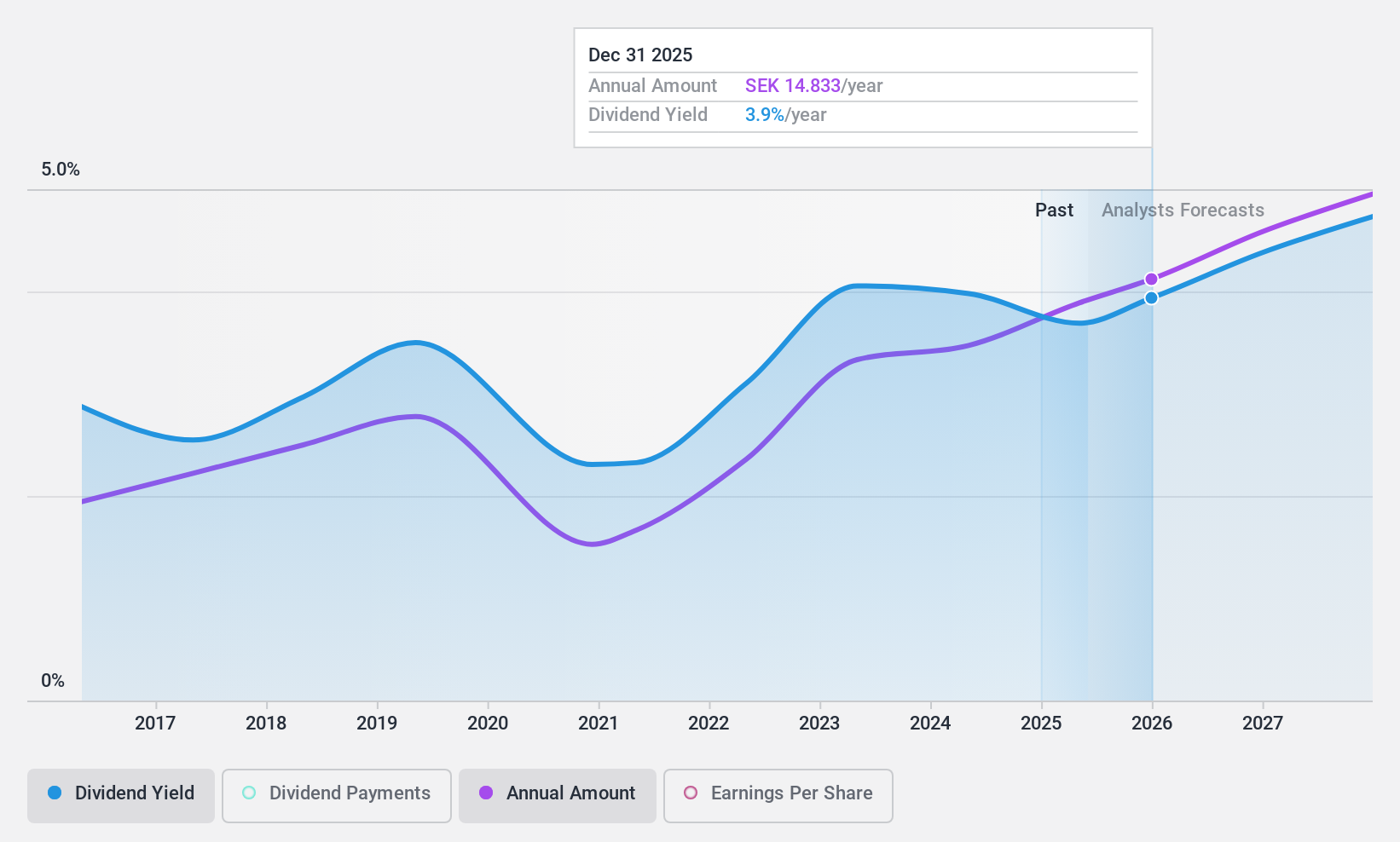

Loomis (OM:LOOMIS)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Loomis AB specializes in services for the distribution, handling, storage, recycling of cash and other valuables with a market capitalization of approximately SEK 20.90 billion.

Operations: Loomis AB generates its revenue primarily through operations in Europe and Latin America, totaling SEK 13.86 billion, and in the United States of America, which contributes SEK 15.17 billion.

Dividend Yield: 4.2%

Loomis has demonstrated a decade of fluctuating dividend reliability, challenging its status among Sweden's top dividend stocks. Despite this, recent increases in dividends to SEK 12.50 per share signal a potential positive shift. The company maintains a healthy coverage with earnings and cash flows supporting these payouts, indicated by payout ratios of 61.2% and 32.6% respectively. Additionally, Loomis initiated a SEK 200 million share repurchase program on May 7, 2024, reflecting confidence in its financial structure and future prospects.

- Navigate through the intricacies of Loomis with our comprehensive dividend report here.

- Upon reviewing our latest valuation report, Loomis' share price might be too pessimistic.

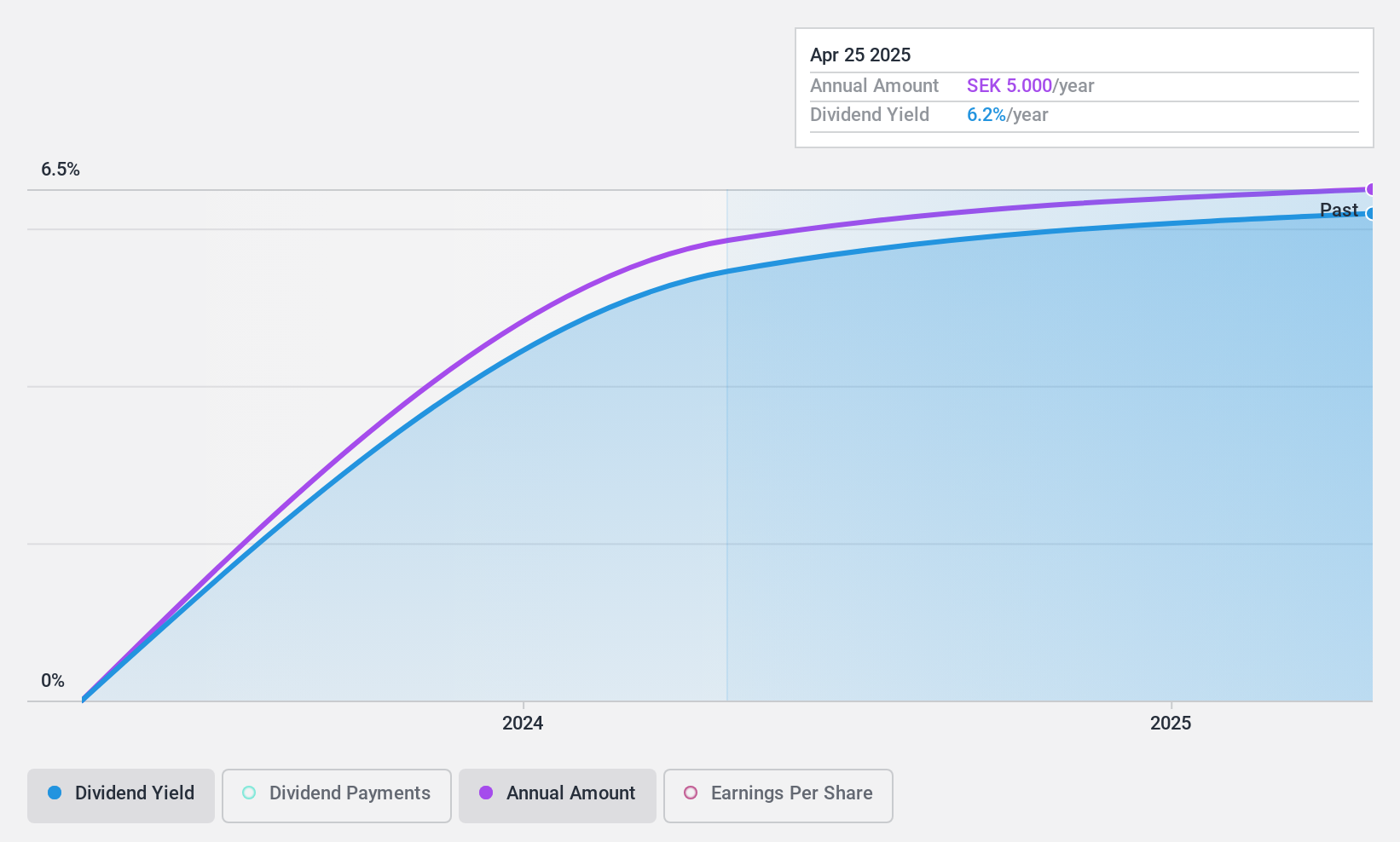

Solid Försäkringsaktiebolag (OM:SFAB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Solid Försäkringsaktiebolag operates in the non-life insurance sector, offering products to private individuals across Sweden, Denmark, Norway, Finland, and other European countries, with a market capitalization of approximately SEK 1.58 billion.

Operations: Solid Försäkringsaktiebolag generates its revenue primarily through three segments: Product (SEK 328.53 million), Assistance (SEK 339.51 million), and Personal Safety (SEK 423.71 million).

Dividend Yield: 5.2%

Solid Försäkringsaktiebolag recently initiated dividend payments, with a declared distribution of SEK 4.50 per share, totaling SEK 82.84 million, effective from April 29, 2024. Although new to dividends, the company supports these with a payout ratio of 50.2% and cash flows at an 86.5% cash payout ratio. The dividend yield stands at a competitive 5.24%, placing it in the top quartile within the Swedish market context despite an unstable dividend track record and recent board changes adding potential strategic shifts.

- Click here to discover the nuances of Solid Försäkringsaktiebolag with our detailed analytical dividend report.

- In light of our recent valuation report, it seems possible that Solid Försäkringsaktiebolag is trading behind its estimated value.

Seize The Opportunity

- Get an in-depth perspective on all 21 Top Dividend Stocks by using our screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:LOOMIS

Loomis

Provides solutions for the distribution, payments, handling, storage, and recycling of cash and other valuables.

Flawless balance sheet, good value and pays a dividend.