- Sweden

- /

- Construction

- /

- OM:SWEC B

Sweco (OM:SWEC B) Earnings Beat: Margin Growth Reinforces Optimistic Market Narratives

Reviewed by Simply Wall St

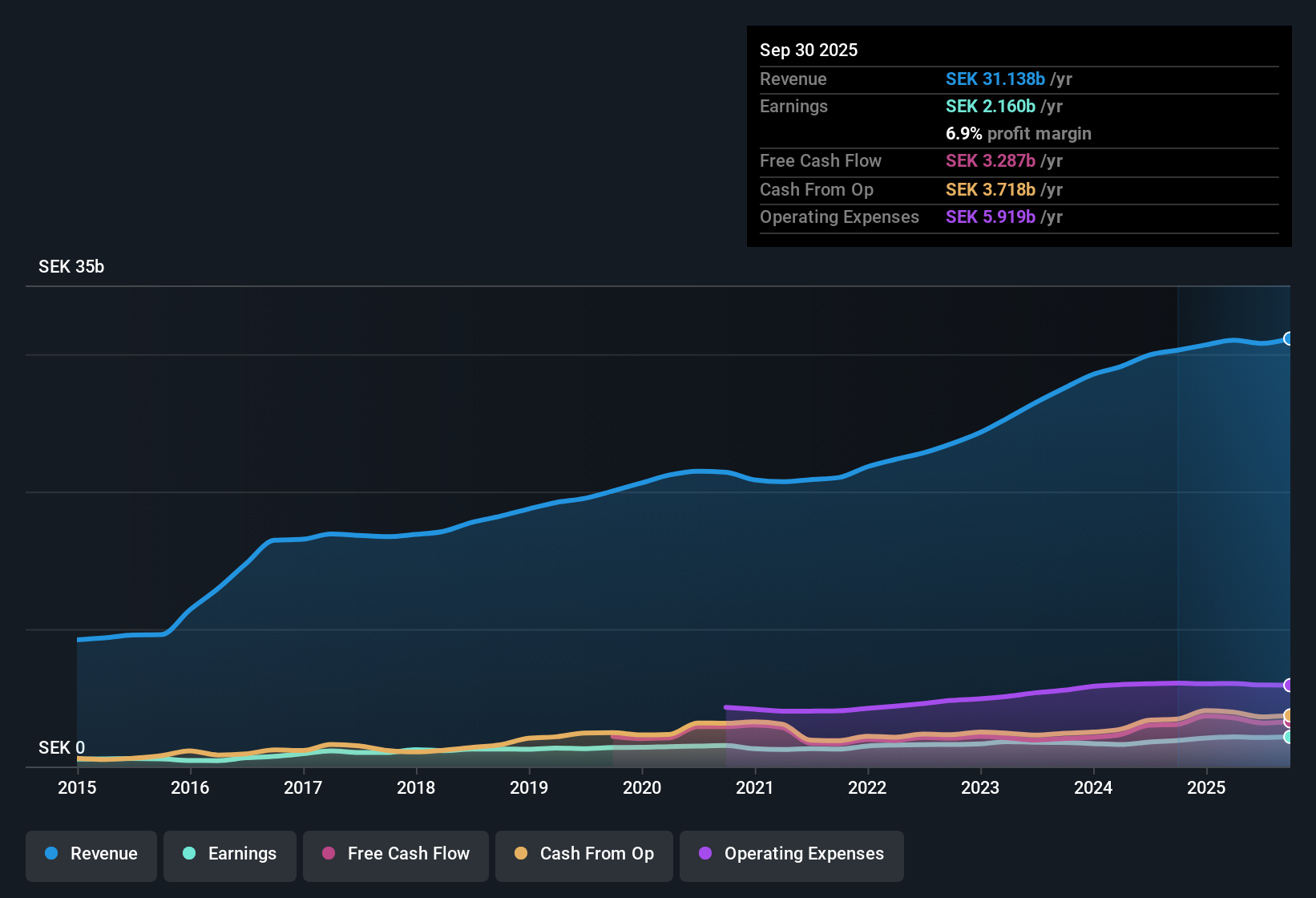

Sweco (OM:SWEC B) reported earnings growth of 14.2% over the past year, building on a 10% annual earnings growth rate over the past five years. Net profit margins reached 6.9%, up from 6.2% a year ago, and revenue is forecast to accelerate at 6.8% per year, outpacing the broader Swedish market’s 3.7% estimate. As investors digest these strong fundamentals, Sweco’s above-average valuation multiples and only minor risk regarding dividend sustainability may shape the market’s response to the latest results.

See our full analysis for Sweco.Next, we will see how these headline numbers compare with the dominant narratives in the market. Some expectations might be reaffirmed, while others could be up for debate.

See what the community is saying about Sweco

Forecasted Margins Set to Rise

- Analysts expect Sweco’s profit margins to improve from 6.9% today to 8.2% over the next three years, highlighting further efficiency gains beyond the current margin uptick.

- According to the analysts' consensus view, operational efficiency and higher pricing are anticipated to be major drivers for future earnings, supported by

- Recent and ongoing cost control measures, such as workforce adjustments in Sweden, Finland, and Norway, are designed to protect and potentially increase margins.

- Despite these improvements, consensus notes that restructuring costs could still pressure margins in more challenging geographic markets, so upside is not risk-free.

- Big margin expansions are at stake. See what all sides are saying about the opportunity and risk in the full consensus breakdown. 📊 Read the full Sweco Consensus Narrative.

Acquisitions Fueling Revenue Ambitions

- The narrative highlights Sweco’s emphasis on acquisitions and recent project wins, positioning the company to achieve forecasted annual revenue growth of 6.2% over the next three years versus a Swedish market average of 3.7%.

- Consensus narrative points out that expanding the order backlog via wins in energy and infrastructure segments is expected to ensure revenue stability and create room for further expansion,

- However, muted M&A activity last year and reliance on future acquisitions introduce some unpredictability to Sweco's ability to meet long-term growth targets.

- Should acquisition momentum falter, revenue could fall short of forecasts, tempering some of the bullish hopes for outsized top-line progress.

Premium Valuation Versus Peers

- Sweco trades at a Price-to-Earnings ratio of 28.8x, substantially above peer and sector averages of 17.4x and 14.5x, while the latest share price of SEK172.40 is nearly identical to DCF fair value at SEK171.92.

- Analysts' consensus view emphasizes that to justify this premium multiple, Sweco must deliver on higher future earnings and margin expectations,

- But the future price-to-earnings ratio estimate still remains above industry standards, meaning any shortfall in growth makes the valuation vulnerable to downward revisions.

- The analyst price target of SEK189.00 suggests potential upside. However, the required execution leaves little room for slip-ups given the stretched peer comparison.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Sweco on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Do the figures point you in a different direction? Turn your viewpoint into a unique narrative in just a few minutes. Do it your way

A great starting point for your Sweco research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Sweco’s premium valuation leaves little margin for error. Any stumble in executing on lofty growth or margin expectations could mean downside for investors.

If you want more confidence that you’re not overpaying, use our these 851 undervalued stocks based on cash flows to target companies trading well below their intrinsic value and prioritize upside potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:SWEC B

Sweco

Provides architecture and engineering consultancy services worldwide.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives