- Sweden

- /

- Industrials

- /

- OM:STOR B

Can Storskogen Group (OM:STOR B) Sustain Earnings Momentum Amid Leadership Transition and Strategic Shifts?

Reviewed by Sasha Jovanovic

- Storskogen Group recently reported its third quarter 2025 earnings, highlighting improved net income of SEK 316 million despite stable quarterly sales, and announced that long-time executive Peter Ahlgren will transition from Head of Business Area Services to a Senior Advisor position once a successor is appointed.

- The leadership transition comes after over a decade of foundational contributions from Ahlgren, coinciding with Storskogen’s transformation into an international group with around SEK 33 billion in annual sales and approximately 11,000 employees.

- We will explore how Storskogen's earnings growth and a key management change could influence its future investment prospects and strategy.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Storskogen Group Investment Narrative Recap

To be a shareholder in Storskogen Group, you would likely need to believe in management’s ability to deliver earnings growth despite ongoing top-line challenges and flat organic sales. The recent leadership transition, with Peter Ahlgren moving into a Senior Advisor role, does not materially affect the core short-term catalyst of successful integration and performance of acquired businesses, but the structural risk remains centered on weak organic sales growth and muted demand in key segments.

Among recent company announcements, Storskogen’s third quarter results stand out: while sales remained flat year-on-year at SEK 7,982 million, the company achieved improved net income of SEK 316 million. This reflects management’s focus on efficiency and margin discipline, which continues to be key for mitigating risks associated with slow organic growth and fluctuating demand in core business areas.

By contrast, investors should be aware that reliance on acquired growth over organic expansion raises questions about the sustainability of earnings if...

Read the full narrative on Storskogen Group (it's free!)

Storskogen Group's outlook anticipates SEK35.1 billion in revenue and SEK2.0 billion in earnings by 2028. This is based on a 2.1% annual revenue growth rate and a SEK1.0 billion earnings increase from the current SEK973.0 million.

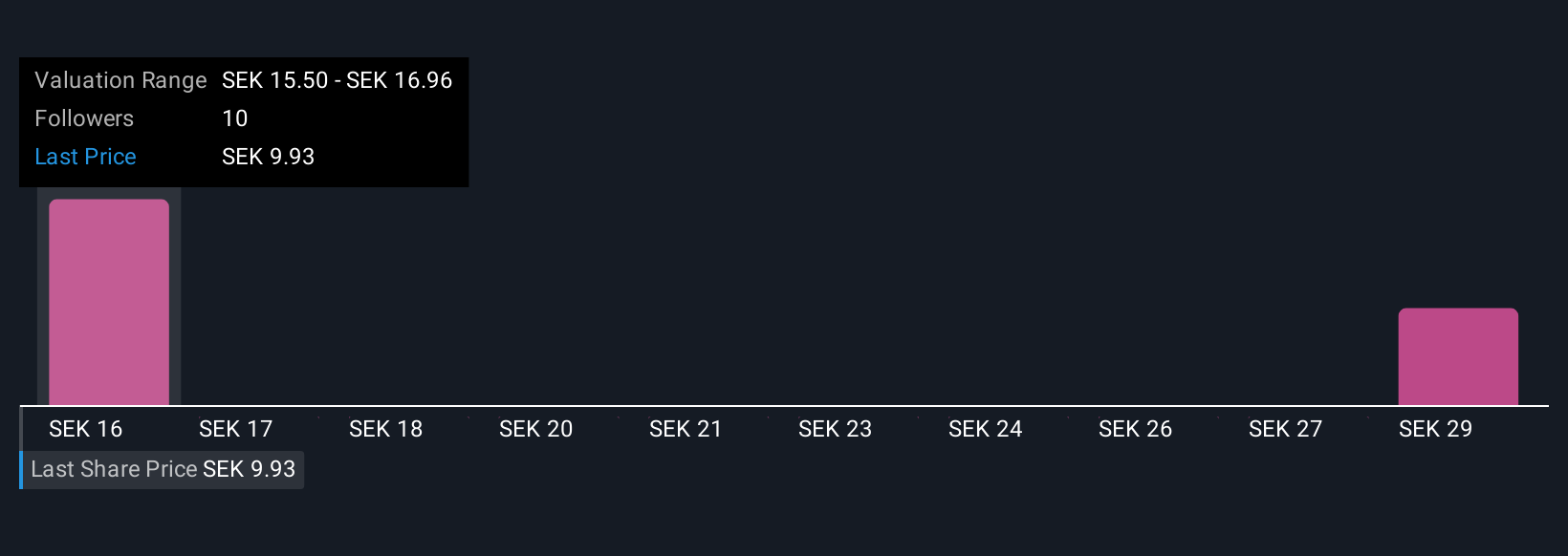

Uncover how Storskogen Group's forecasts yield a SEK15.50 fair value, a 38% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community participants provided two fair value estimates ranging from SEK 15.50 to SEK 36.02 per share. While some believe Storskogen is substantially undervalued, persistent weak organic sales growth keeps the debate open about future performance and long-term value, encouraging readers to explore more viewpoints.

Explore 2 other fair value estimates on Storskogen Group - why the stock might be worth just SEK15.50!

Build Your Own Storskogen Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Storskogen Group research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Storskogen Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Storskogen Group's overall financial health at a glance.

Want Some Alternatives?

Our top stock finds are flying under the radar-for now. Get in early:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 35 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:STOR B

Storskogen Group

Owns and develops small and medium-sized businesses operating in trade, industry, and services business areas.

Good value with adequate balance sheet.

Market Insights

Community Narratives