As European markets experience mixed performances, with the STOXX Europe 600 Index recently pulling back slightly after reaching new highs, investors are closely watching for signals from the European Central Bank amid stable inflation rates. In this environment, dividend stocks can offer a measure of stability and income potential, making them an attractive option for those looking to navigate uncertain market conditions.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.43% | ★★★★★★ |

| Telekom Austria (WBAG:TKA) | 4.44% | ★★★★★☆ |

| Scandinavian Tobacco Group (CPSE:STG) | 9.83% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.35% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.99% | ★★★★★★ |

| Evolution (OM:EVO) | 4.87% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.19% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.68% | ★★★★★★ |

| Bravida Holding (OM:BRAV) | 4.73% | ★★★★★★ |

| Banca Popolare di Sondrio (BIT:BPSO) | 5.46% | ★★★★★☆ |

Click here to see the full list of 225 stocks from our Top European Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

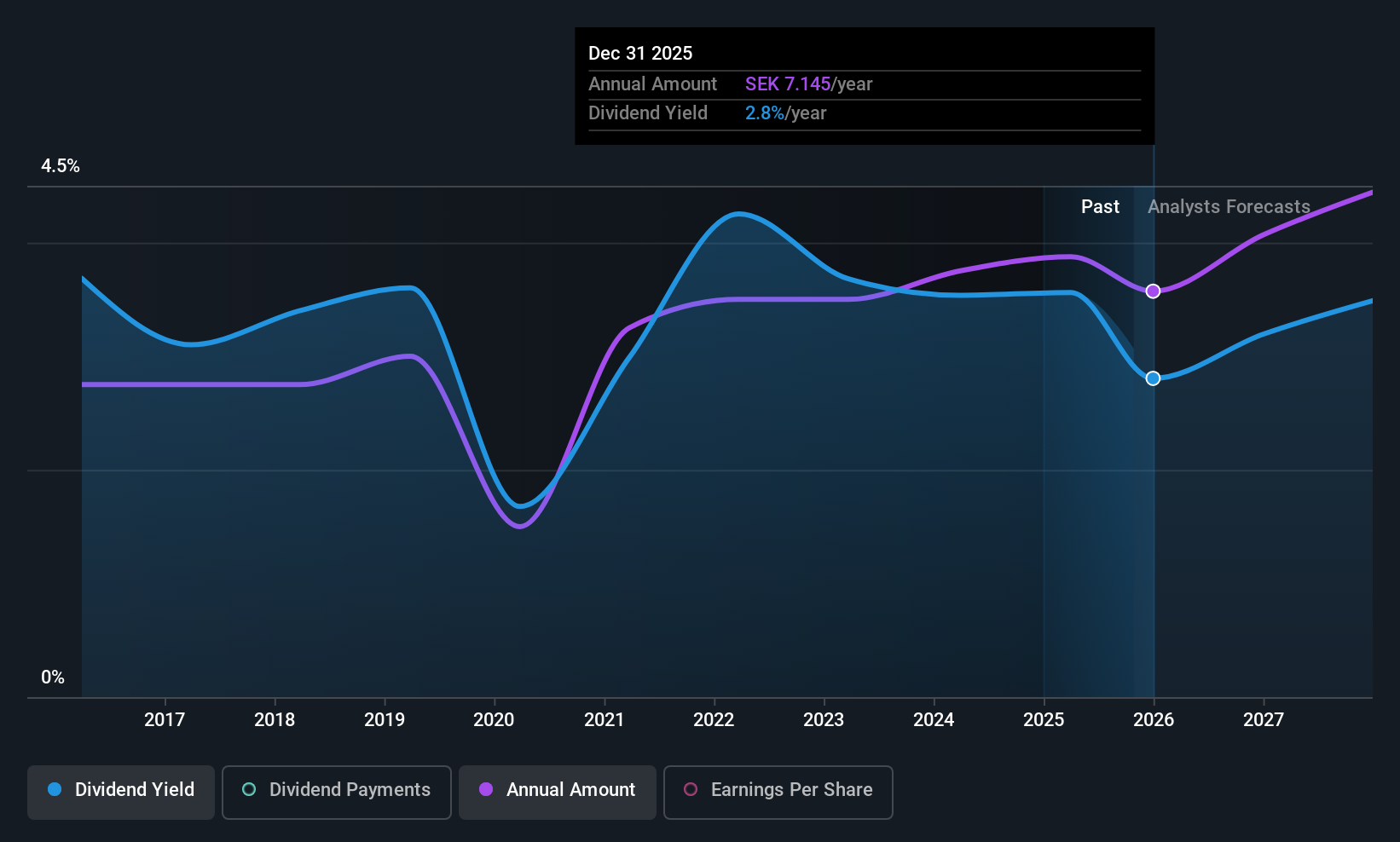

AB SKF (OM:SKF B)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: AB SKF (publ) is a global company that designs, manufactures, and sells bearings and units, seals, lubrication systems, condition monitoring, and related services with a market cap of approximately SEK116.83 billion.

Operations: AB SKF generates revenue from two primary segments: Automotive, contributing SEK27.16 billion, and Industrial, accounting for SEK67.18 billion.

Dividend Yield: 3%

AB SKF's dividend payments are covered by both earnings and cash flows, with payout ratios around 72.5% and 72.8%, respectively, indicating sustainability despite a historically volatile track record. The dividend yield is modest at 3.02%, below the top quartile in Sweden, but recent initiatives like SKF Ventures aim to drive long-term value through innovation. Recent earnings showed declines in sales and net income compared to last year, amidst strategic shifts such as relocating operations from Argentina.

- Click to explore a detailed breakdown of our findings in AB SKF's dividend report.

- Our expertly prepared valuation report AB SKF implies its share price may be lower than expected.

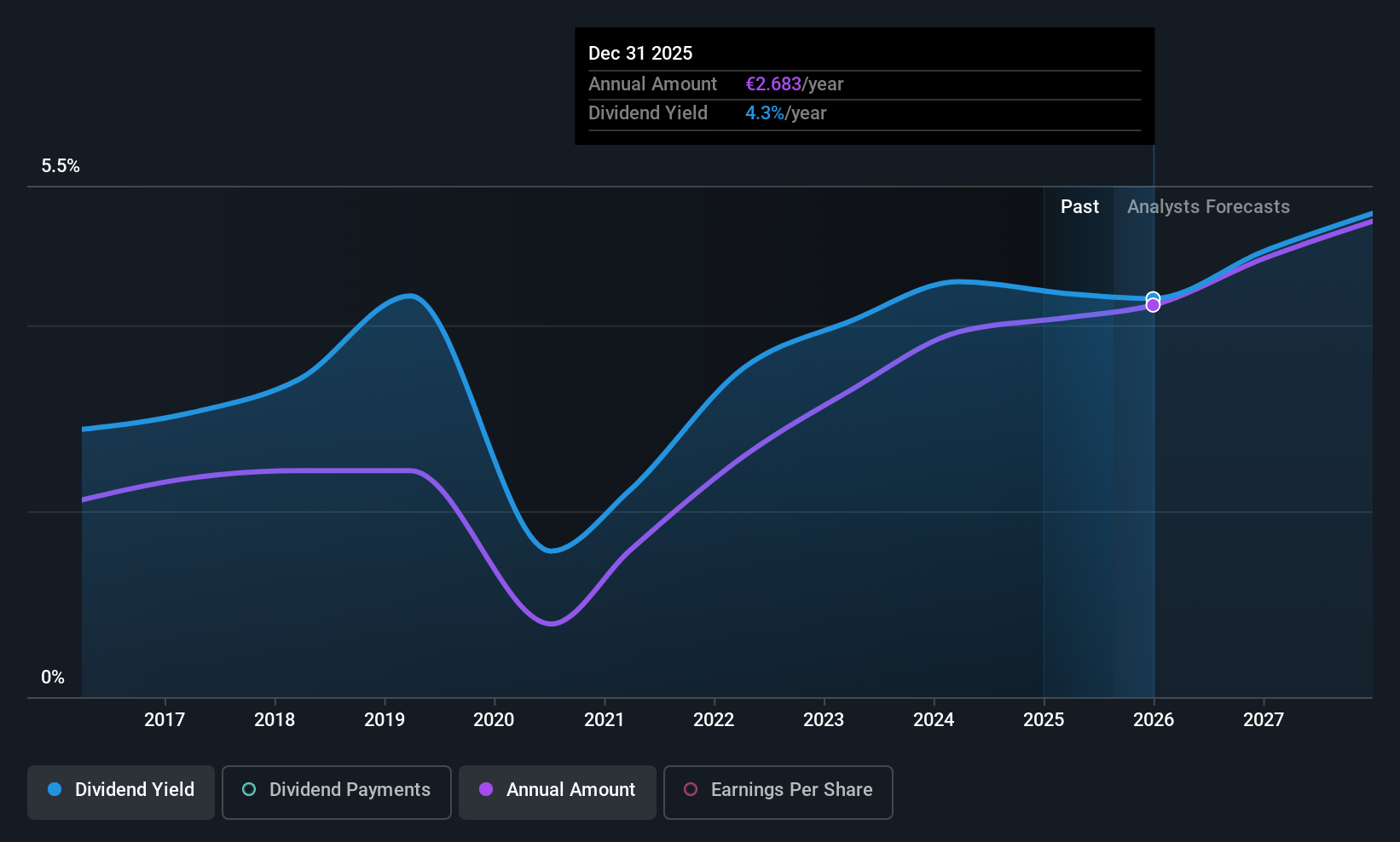

Andritz (WBAG:ANDR)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Andritz AG provides industrial machinery, equipment, and services across various global regions including Europe, North America, South America, China, Asia, Africa, and Australia with a market capitalization of €6.31 billion.

Operations: Andritz AG's revenue is primarily derived from its four main segments: Pulp & Paper (€2.94 billion), Hydro Power (€1.68 billion), Metals (€1.68 billion), and Environment & Energy (€1.52 billion).

Dividend Yield: 4%

Andritz's dividend payments are covered by both earnings and cash flows, with payout ratios of 55.7% and 74.2%, respectively, ensuring sustainability despite a volatile history. The dividend yield at 4.02% is below Austria's top quartile, but the stock trades at good value relative to peers. Recent earnings showed declines in sales and net income year-over-year, though revenue guidance for 2025 remains optimistic between €8 billion and €8.3 billion amidst strategic expansions in its Pulp & Paper division.

- Dive into the specifics of Andritz here with our thorough dividend report.

- Upon reviewing our latest valuation report, Andritz's share price might be too pessimistic.

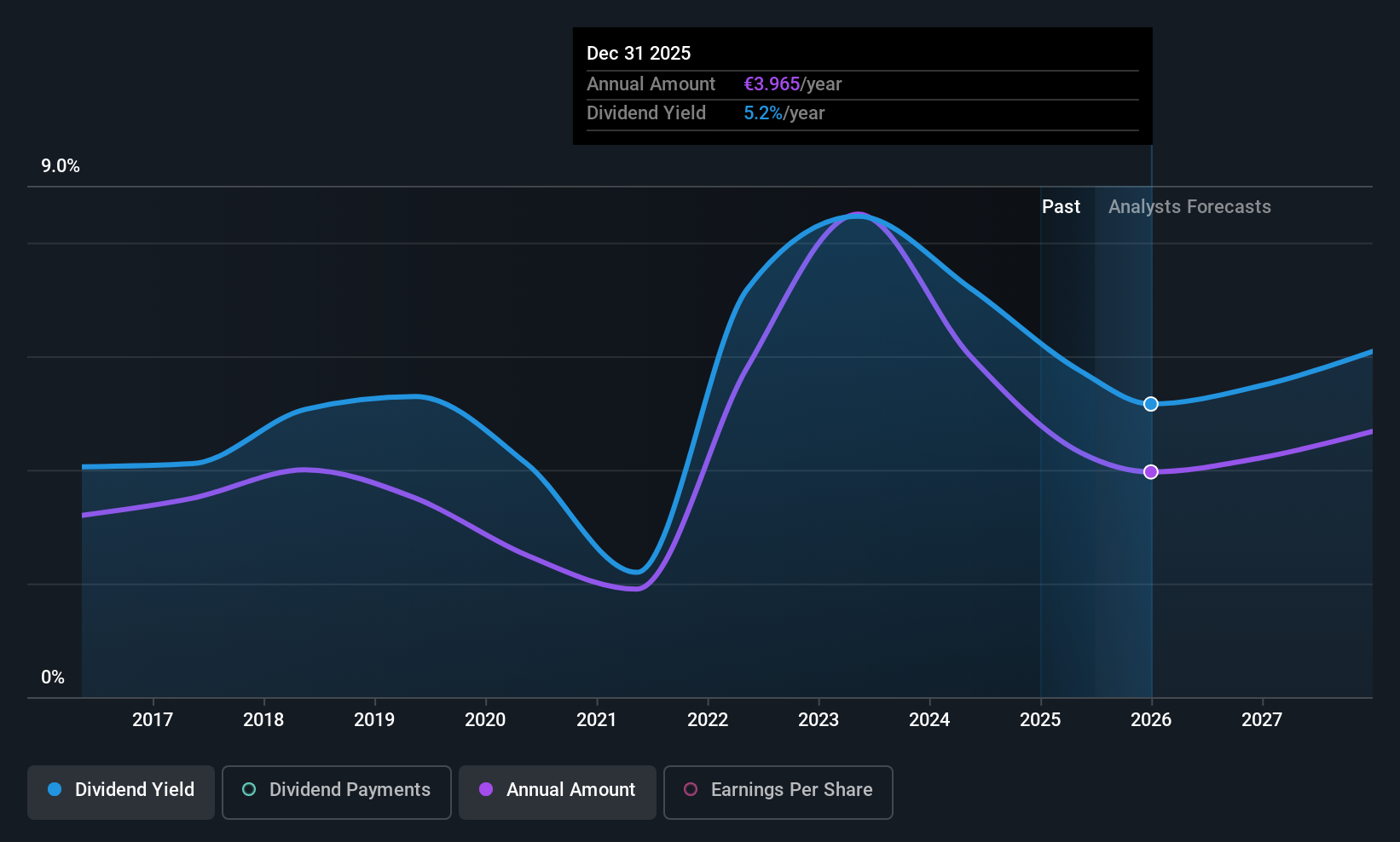

Bayerische Motoren Werke (XTRA:BMW)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bayerische Motoren Werke Aktiengesellschaft develops, manufactures, and sells automobiles and motorcycles, along with spare parts and accessories globally, with a market cap of approximately €52.47 billion.

Operations: Bayerische Motoren Werke's revenue is primarily derived from its Automotive segment at €120.56 billion and Financial Services at €39.40 billion, with additional contributions from the Motorcycles segment totaling €3.13 billion.

Dividend Yield: 5%

BMW's dividend yield of 5.01% ranks in the top 25% of German payers, yet its reliability is questionable due to volatility and lack of free cash flow coverage. Although dividends are well-covered by earnings with a payout ratio of 46.2%, debt levels are not well-managed by operating cash flow. The stock trades at a slight discount to fair value, and recent strategic collaboration on all-solid-state battery technology could influence future financial performance.

- Navigate through the intricacies of Bayerische Motoren Werke with our comprehensive dividend report here.

- The analysis detailed in our Bayerische Motoren Werke valuation report hints at an deflated share price compared to its estimated value.

Make It Happen

- Click here to access our complete index of 225 Top European Dividend Stocks.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bayerische Motoren Werke might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:BMW

Bayerische Motoren Werke

Develops, manufactures, and sells automobiles and motorcycles, spare parts, and accessories worldwide.

Good value with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives