- Sweden

- /

- Consumer Durables

- /

- OM:DUNI

Bahnhof And 2 Other Swedish Dividend Stocks To Consider

Reviewed by Simply Wall St

As global markets grapple with rising oil prices and geopolitical tensions, the European market has seen a cautious sentiment, with major indices like the STOXX Europe 600 Index experiencing declines. In this environment, Swedish dividend stocks present an intriguing option for investors seeking stability and income potential amidst market fluctuations. A good dividend stock typically offers a reliable payout history and financial resilience, qualities that can be particularly appealing during times of economic uncertainty.

Top 10 Dividend Stocks In Sweden

| Name | Dividend Yield | Dividend Rating |

| Bredband2 i Skandinavien (OM:BRE2) | 4.53% | ★★★★★★ |

| Nordea Bank Abp (OM:NDA SE) | 8.79% | ★★★★★☆ |

| HEXPOL (OM:HPOL B) | 3.84% | ★★★★★☆ |

| Zinzino (OM:ZZ B) | 3.23% | ★★★★★☆ |

| Axfood (OM:AXFO) | 3.01% | ★★★★★☆ |

| Skandinaviska Enskilda Banken (OM:SEB A) | 5.63% | ★★★★★☆ |

| Duni (OM:DUNI) | 4.73% | ★★★★★☆ |

| Avanza Bank Holding (OM:AZA) | 4.85% | ★★★★★☆ |

| Loomis (OM:LOOMIS) | 3.86% | ★★★★☆☆ |

| Bahnhof (OM:BAHN B) | 3.80% | ★★★★☆☆ |

Click here to see the full list of 23 stocks from our Top Swedish Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Bahnhof (OM:BAHN B)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bahnhof AB (publ) operates in the Internet and telecommunications sector across Sweden and Europe, with a market cap of SEK5.66 billion.

Operations: Bahnhof AB (publ) generates revenue through its operations in the Internet and telecommunications sectors across Sweden and Europe.

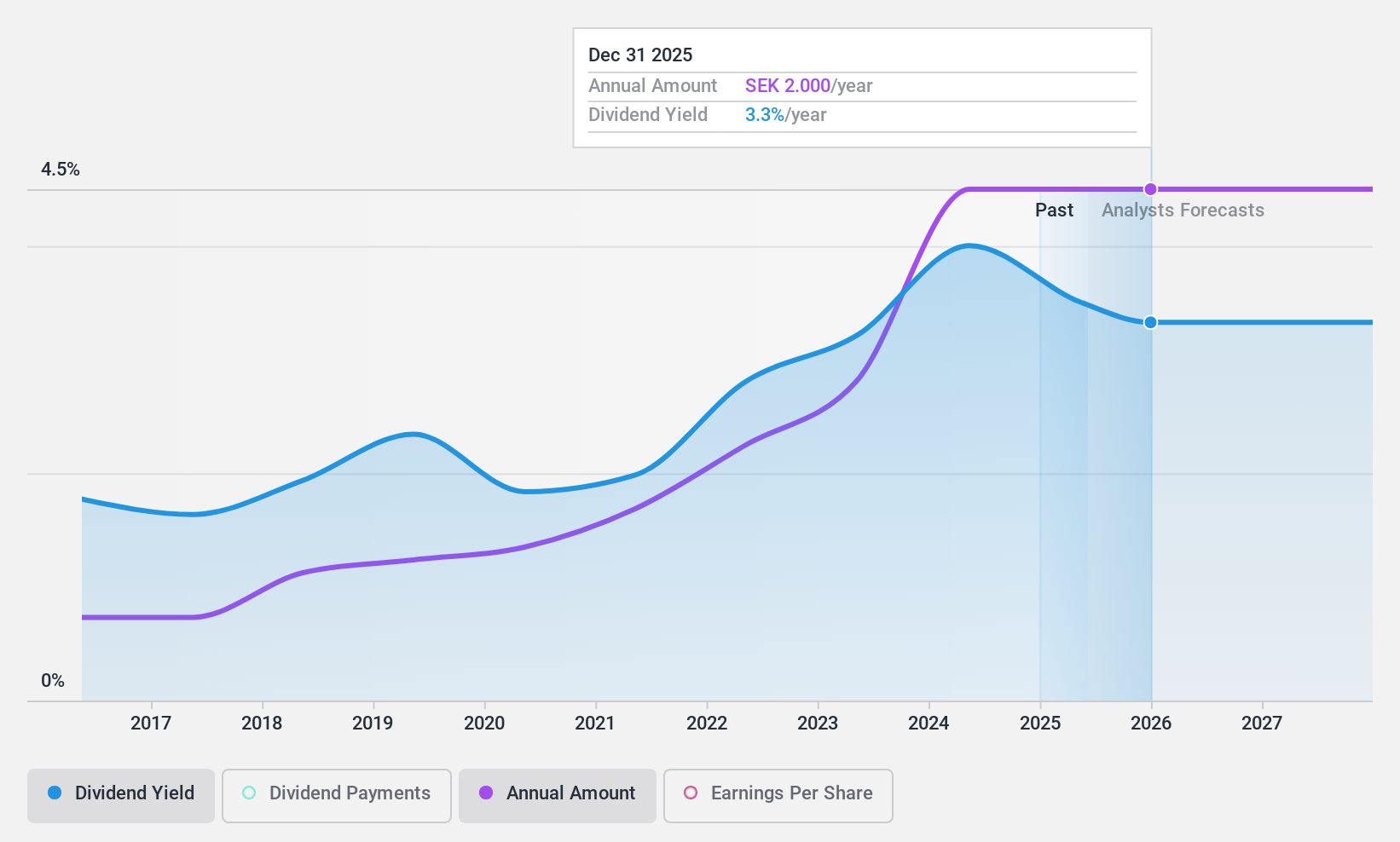

Dividend Yield: 3.8%

Bahnhof's dividend yield of 3.8% is lower than the top Swedish payers and isn't well covered by earnings, with a high payout ratio of 94.4%. However, it is supported by cash flows at an 85.3% cash payout ratio. Dividends have been stable and growing over the past decade, though not fully sustainable from earnings alone. Recent inclusion in the S&P Global BMI Index may enhance its profile among investors seeking reliable dividend stocks in Sweden.

- Take a closer look at Bahnhof's potential here in our dividend report.

- Upon reviewing our latest valuation report, Bahnhof's share price might be too optimistic.

Duni (OM:DUNI)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Duni AB (publ) is a company that develops, manufactures, and sells concepts and products for serving, take-away, and meal packaging in Sweden and internationally, with a market cap of SEK4.96 billion.

Operations: Duni AB's revenue is primarily derived from its Dining Solutions segment, which generated SEK4.52 billion, and its Food Packaging Solutions segment, contributing SEK3.05 billion.

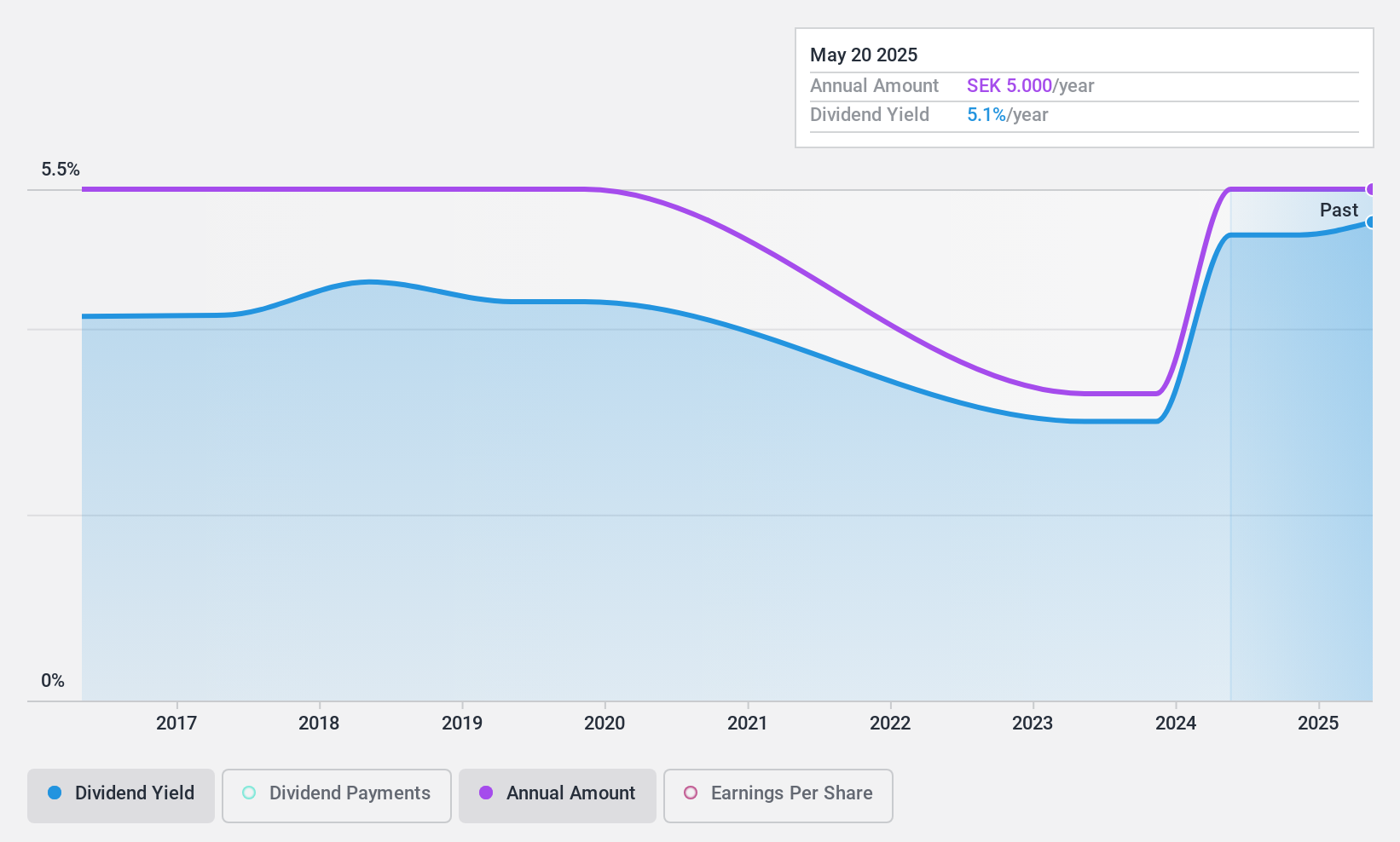

Dividend Yield: 4.7%

Duni's dividend yield of 4.73% ranks it among the top 25% of Swedish payers, with dividends well-covered by earnings and cash flows at payout ratios of 63.9% and 42.9%, respectively. However, its dividend history is marked by volatility, raising concerns about reliability despite recent growth in earnings at 23% annually over five years. The company's strategic expansion in Germany could improve operational efficiency but may also introduce short-term financial adjustments impacting future dividends.

- Click here and access our complete dividend analysis report to understand the dynamics of Duni.

- Upon reviewing our latest valuation report, Duni's share price might be too pessimistic.

AB SKF (OM:SKF B)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: AB SKF (publ) is a global company that designs, manufactures, and sells bearings and units, seals, lubrication systems, condition monitoring, and services with a market cap of SEK91.49 billion.

Operations: AB SKF generates revenue through its Automotive segment, which accounts for SEK29.44 billion, and its Industrial segment, contributing SEK71.08 billion.

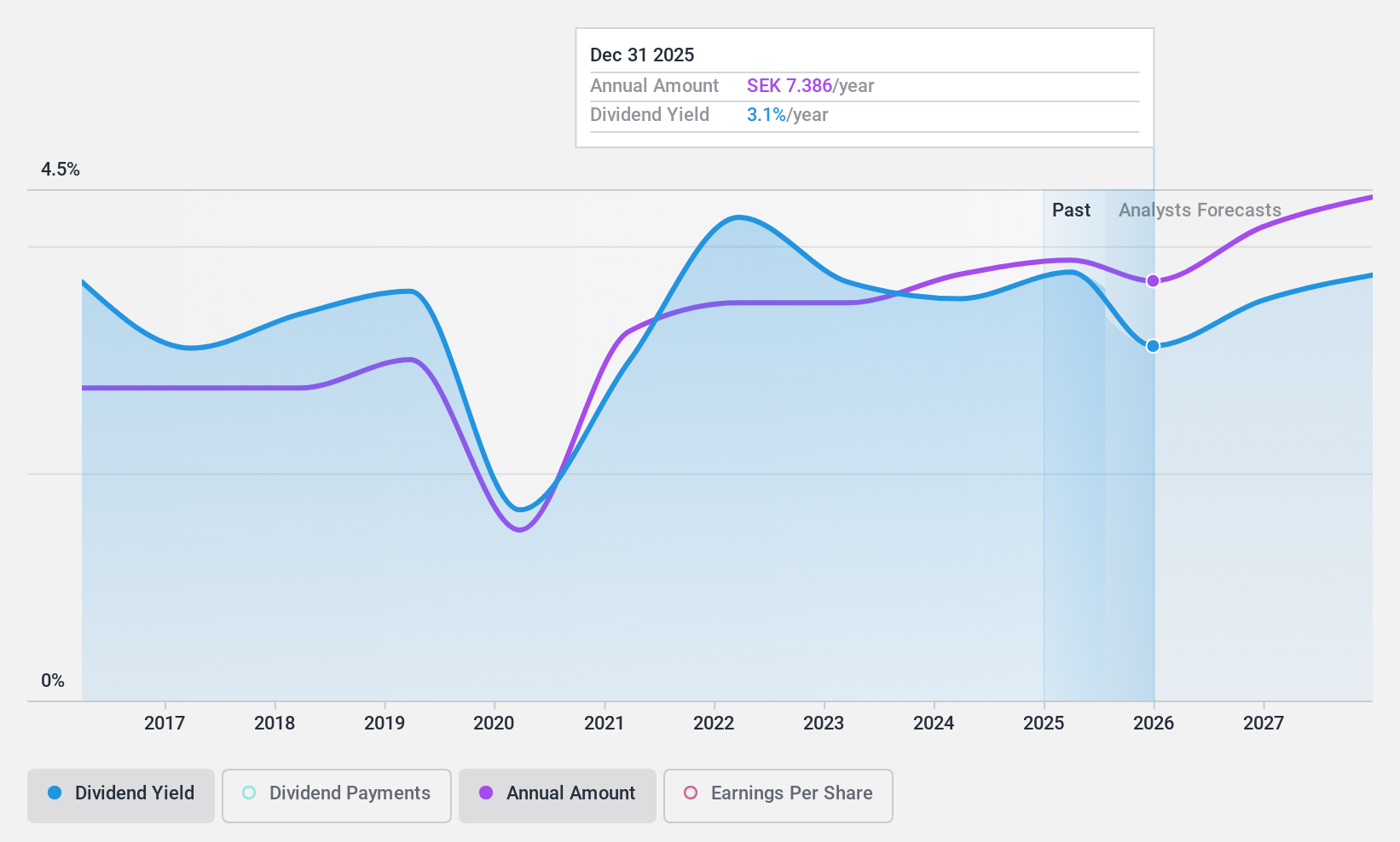

Dividend Yield: 3.7%

AB SKF's dividend yield of 3.73% is lower than the top quartile in Sweden, with dividends covered by earnings and cash flows at payout ratios of 59.9% and 53.6%, respectively. Despite a history of volatility, recent strategic moves such as spinning off its automotive segment could enhance focus on its industrial unit, potentially stabilizing future payouts. However, past dividend unreliability remains a concern for investors seeking consistent income streams from this stock.

- Dive into the specifics of AB SKF here with our thorough dividend report.

- Our expertly prepared valuation report AB SKF implies its share price may be lower than expected.

Where To Now?

- Access the full spectrum of 23 Top Swedish Dividend Stocks by clicking on this link.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:DUNI

Duni

Develops, manufactures, and sells concepts and products for the serving, take-away, and packaging of meals in Sweden, Poland, and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

The AI Infrastructure Giant Grows Into Its Valuation

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success