- Sweden

- /

- Retail Distributors

- /

- OM:ZZ B

3 Swedish Dividend Stocks Yielding Up To 5.1%

Reviewed by Simply Wall St

As global markets react to recent economic developments, including interest rate cuts by the European Central Bank and mixed performance across various indices, investors are increasingly seeking stable returns amidst volatility. In this context, dividend stocks remain a popular choice for those looking to balance income with potential growth. A good dividend stock typically offers consistent payouts and has a strong financial foundation, making it an attractive option in uncertain market conditions. Here are three Swedish dividend stocks yielding up to 5.1% that might pique your interest.

Top 10 Dividend Stocks In Sweden

| Name | Dividend Yield | Dividend Rating |

| Bredband2 i Skandinavien (OM:BRE2) | 4.30% | ★★★★★★ |

| Betsson (OM:BETS B) | 5.77% | ★★★★★☆ |

| Nordea Bank Abp (OM:NDA SE) | 8.72% | ★★★★★☆ |

| Zinzino (OM:ZZ B) | 3.62% | ★★★★★☆ |

| HEXPOL (OM:HPOL B) | 3.57% | ★★★★★☆ |

| Axfood (OM:AXFO) | 3.03% | ★★★★★☆ |

| Skandinaviska Enskilda Banken (OM:SEB A) | 5.40% | ★★★★★☆ |

| Duni (OM:DUNI) | 5.09% | ★★★★★☆ |

| Avanza Bank Holding (OM:AZA) | 4.85% | ★★★★★☆ |

| Afry (OM:AFRY) | 3.06% | ★★★★☆☆ |

Click here to see the full list of 20 stocks from our Top Swedish Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

Solid Försäkringsaktiebolag (OM:SFAB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Solid Försäkringsaktiebolag (OM:SFAB) offers non-life insurance services to both private and business clients across Sweden, Denmark, Norway, Finland, Germany, Switzerland, and other international markets with a market cap of SEK1.61 billion.

Operations: Solid Försäkringsaktiebolag (OM:SFAB) generates its revenue from three main segments: Product (SEK320.51 million), Assistance (SEK351.63 million), and Personal Safety (SEK435.09 million).

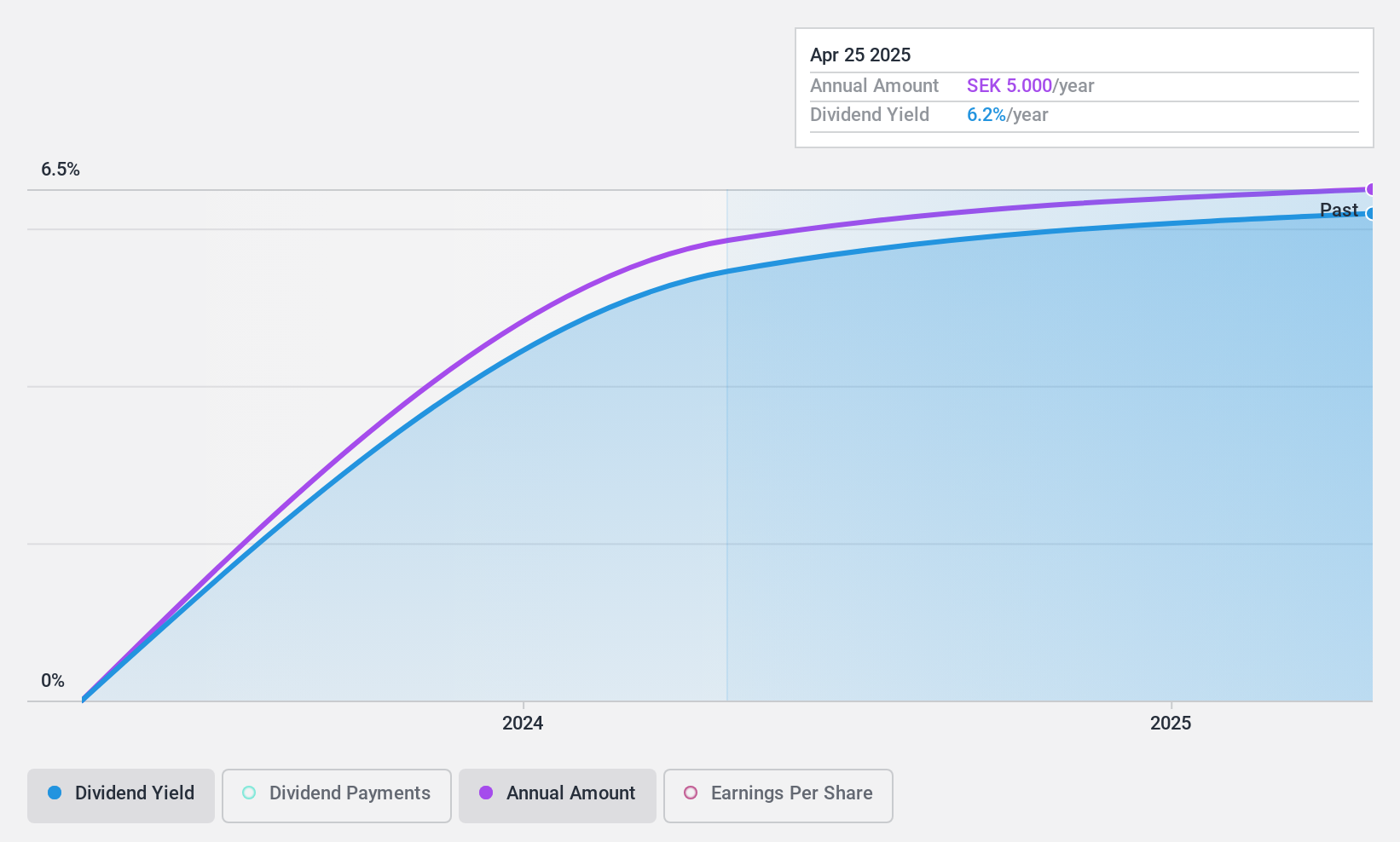

Dividend Yield: 5.1%

Solid Försäkringsaktiebolag's dividend payments are covered by earnings (49.1% payout ratio) and free cash flow (73.7% cash payout ratio). Although the company has only recently started paying dividends, its current yield of 5.13% places it in the top 25% of Swedish dividend payers. Recent share repurchases, totaling SEK 10.19 million for 122,188 shares, aim to improve capital structure and shareholder value. Earnings have grown at an annual rate of 28.4% over the past five years.

- Navigate through the intricacies of Solid Försäkringsaktiebolag with our comprehensive dividend report here.

- The analysis detailed in our Solid Försäkringsaktiebolag valuation report hints at an deflated share price compared to its estimated value.

AB SKF (OM:SKF B)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: AB SKF (publ) designs, manufactures, and sells bearings and units, seals, lubrication systems, condition monitoring, and services worldwide with a market cap of SEK89.45 billion.

Operations: AB SKF (publ) generates revenue from two primary segments: Automotive, which contributes SEK29.44 billion, and Industrial, which accounts for SEK71.08 billion.

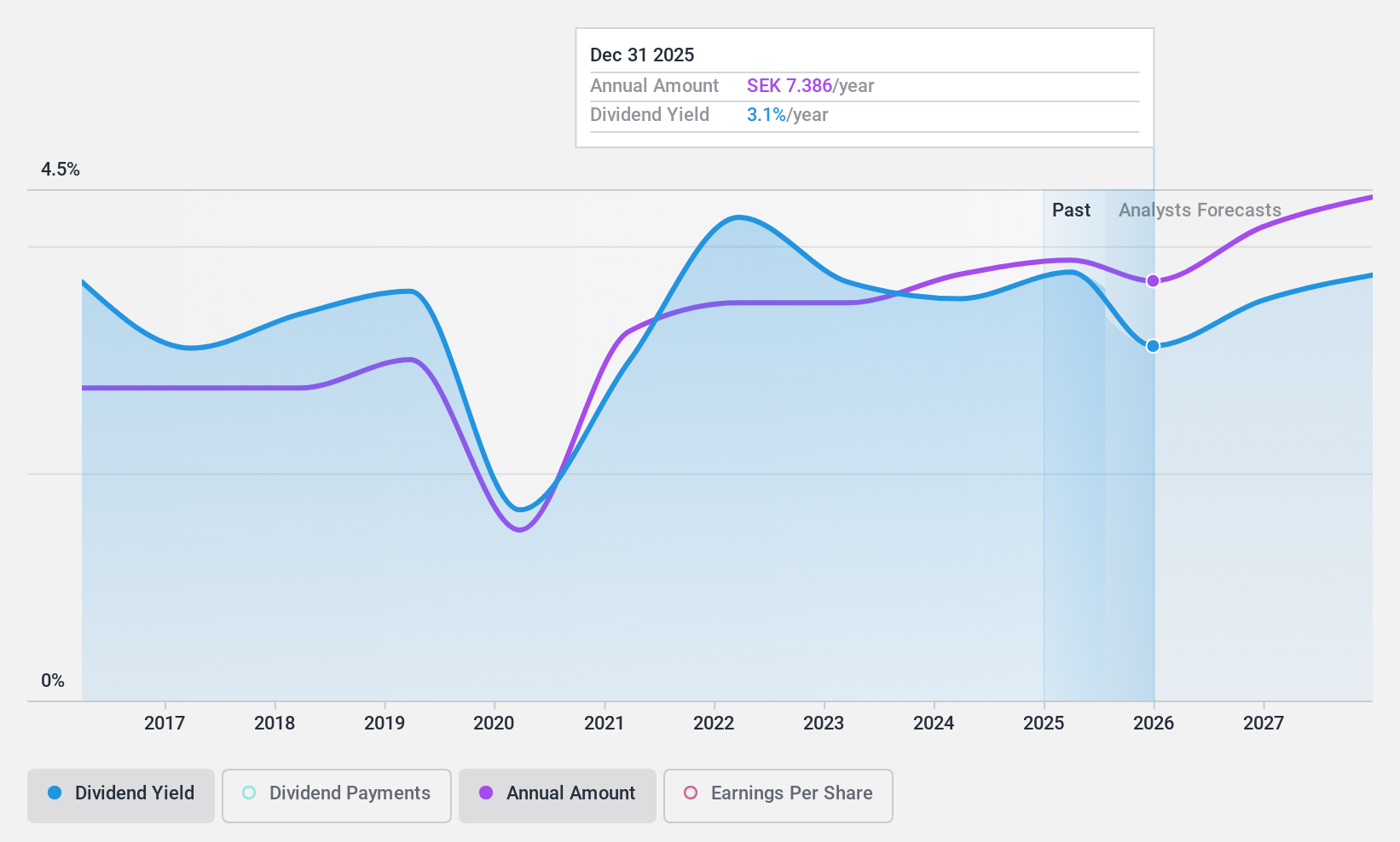

Dividend Yield: 3.8%

AB SKF's dividend yield (3.82%) is below the top 25% of Swedish dividend payers. The company's payout ratios are reasonable, with 59.9% of earnings and 53.6% of cash flows covering dividends, indicating sustainability despite a volatile track record over the past decade. Recent strategic moves include exploring a separation of its Automotive business and producing eco-friendly bearings with voestalpine Wire Technology, which may impact future financial stability and growth prospects for dividends.

- Get an in-depth perspective on AB SKF's performance by reading our dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of AB SKF shares in the market.

Zinzino (OM:ZZ B)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Zinzino AB (publ) is a direct sales company that offers dietary supplements and skincare products in Sweden and internationally, with a market cap of SEK 2.84 billion.

Operations: Zinzino AB (publ) generates revenue primarily from its Zinzino (including VMA Life) segment, which contributed SEK 1.83 billion, and the Faun segment, which added SEK 170.31 million.

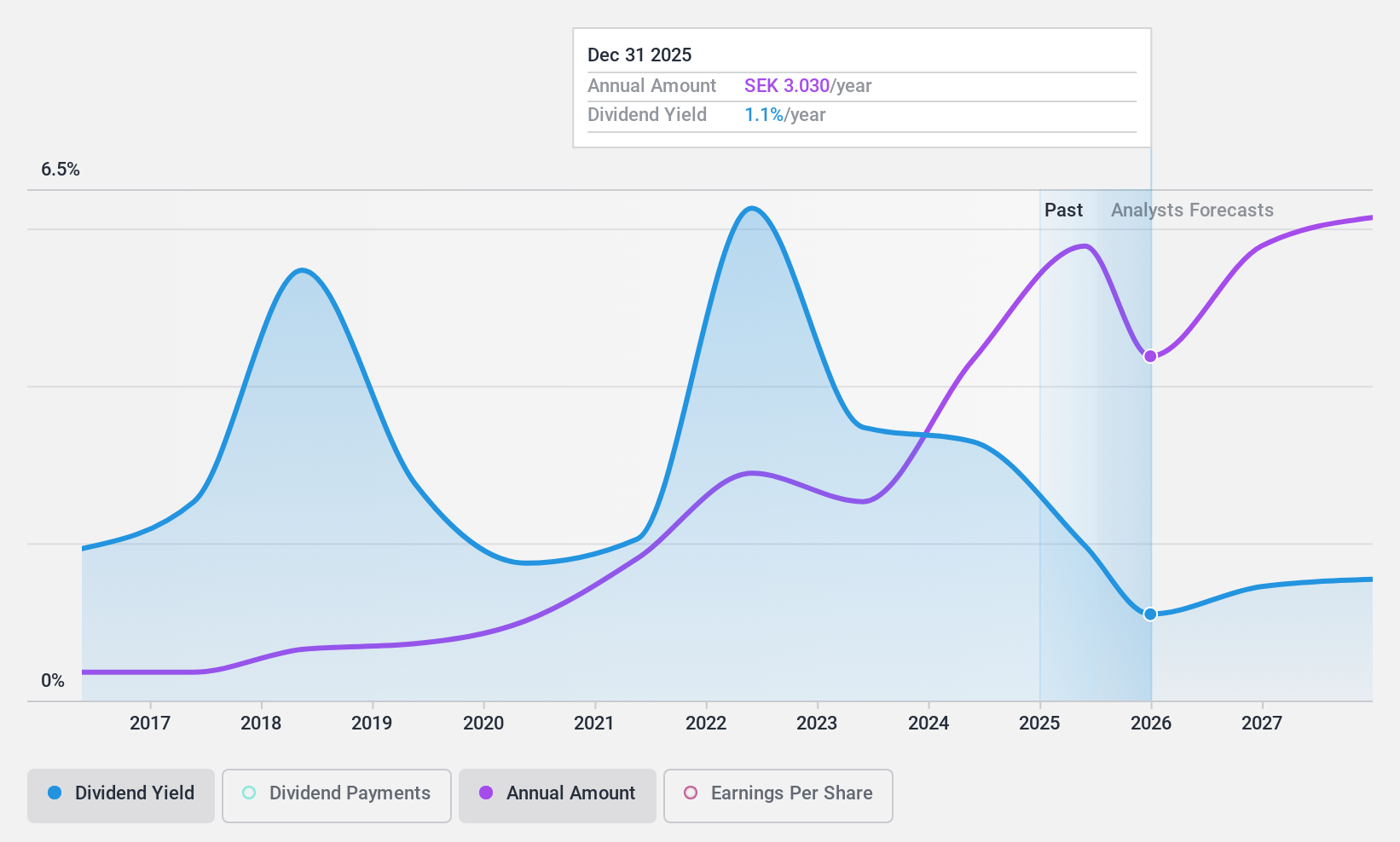

Dividend Yield: 3.6%

Zinzino's recent financial performance shows strong revenue growth, with a 39% increase in August to SEK 178.7 million and a year-to-date rise of 21% to SEK 1.31 billion. Earnings have also improved, with net income for the second quarter at SEK 47.99 million, up from SEK 36.8 million last year. Despite significant insider selling recently, Zinzino maintains reliable dividend payments covered by both earnings (56.3%) and cash flows (47.4%), though its yield is lower than top-tier Swedish dividend payers at 3.62%.

- Click here to discover the nuances of Zinzino with our detailed analytical dividend report.

- According our valuation report, there's an indication that Zinzino's share price might be on the cheaper side.

Key Takeaways

- Delve into our full catalog of 20 Top Swedish Dividend Stocks here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zinzino might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:ZZ B

Zinzino

A direct sales company, provides dietary supplements and skincare products in Sweden and internationally.

Outstanding track record with flawless balance sheet and pays a dividend.