SaltX Technology Holding (OM:SALT B): Losses Worsen, Premium Valuation Challenges Market Optimism

Reviewed by Simply Wall St

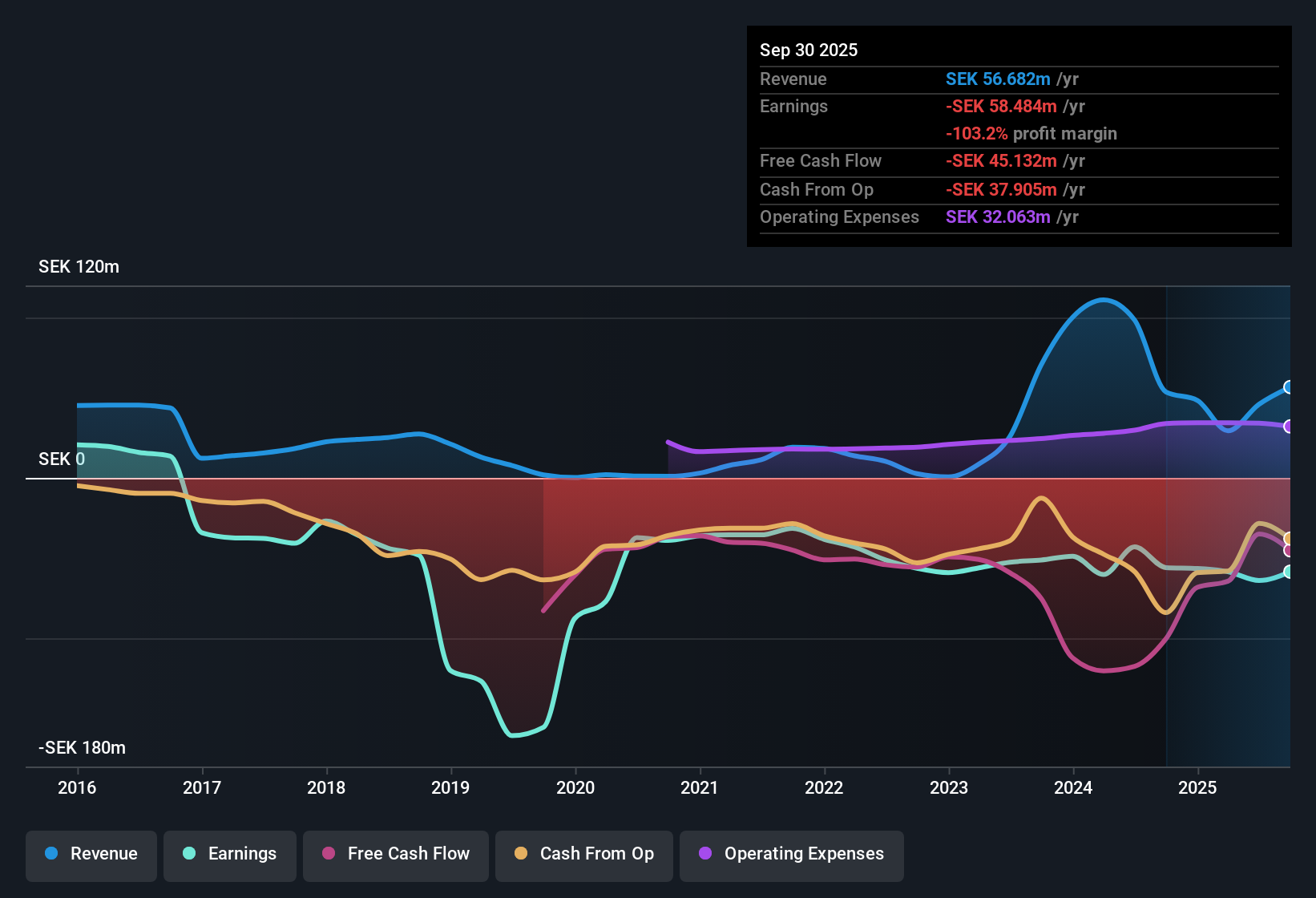

SaltX Technology Holding (OM:SALT B) remains unprofitable, with net profit margins showing no improvement over the last year and losses deepening by 10.5% annually over the past five years. The Price-to-Sales Ratio stands at 18.7x, which is a substantial premium to both the Swedish machinery industry average of 1.8x and the peer group’s 2.8x. With shares trading at such a high valuation despite mounting losses and no visible improvement in profitability, the current results underline the ongoing challenges confronting the company’s bottom line.

See our full analysis for SaltX Technology Holding.Now, let's see how these headline earnings compare to the community and analyst narratives. This helps set up which stories the numbers support and which ones raise new questions.

Curious how numbers become stories that shape markets? Explore Community Narratives

Net Losses Deepen at a 5-Year Rate

- SaltX’s losses have accelerated, with net losses rising by 10.5% per year over the last five years. This pace stands out as substantial even in a volatile sector.

- What’s striking, comparing recent performance against the prevailing market view, is just how persistent the negative profitability trend remains.

- This enduring loss rate runs counter to optimism seen in other cleantech companies that sometimes pivot to profitability on project wins.

- Despite talk of technological innovation or sector momentum, the lack of earnings improvement maintains pressure on financial health.

Share Price Volatility Outpaces Financial Stability

- The company’s share price has not remained stable during the past three months. This aligns with the EDGAR summary’s point about SaltX’s shaky financial position.

- Bears point out that this instability challenges the narrative of SaltX as a robust industry contender.

- Unstable pricing is often interpreted as a sign that market participants remain unconvinced about the company’s earnings momentum or near-term prospects.

- Absent any improvement in profitability or meaningful financial rewards, downside risk takes center stage for cautious observers.

Premium Valuation Despite Mounting Losses

- SaltX trades at a Price-to-Sales Ratio of 18.7x, which is far above the Swedish machinery industry average of 1.8x and even the peer group’s 2.8x. This sets it apart as a significant outlier.

- Prevailing market analysis spotlights this trend, questioning whether the premium can persist without tangible progress.

- The ongoing absence of high-quality earnings makes it difficult to justify the premium valuation solely on future potential.

- With no visible revenue or earnings growth on the horizon, the gap between SaltX’s current price and its sector fundamentals widens further.

- See how the numbers stack up to the full narrative discussion with a closer look at market perspectives. 📊 Read the full SaltX Technology Holding Consensus Narrative.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on SaltX Technology Holding's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

SaltX’s ongoing net losses, weak earnings trend, and high valuation raise concerns about both its financial health and prospects for stability.

If you’re seeking more resilient opportunities, use solid balance sheet and fundamentals stocks screener (1979 results) to target companies with durable balance sheets and robust fundamentals that can better withstand turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:SALT B

SaltX Technology Holding

Engages in the development and sale of sustainable technology in Sweden.

Excellent balance sheet with low risk.

Market Insights

Community Narratives