- Sweden

- /

- Aerospace & Defense

- /

- OM:SAAB B

Why Saab (OM:SAAB B) Is Down 6.2% After Securing Major Global Defense Contracts and Partnerships

Reviewed by Sasha Jovanovic

- In the past week, Saab AB announced several major defense contracts, including a €3.1 billion order for 17 Gripen E/F fighters from the Colombian Government, additional electronic warfare sensor suite orders from Airbus Defence and Space totaling approximately €549 million, and a SEK 510 million contract for Carl-Gustaf M4 deliveries to Denmark, alongside a new partnership with Ericsson Canada and Calian focused on advanced secure communications for Canadian defense.

- These developments highlight Saab's growing prominence in both global sales and cross-sector technological collaborations, emphasizing its role in defense innovation and security modernization initiatives.

- We'll now examine how the multi-billion euro Gripen fighter deal and secured partnerships could reshape Saab's future investment narrative.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Saab Investment Narrative Recap

Investors in Saab need to believe in the trajectory of global defense spending and the company’s capacity for innovative partnerships and advanced technology solutions. The recent influx of multi-billion euro contracts and new collaborations may strengthen Saab's near-term growth drivers, but does not remove the risk of revenue volatility tied to changing government defense budgets or the challenge of scaling production efficiently to meet new demand.

Of the recent announcements, the €3.1 billion Gripen fighter contract with Colombia stands out, as it materially boosts Saab’s international order intake and underpins demand for its flagship products. This aligns closely with one of the stock’s clearest catalysts, the growing global need for next-generation air defense platforms, but also leaves Saab exposed to execution risks and the ongoing dependence on large-scale government clients.

By contrast, investors should be aware of how Saab’s heavy reliance on government defense spending could quickly affect future growth if...

Read the full narrative on Saab (it's free!)

Saab's narrative projects SEK112.3 billion revenue and SEK9.8 billion earnings by 2028. This requires 17.1% yearly revenue growth and an earnings increase of SEK4.6 billion from SEK5.2 billion.

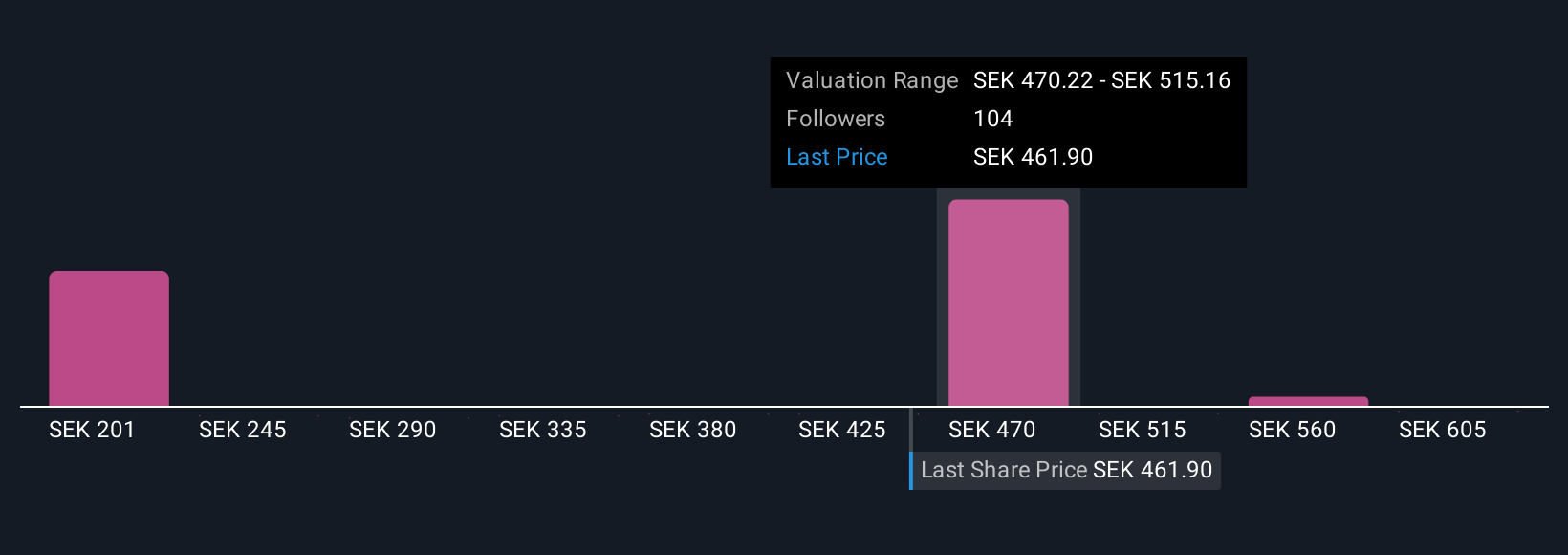

Uncover how Saab's forecasts yield a SEK481.00 fair value, in line with its current price.

Exploring Other Perspectives

Fifteen fair value estimates from the Simply Wall St Community stretch from SEK261.82 to SEK640.61, capturing a wide spectrum of expectations. With global defense spending accelerating, your own view on Saab’s path can differ meaningfully from others, explore multiple perspectives to sharpen your approach.

Explore 15 other fair value estimates on Saab - why the stock might be worth as much as 30% more than the current price!

Build Your Own Saab Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Saab research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Saab research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Saab's overall financial health at a glance.

Looking For Alternative Opportunities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Find companies with promising cash flow potential yet trading below their fair value.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:SAAB B

Saab

Provides products, services, and solutions for military defense, aviation, and civil security markets Internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives