It's A Story Of Risk Vs Reward With Precomp Solutions AB (publ) (STO:PCOM B)

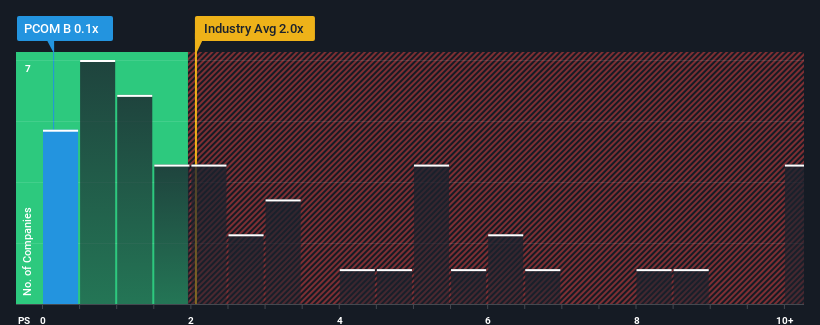

You may think that with a price-to-sales (or "P/S") ratio of 0.1x Precomp Solutions AB (publ) (STO:PCOM B) is a stock worth checking out, seeing as almost half of all the Machinery companies in Sweden have P/S ratios greater than 2x and even P/S higher than 6x aren't out of the ordinary. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Precomp Solutions

What Does Precomp Solutions' P/S Mean For Shareholders?

For example, consider that Precomp Solutions' financial performance has been poor lately as its revenue has been in decline. It might be that many expect the disappointing revenue performance to continue or accelerate, which has repressed the P/S. Those who are bullish on Precomp Solutions will be hoping that this isn't the case so that they can pick up the stock at a lower valuation.

Although there are no analyst estimates available for Precomp Solutions, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Precomp Solutions' Revenue Growth Trending?

Precomp Solutions' P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 12%. Still, the latest three year period has seen an excellent 33% overall rise in revenue, in spite of its unsatisfying short-term performance. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

This is in contrast to the rest of the industry, which is expected to grow by 2.1% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this information, we find it odd that Precomp Solutions is trading at a P/S lower than the industry. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

The Key Takeaway

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We're very surprised to see Precomp Solutions currently trading on a much lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. When we see strong revenue with faster-than-industry growth, we assume there are some significant underlying risks to the company's ability to make money which is applying downwards pressure on the P/S ratio. At least price risks look to be very low if recent medium-term revenue trends continue, but investors seem to think future revenue could see a lot of volatility.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Precomp Solutions, and understanding these should be part of your investment process.

If you're unsure about the strength of Precomp Solutions' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:PCOM B

Precomp Solutions

Manufactures and supplies precision components and cutting tools in Europe.

Slight risk with questionable track record.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success