Positive Sentiment Still Eludes OXE Marine AB (publ) (STO:OXE) Following 27% Share Price Slump

The OXE Marine AB (publ) (STO:OXE) share price has fared very poorly over the last month, falling by a substantial 27%. Longer-term, the stock has been solid despite a difficult 30 days, gaining 16% in the last year.

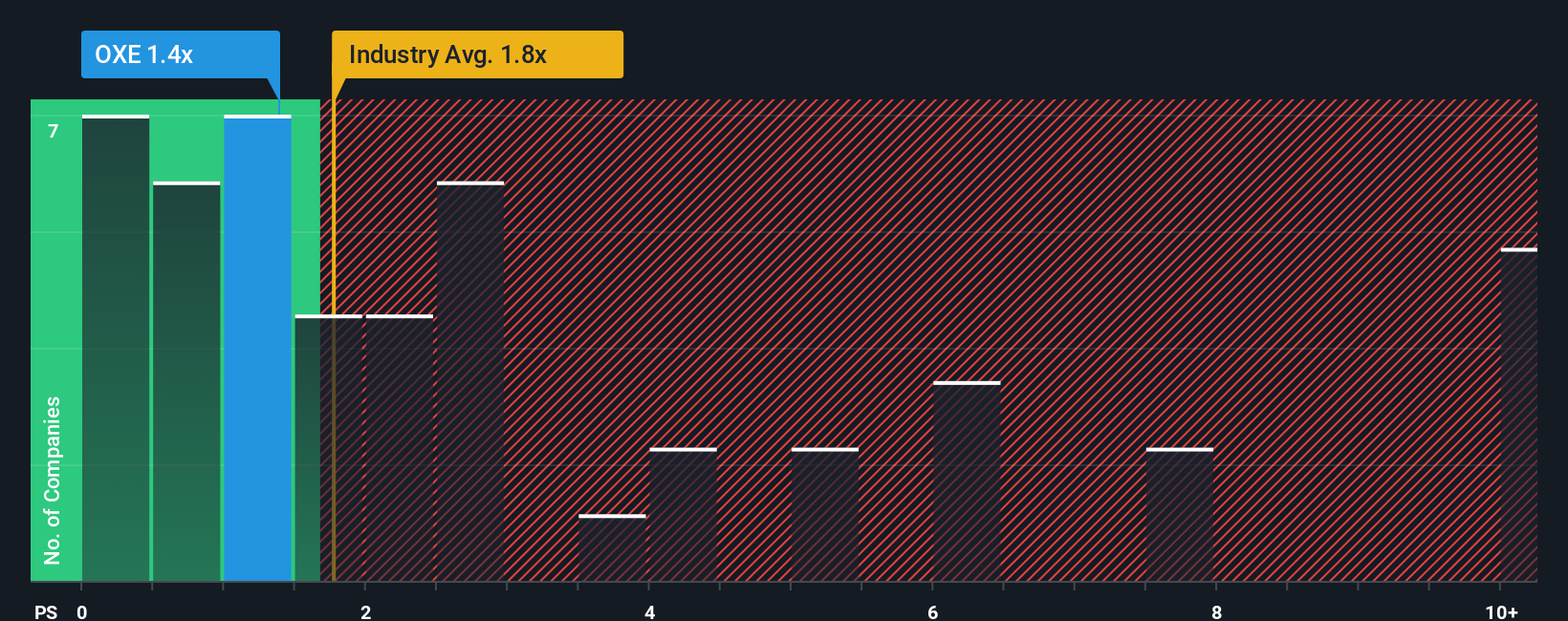

In spite of the heavy fall in price, there still wouldn't be many who think OXE Marine's price-to-sales (or "P/S") ratio of 1.4x is worth a mention when the median P/S in Sweden's Machinery industry is similar at about 1.8x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for OXE Marine

What Does OXE Marine's Recent Performance Look Like?

With its revenue growth in positive territory compared to the declining revenue of most other companies, OXE Marine has been doing quite well of late. It might be that many expect the strong revenue performance to deteriorate like the rest, which has kept the P/S ratio from rising. Those who are bullish on OXE Marine will be hoping that this isn't the case, so that they can pick up the stock at a slightly lower valuation.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on OXE Marine.Do Revenue Forecasts Match The P/S Ratio?

The only time you'd be comfortable seeing a P/S like OXE Marine's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. Fortunately, a few good years before that means that it was still able to grow revenue by 16% in total over the last three years. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Looking ahead now, revenue is anticipated to climb by 19% per year during the coming three years according to the lone analyst following the company. With the industry only predicted to deliver 4.6% per annum, the company is positioned for a stronger revenue result.

With this information, we find it interesting that OXE Marine is trading at a fairly similar P/S compared to the industry. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What Does OXE Marine's P/S Mean For Investors?

OXE Marine's plummeting stock price has brought its P/S back to a similar region as the rest of the industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that OXE Marine currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

Before you settle on your opinion, we've discovered 5 warning signs for OXE Marine (1 can't be ignored!) that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:OXE

OXE Marine

Designs, develops, and distributes diesel outboard engines for the marine market in Sweden and internationally.

Moderate risk with adequate balance sheet.

Market Insights

Community Narratives