Munters Group (OM:MTRS) Lands $215 Million US Hyperscaler Deal Will Data Center Bets Pay Off?

Reviewed by Sasha Jovanovic

- Munters Group announced it has secured several orders worth approximately US$215 million (about SEK2 billion) from a major US hyperscaler for custom-designed Computer Room Air Handlers, with deliveries scheduled from late 2026 through early 2028.

- This long-term deal highlights Munters' increasing presence within the data center cooling market and the growing importance of hyperscaler relationships in driving future revenue streams.

- We'll explore how this sizeable data center order from a leading US hyperscaler may impact Munters Group's growth outlook and positioning.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Munters Group Investment Narrative Recap

To be a shareholder in Munters Group, you need conviction in the long-term adoption of digital infrastructure and Munters’ ability to secure major data center contracts, which has been reinforced by this US$215 million deal. While this news strengthens visibility on forward revenues and underpins the most important near-term growth catalyst, demand for data center cooling, risks tied to execution, margin pressure, and industry competition still merit close attention. In the short term, this order may not be enough to fully offset challenges around earnings volatility and cash flow.

One particularly relevant recent announcement is Munters’ SEK 1 billion green bond issuance in September 2025. This move expands funding options at a time when the company is committing to significant multi-year projects and ongoing capital expenditures, factors that could either strengthen or constrain Munters’ financial flexibility depending on operational outcomes. Investors are likely weighing how new debt and large orders interplay with capacity, leverage, and risk management.

However, even as data center demand grows, investors should be aware that rapid technology shifts, such as alternate cooling emerging among hyperscalers, could alter this picture...

Read the full narrative on Munters Group (it's free!)

Munters Group's outlook anticipates SEK18.7 billion in revenue and SEK1.5 billion in earnings by 2028. This scenario requires 4.6% annual revenue growth and an earnings increase of SEK684 million from the current SEK816 million.

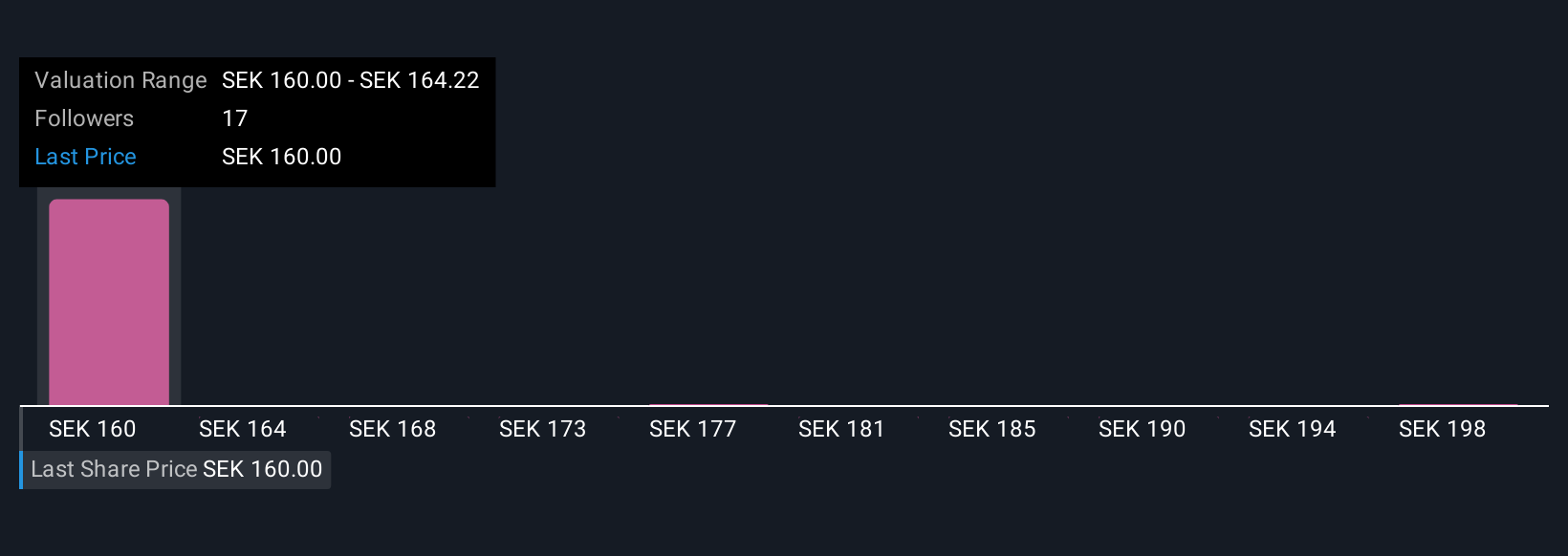

Uncover how Munters Group's forecasts yield a SEK185.00 fair value, a 17% upside to its current price.

Exploring Other Perspectives

Four fair value estimates from the Simply Wall St Community range from SEK165.56 to SEK202.22. Despite high conviction in data center catalysts, margin and competition risks remain in focus for those reassessing Munters’ performance outlook. Consider the varied analyses as you form your own perspective.

Explore 4 other fair value estimates on Munters Group - why the stock might be worth as much as 28% more than the current price!

Build Your Own Munters Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Munters Group research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Munters Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Munters Group's overall financial health at a glance.

Curious About Other Options?

Our top stock finds are flying under the radar-for now. Get in early:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:MTRS

Munters Group

Provides climate solutions in the Americas, Europe, the Middle East, Africa, and Asia.

Reasonable growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives