Did a $30 Million Dehumidification Order Just Shift Munters Group’s (OM:MTRS) Investment Narrative?

Reviewed by Sasha Jovanovic

- Munters Group recently announced it secured a significant order worth US$30 million (approximately SEK280 million) from a US-based commercial battery cell producer, featuring advanced LDP dehumidification systems for ultra-dry air environments.

- This order highlights growing demand for climate control technologies in critical battery production processes, reinforcing Munters’ position in high-spec industrial applications.

- We'll explore how this new contract for specialized battery cell solutions could influence Munters Group's broader market outlook and investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Munters Group Investment Narrative Recap

To be a Munters Group shareholder, you'd typically need to believe in the company's potential to capitalize on rising demand for advanced climate control in sectors like data centers and batteries. The recent US$30 million order confirms robust interest in Munters' high-performance dehumidification systems, but given margin pressures and recent earnings volatility, this order on its own may not materially shift the short-term earnings catalyst or fully address the central risks around margin compression and capital allocation. Among recent announcements, Munters' Q3 report is especially relevant: while sales grew to SEK3,798 million, net income and earnings per share declined year-over-year. This highlights the ongoing pressure on profitability even as top-line growth persists, underscoring why a single high-value order might not be enough to offset margin risk or volatility in earnings. But with margin pressures persisting despite a strong order book, investors should not overlook the risk that...

Read the full narrative on Munters Group (it's free!)

Munters Group is projected to achieve SEK18.7 billion in revenue and SEK1.5 billion in earnings by 2028. To reach these targets, analysts expect a 4.6% annual revenue growth rate and an earnings increase of about SEK684 million from the current SEK816 million.

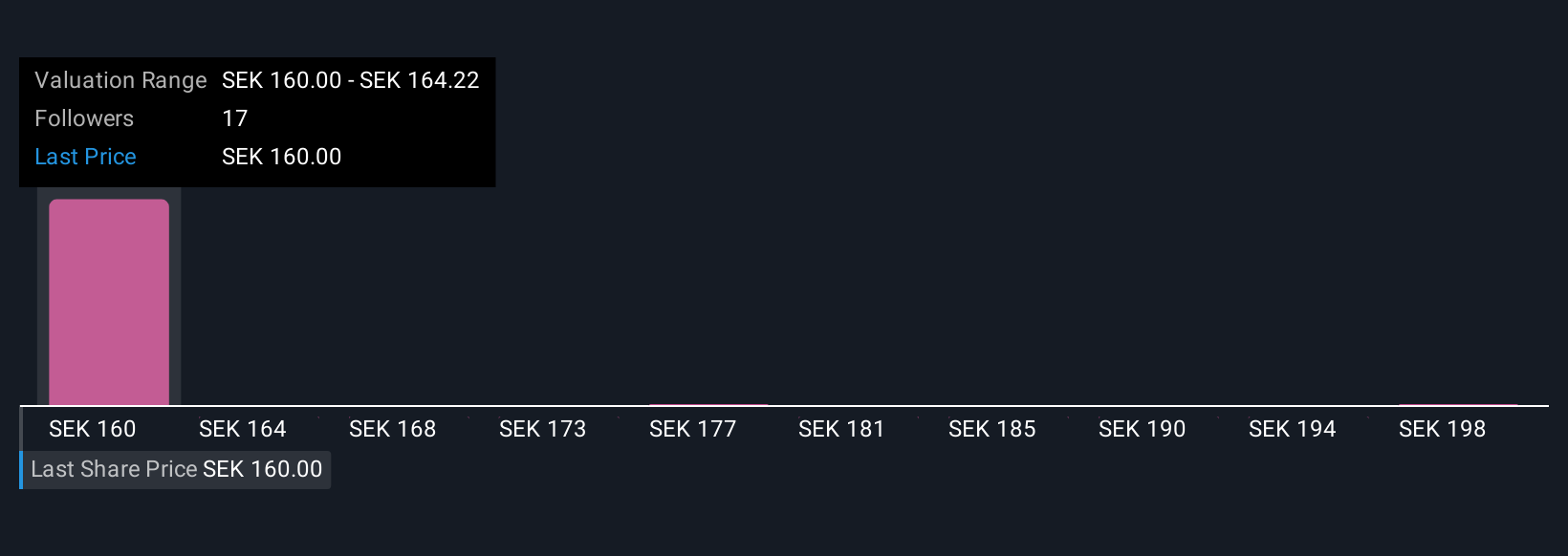

Uncover how Munters Group's forecasts yield a SEK169.00 fair value, a 4% upside to its current price.

Exploring Other Perspectives

Four community members on Simply Wall St estimate Munters' fair value between SEK169 and SEK202.22. While opinions differ widely, many still see margin pressures as an issue shaping potential returns for shareholders.

Explore 4 other fair value estimates on Munters Group - why the stock might be worth just SEK169.00!

Build Your Own Munters Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Munters Group research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Munters Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Munters Group's overall financial health at a glance.

Looking For Alternative Opportunities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:MTRS

Munters Group

Provides climate solutions in the Americas, Europe, the Middle East, Africa, and Asia.

Reasonable growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives