- Sweden

- /

- Electrical

- /

- OM:HTRO

Hexatronic Group AB (publ) (STO:HTRO) Shares Slammed 26% But Getting In Cheap Might Be Difficult Regardless

Hexatronic Group AB (publ) (STO:HTRO) shareholders that were waiting for something to happen have been dealt a blow with a 26% share price drop in the last month. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 56% loss during that time.

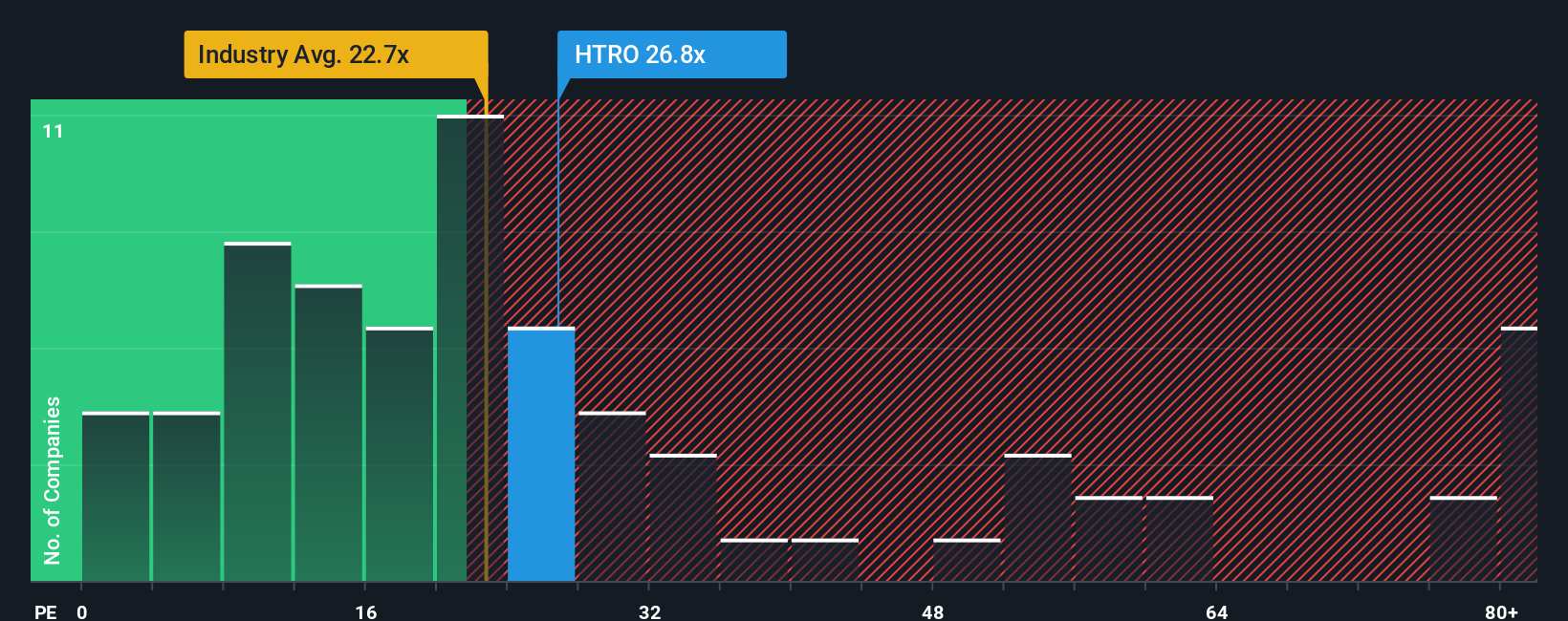

In spite of the heavy fall in price, Hexatronic Group's price-to-earnings (or "P/E") ratio of 26.8x might still make it look like a sell right now compared to the market in Sweden, where around half of the companies have P/E ratios below 21x and even P/E's below 14x are quite common. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

While the market has experienced earnings growth lately, Hexatronic Group's earnings have gone into reverse gear, which is not great. One possibility is that the P/E is high because investors think this poor earnings performance will turn the corner. If not, then existing shareholders may be extremely nervous about the viability of the share price.

Check out our latest analysis for Hexatronic Group

Is There Enough Growth For Hexatronic Group?

Hexatronic Group's P/E ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 72%. As a result, earnings from three years ago have also fallen 81% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Turning to the outlook, the next three years should generate growth of 58% each year as estimated by the dual analysts watching the company. Meanwhile, the rest of the market is forecast to only expand by 19% per annum, which is noticeably less attractive.

In light of this, it's understandable that Hexatronic Group's P/E sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

Despite the recent share price weakness, Hexatronic Group's P/E remains higher than most other companies. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Hexatronic Group maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Hexatronic Group (of which 1 doesn't sit too well with us!) you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Hexatronic Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:HTRO

Hexatronic Group

Develops, manufactures, markets, and sells fiber communication solutions in Sweden, the United States, Germany, the United Kingdom, and internationally.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives