- Sweden

- /

- Industrials

- /

- OM:HAKI B

We Wouldn't Be Too Quick To Buy HAKI Safety AB (publ) (STO:HAKI B) Before It Goes Ex-Dividend

Readers hoping to buy HAKI Safety AB (publ) (STO:HAKI B) for its dividend will need to make their move shortly, as the stock is about to trade ex-dividend. The ex-dividend date is one business day before a company's record date, which is the date on which the company determines which shareholders are entitled to receive a dividend. The ex-dividend date is important because any transaction on a stock needs to have been settled before the record date in order to be eligible for a dividend. This means that investors who purchase HAKI Safety's shares on or after the 29th of October will not receive the dividend, which will be paid on the 4th of November.

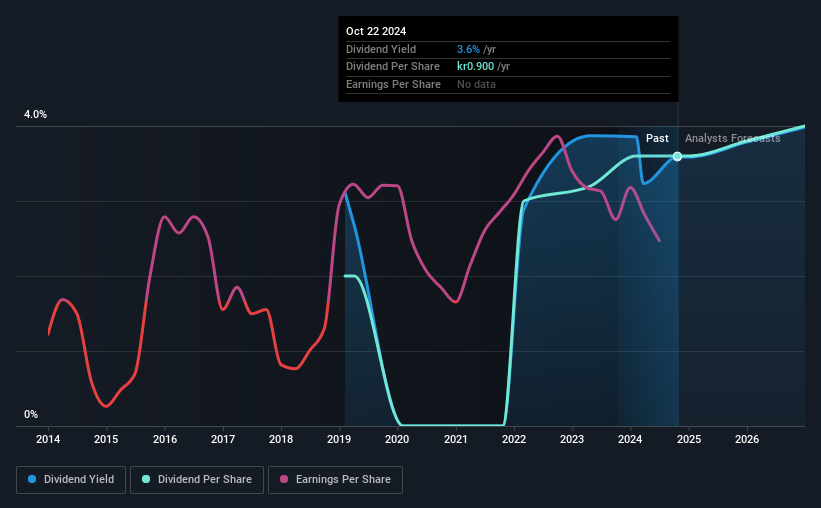

The company's next dividend payment will be kr00.45 per share, and in the last 12 months, the company paid a total of kr0.90 per share. Last year's total dividend payments show that HAKI Safety has a trailing yield of 3.6% on the current share price of kr025.10. Dividends are an important source of income to many shareholders, but the health of the business is crucial to maintaining those dividends. That's why we should always check whether the dividend payments appear sustainable, and if the company is growing.

View our latest analysis for HAKI Safety

If a company pays out more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. HAKI Safety paid out more than half (65%) of its earnings last year, which is a regular payout ratio for most companies. A useful secondary check can be to evaluate whether HAKI Safety generated enough free cash flow to afford its dividend. Dividends consumed 55% of the company's free cash flow last year, which is within a normal range for most dividend-paying organisations.

It's encouraging to see that the dividend is covered by both profit and cash flow. This generally suggests the dividend is sustainable, as long as earnings don't drop precipitously.

Click here to see how much of its profit HAKI Safety paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

Companies with falling earnings are riskier for dividend shareholders. If earnings decline and the company is forced to cut its dividend, investors could watch the value of their investment go up in smoke. Readers will understand then, why we're concerned to see HAKI Safety's earnings per share have dropped 6.3% a year over the past five years. When earnings per share fall, the maximum amount of dividends that can be paid also falls.

The main way most investors will assess a company's dividend prospects is by checking the historical rate of dividend growth. HAKI Safety has delivered an average of 10% per year annual increase in its dividend, based on the past six years of dividend payments. Growing the dividend payout ratio while earnings are declining can deliver nice returns for a while, but it's always worth checking for when the company can't increase the payout ratio any more - because then the music stops.

The Bottom Line

From a dividend perspective, should investors buy or avoid HAKI Safety? It's never good to see earnings per share shrinking, but at least the dividend payout ratios appear reasonable. We're aware though that if earnings continue to decline, the dividend could be at risk. Overall it doesn't look like the most suitable dividend stock for a long-term buy and hold investor.

With that in mind though, if the poor dividend characteristics of HAKI Safety don't faze you, it's worth being mindful of the risks involved with this business. Every company has risks, and we've spotted 4 warning signs for HAKI Safety (of which 1 is concerning!) you should know about.

A common investing mistake is buying the first interesting stock you see. Here you can find a full list of high-yield dividend stocks.

Valuation is complex, but we're here to simplify it.

Discover if HAKI Safety might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:HAKI B

HAKI Safety

Offers scaffolding systems and services for complex projects in industry, infrastructure, and construction.

Good value with reasonable growth potential.