- Sweden

- /

- Capital Markets

- /

- OM:AZA

Top Swedish Dividend Stocks For July 2024

Reviewed by Simply Wall St

As the Swedish market navigates through a period of mixed economic signals and fluctuating indices, investors are increasingly seeking stable returns amidst the uncertainty. In this environment, dividend stocks offer an attractive option for those looking to generate consistent income while potentially benefiting from long-term capital appreciation.

Top 10 Dividend Stocks In Sweden

| Name | Dividend Yield | Dividend Rating |

| Betsson (OM:BETS B) | 5.94% | ★★★★★☆ |

| Zinzino (OM:ZZ B) | 3.84% | ★★★★★☆ |

| Nordea Bank Abp (OM:NDA SE) | 8.49% | ★★★★★☆ |

| HEXPOL (OM:HPOL B) | 3.40% | ★★★★★☆ |

| Axfood (OM:AXFO) | 3.18% | ★★★★★☆ |

| Duni (OM:DUNI) | 4.92% | ★★★★★☆ |

| Skandinaviska Enskilda Banken (OM:SEB A) | 5.16% | ★★★★★☆ |

| Avanza Bank Holding (OM:AZA) | 4.78% | ★★★★★☆ |

| Bahnhof (OM:BAHN B) | 3.85% | ★★★★☆☆ |

| SSAB (OM:SSAB A) | 9.06% | ★★★★☆☆ |

Click here to see the full list of 20 stocks from our Top Swedish Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

Avanza Bank Holding (OM:AZA)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Avanza Bank Holding AB (publ), with a market cap of SEK37.86 billion, provides savings, pension, and mortgage products in Sweden through its subsidiaries.

Operations: Avanza Bank Holding AB (publ) generates revenue primarily from its commercial operations, amounting to SEK3.96 billion.

Dividend Yield: 4.8%

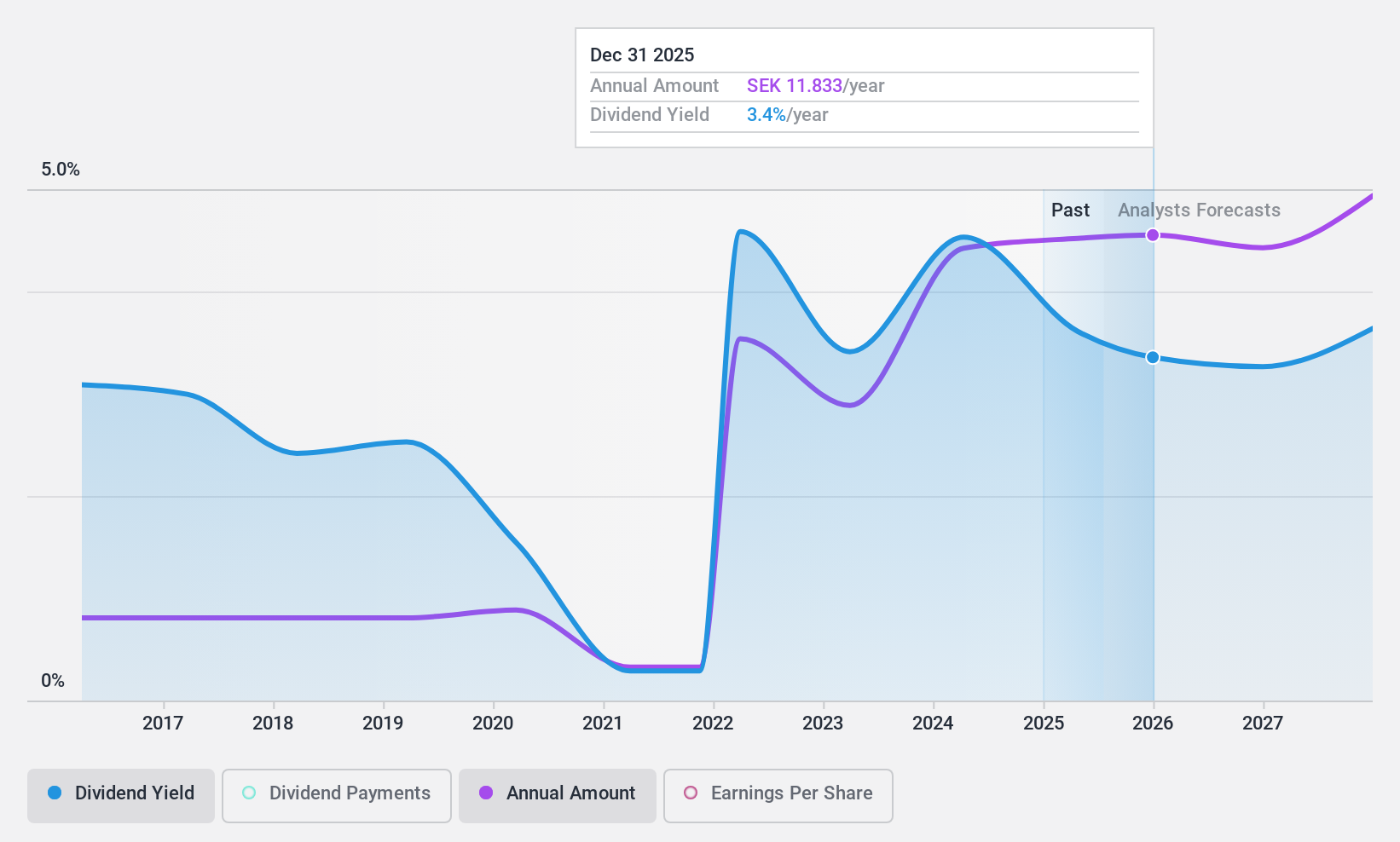

Avanza Bank Holding AB has shown consistent earnings growth, with Q2 2024 net income at SEK 506 million and a six-month net income of SEK 1.06 billion. Despite a volatile dividend history, recent payouts are covered by both earnings (87.3% payout ratio) and cash flows (55.8% cash payout ratio). The dividend yield stands at 4.78%, placing it in the top quartile of Swedish dividend payers, though the track record remains unstable.

- Take a closer look at Avanza Bank Holding's potential here in our dividend report.

- Upon reviewing our latest valuation report, Avanza Bank Holding's share price might be too optimistic.

FM Mattsson (OM:FMM B)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: FM Mattsson AB (publ) develops, manufactures, and sells water taps and related products for bathrooms and kitchens across several European countries, with a market cap of SEK2.20 billion.

Operations: FM Mattsson AB (publ) generates revenue from two primary segments: International, contributing SEK783.23 million, and Nordic Countries, contributing SEK1.12 billion.

Dividend Yield: 4.8%

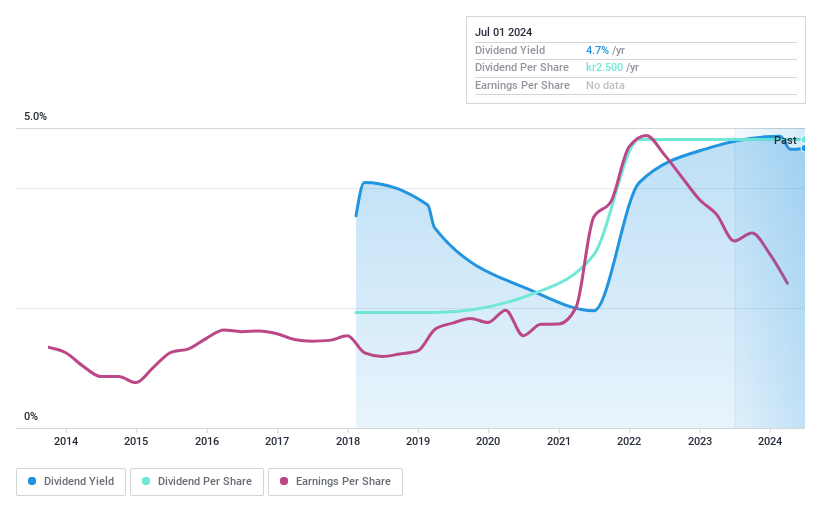

FM Mattsson, recently renamed from FM Mattsson Mora Group AB, offers a dividend yield of 4.81%, positioning it in the top 25% of Swedish dividend payers. Despite a relatively short history of six years, dividends have been stable and covered by earnings (86.3% payout ratio) and free cash flows (49.5% cash payout ratio). However, Q1 2024 results showed a decline in net income to SEK 28.2 million from SEK 52.9 million year-on-year, raising concerns about future sustainability.

- Navigate through the intricacies of FM Mattsson with our comprehensive dividend report here.

- In light of our recent valuation report, it seems possible that FM Mattsson is trading behind its estimated value.

Loomis (OM:LOOMIS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Loomis AB (publ) offers services for the distribution, payments, handling, storage, and recycling of cash and other valuables with a market cap of SEK23.58 billion.

Operations: Loomis AB (publ) generates revenue from Loomis Pay (SEK 77 million), Europe and Latin America (SEK 14.32 billion), and the United States of America (SEK 15.45 billion).

Dividend Yield: 3.7%

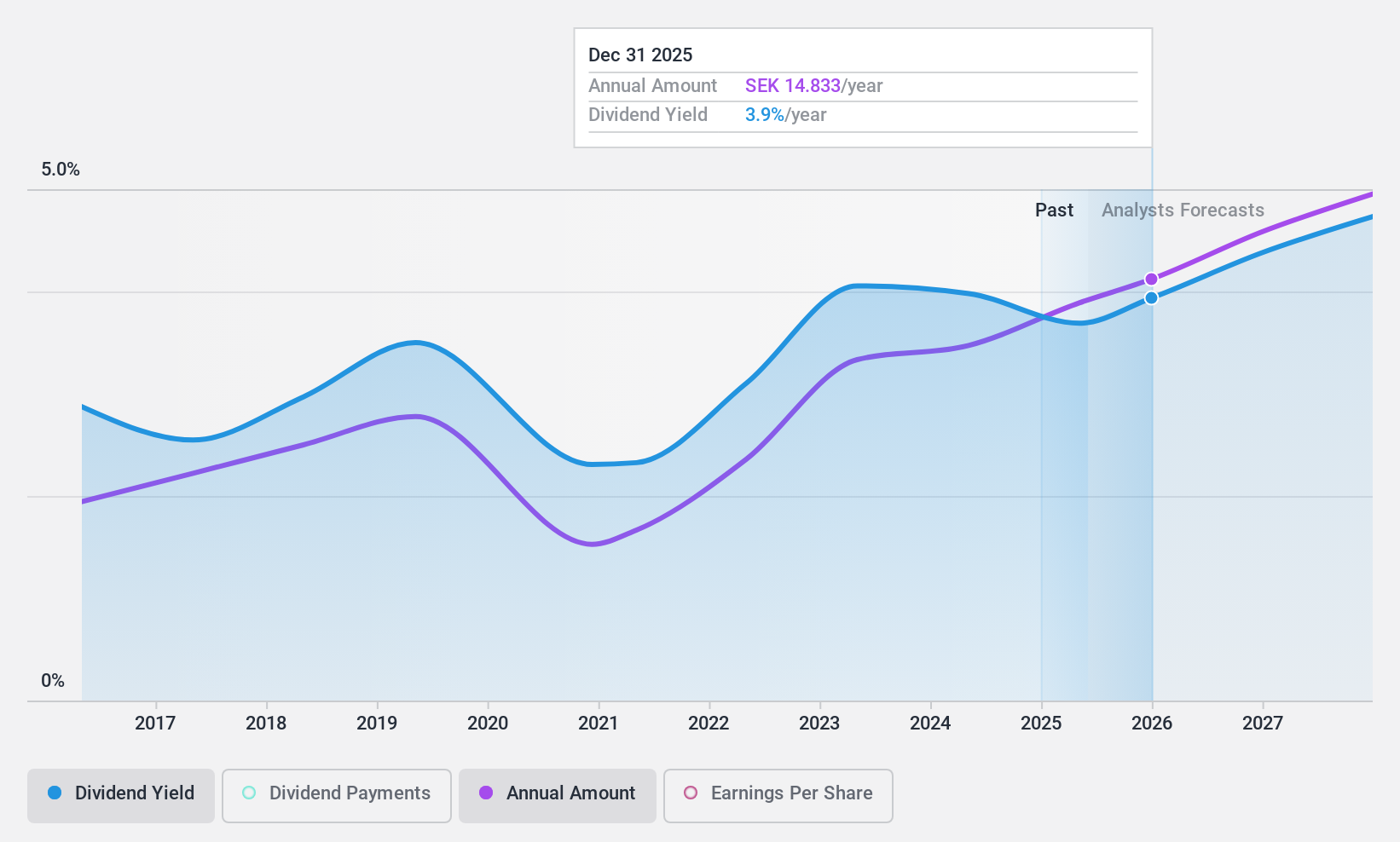

Loomis AB’s dividend yield of 3.69% is below the top quartile of Swedish dividend payers. Despite a volatile dividend history, recent dividends are well-covered by earnings (59.4% payout ratio) and cash flows (26.3% cash payout ratio). The company reported Q2 2024 sales of SEK 7.64 billion and net income of SEK 396 million, showing year-on-year growth in both metrics. Recent share buybacks totaling SEK 199.75 million may enhance shareholder value further.

- Dive into the specifics of Loomis here with our thorough dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Loomis shares in the market.

Seize The Opportunity

- Access the full spectrum of 20 Top Swedish Dividend Stocks by clicking on this link.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:AZA

Avanza Bank Holding

Offers a range of savings, pension, and mortgages products in Sweden.

Established dividend payer with adequate balance sheet.