Stock Analysis

- Sweden

- /

- Retail Distributors

- /

- OM:ZZ B

Three Swedish Dividend Stocks Offering Yields From 3% To 4.6%

Reviewed by Simply Wall St

As global markets experience modest gains and shifts in investor sentiment, Sweden's market remains a point of interest for those looking at dividend stocks. In the current economic climate, understanding the stability and yield potential of stocks is crucial for investors seeking to enhance their portfolios with international exposure.

Top 10 Dividend Stocks In Sweden

| Name | Dividend Yield | Dividend Rating |

| Zinzino (OM:ZZ B) | 4.50% | ★★★★★★ |

| Betsson (OM:BETS B) | 6.04% | ★★★★★☆ |

| Loomis (OM:LOOMIS) | 4.54% | ★★★★★☆ |

| HEXPOL (OM:HPOL B) | 3.35% | ★★★★★☆ |

| Duni (OM:DUNI) | 4.88% | ★★★★★☆ |

| Nordea Bank Abp (OM:NDA SE) | 8.19% | ★★★★★☆ |

| Skandinaviska Enskilda Banken (OM:SEB A) | 5.60% | ★★★★★☆ |

| Avanza Bank Holding (OM:AZA) | 4.37% | ★★★★★☆ |

| Afry (OM:AFRY) | 3.00% | ★★★★☆☆ |

| AB Traction (OM:TRAC B) | 4.07% | ★★★★☆☆ |

Click here to see the full list of 25 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of from the screener.

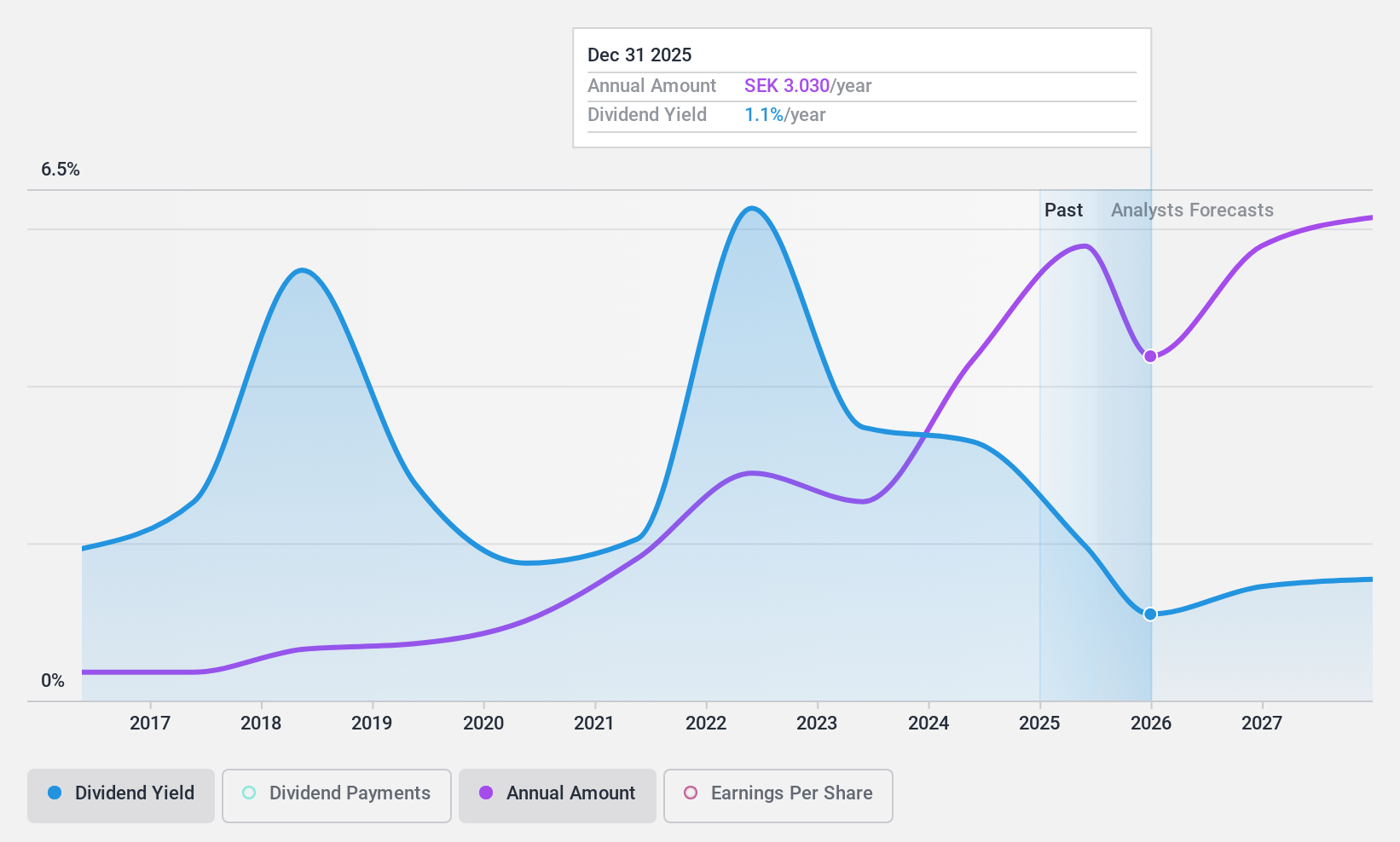

Afry (OM:AFRY)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Afry AB is a company that offers engineering, design, and advisory services across various sectors including infrastructure, industry, energy, and digitalization in North and South America, Finland, and Central Europe, with a market capitalization of SEK 20.76 billion.

Operations: Afry AB generates revenue from several segments, with Infrastructure contributing SEK 10.26 billion, Process Industries SEK 5.53 billion, Industrial & Digital Solutions SEK 6.77 billion, Energy SEK 3.59 billion, and Management Consulting SEK 1.63 billion.

Dividend Yield: 3%

Afry, a Swedish engineering firm, declared a dividend of SEK 5.50 per share at its recent AGM, reflecting its commitment to shareholder returns despite a slight dip in Q1 2024 earnings with net income falling to SEK 355 million from SEK 436 million year-over-year. The firm's dividend yield stands at 3%, below the top quartile of Swedish dividend payers. While dividends are supported by both earnings and cash flows with payout ratios of 61.1% and 37% respectively, Afry's decade-long track record shows volatility in dividend payments, suggesting potential instability for investors seeking consistent income streams. Additionally, Afry is trading significantly below estimated fair value, offering a potentially attractive entry point for value investors.

- Take a closer look at Afry's potential here in our dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Afry shares in the market.

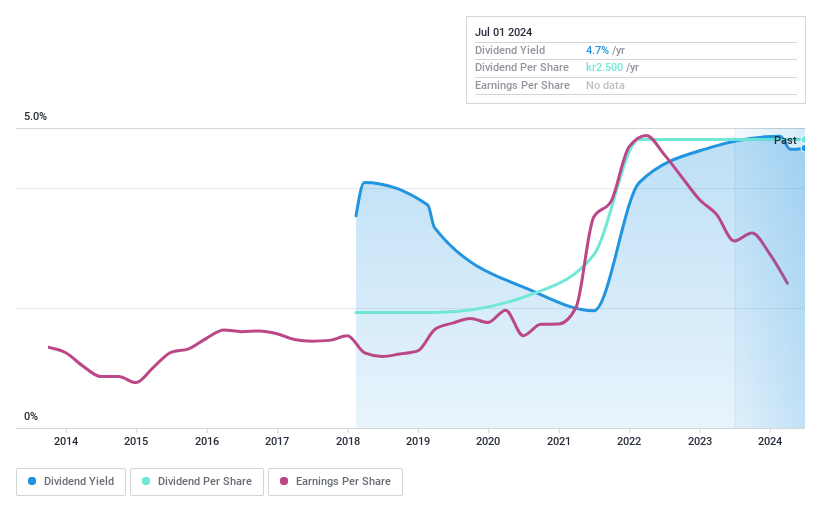

FM Mattsson (OM:FMM B)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: FM Mattsson AB (publ) specializes in developing, manufacturing, and selling water taps and related products for bathrooms and kitchens across Sweden, Norway, Denmark, Finland, Benelux, the UK, Germany, and Italy with a market capitalization of SEK 2.28 billion.

Operations: FM Mattsson AB generates revenue primarily from the Nordic countries, where it earned SEK 1.12 billion, and from international markets with revenues of SEK 783.23 million.

Dividend Yield: 4.6%

FM Mattsson, recently renamed, reported a Q1 2024 sales drop to SEK 493.4 million and a net income decrease to SEK 28.2 million from the previous year. Despite this downturn, the company maintains a dividend yield of 4.63%, ranking in the top quartile of Swedish dividend stocks. Dividends are well-supported by earnings and cash flows with payout ratios at 86.3% and 49.5% respectively, though its history of dividend payments spans only six years, suggesting potential concerns about long-term sustainability and stability in its shareholder returns.

- Navigate through the intricacies of FM Mattsson with our comprehensive dividend report here.

- Upon reviewing our latest valuation report, FM Mattsson's share price might be too pessimistic.

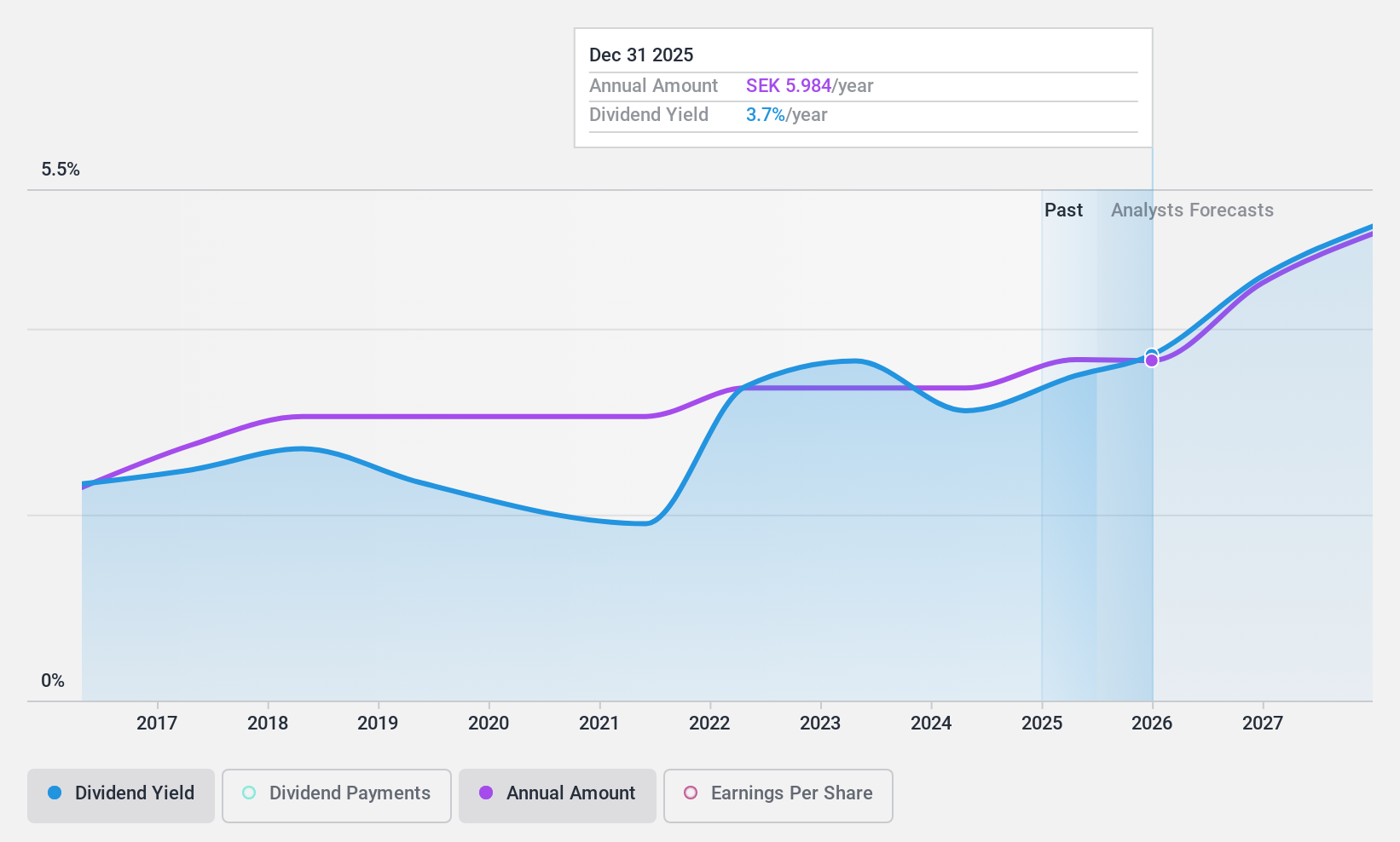

Zinzino (OM:ZZ B)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Zinzino AB (publ), headquartered in Sweden, operates internationally as a direct sales company specializing in dietary supplements and skincare products, with a market capitalization of approximately SEK 2.29 billion.

Operations: Zinzino AB generates its revenue primarily through two segments: Faun, which contributed SEK 161.20 million, and Zinzino (including VMA Life), which accounted for SEK 1737.25 million.

Dividend Yield: 4.5%

Zinzino AB offers a compelling 4.5% dividend yield, well above the Swedish market average. With a decade of stable dividends, recent earnings growth of 107.6%, and forecasts suggesting further annual increases of around 9.75%, the company's dividends appear sustainable, supported by both earnings and cash flows with payout ratios under 60%. However, significant insider selling in the past three months may raise caution among investors. Recent expansions into Serbia and strategic acquisitions in the US and Asia indicate proactive management driving international growth.

- Click here to discover the nuances of Zinzino with our detailed analytical dividend report.

- Our expertly prepared valuation report Zinzino implies its share price may be lower than expected.

Seize The Opportunity

- Unlock more gems! Our Top Dividend Stocks screener has unearthed 22 more companies for you to explore.Click here to unveil our expertly curated list of 25 Top Dividend Stocks.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Zinzino is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:ZZ B

Zinzino

A direct sales company, provides dietary supplements and skincare products in Sweden and internationally.

Outstanding track record with flawless balance sheet and pays a dividend.