- Sweden

- /

- Construction

- /

- OM:FG

Fasadgruppen Group AB (publ) (STO:FG) Stocks Pounded By 25% But Not Lagging Industry On Growth Or Pricing

Fasadgruppen Group AB (publ) (STO:FG) shares have had a horrible month, losing 25% after a relatively good period beforehand. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 44% in that time.

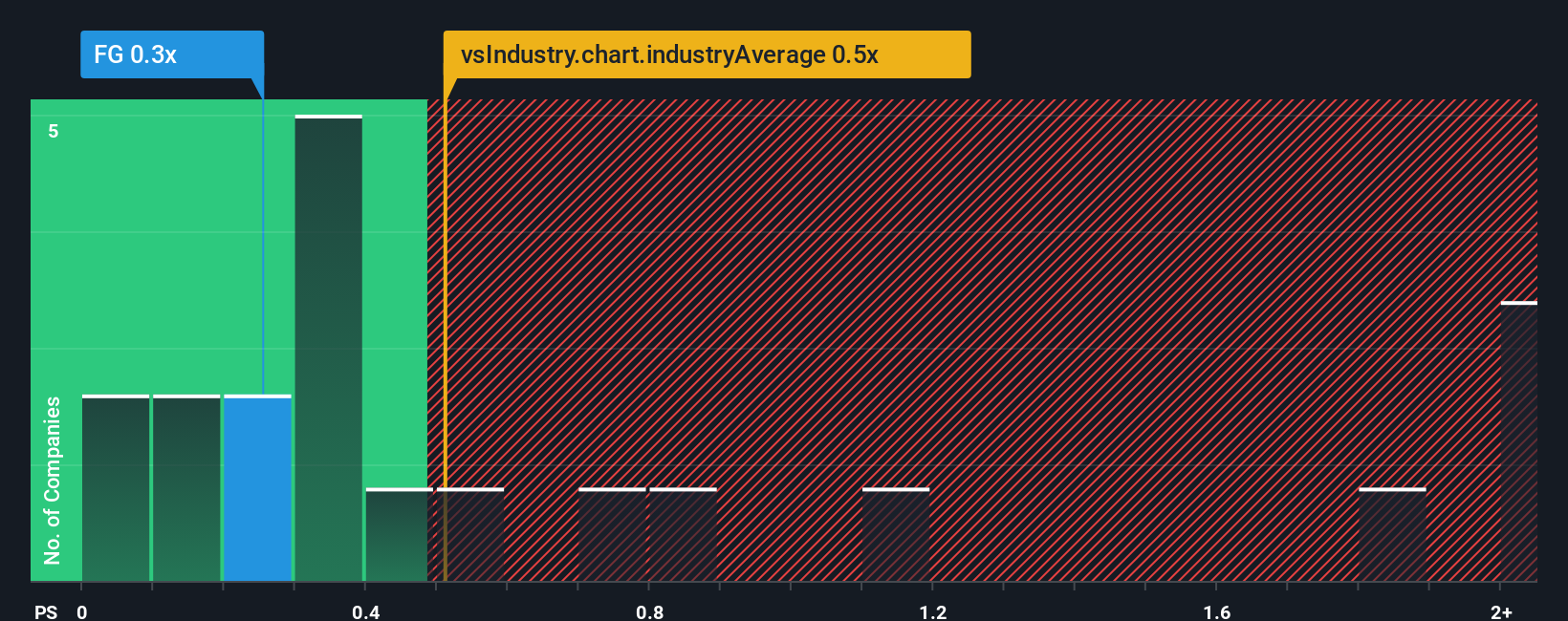

Although its price has dipped substantially, it's still not a stretch to say that Fasadgruppen Group's price-to-sales (or "P/S") ratio of 0.3x right now seems quite "middle-of-the-road" compared to the Construction industry in Sweden, where the median P/S ratio is around 0.4x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Fasadgruppen Group

How Has Fasadgruppen Group Performed Recently?

With revenue growth that's inferior to most other companies of late, Fasadgruppen Group has been relatively sluggish. It might be that many expect the uninspiring revenue performance to strengthen positively, which has kept the P/S ratio from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Fasadgruppen Group.What Are Revenue Growth Metrics Telling Us About The P/S?

The only time you'd be comfortable seeing a P/S like Fasadgruppen Group's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a decent 3.6% gain to the company's revenues. This was backed up an excellent period prior to see revenue up by 47% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 5.1% during the coming year according to the dual analysts following the company. With the industry predicted to deliver 4.7% growth , the company is positioned for a comparable revenue result.

In light of this, it's understandable that Fasadgruppen Group's P/S sits in line with the majority of other companies. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Key Takeaway

Fasadgruppen Group's plummeting stock price has brought its P/S back to a similar region as the rest of the industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

A Fasadgruppen Group's P/S seems about right to us given the knowledge that analysts are forecasting a revenue outlook that is similar to the Construction industry. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. Unless these conditions change, they will continue to support the share price at these levels.

We don't want to rain on the parade too much, but we did also find 1 warning sign for Fasadgruppen Group that you need to be mindful of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:FG

Fasadgruppen Group

Operates as a service provider of facades in Sweden, Denmark, Norway, and Finland.

Undervalued with reasonable growth potential.

Market Insights

Community Narratives