Electrolux Professional (OM:EPRO B) Is Down 6.1% After Cost-Cutting Plan and Weaker Q3 Results – What’s Changed

Reviewed by Sasha Jovanovic

- Electrolux Professional AB recently reported third-quarter 2025 results, with sales of SEK 2,816 million and net income of SEK 40 million, both down compared to the same period last year.

- Alongside the subdued earnings, the company introduced a major efficiency program targeting SEK 85 million in cost savings and a workforce reduction affecting 350 employees, aiming to counter market pressures and improve profitability.

- We'll examine how Electrolux Professional's new cost-saving initiative could alter the company's growth outlook and risk profile moving forward.

These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Electrolux Professional Investment Narrative Recap

To back Electrolux Professional as a shareholder, you need confidence in the company's ability to manage through international demand swings and margin pressures, while executing on cost control and innovation. The latest financial update reinforces margin and earnings risk as the biggest near-term threat, although the efficiency program is positioned as the most immediate catalyst, short-term impact on business fundamentals remains moderate as the savings are phased in and revenue drivers remain unchanged.

The most relevant recent announcement alongside earnings is the cost-saving efficiency program unveiled in September, which aims for SEK 175 million in annual run-rate savings by 2027 and includes significant headcount reductions. This initiative closely aligns with near-term investor focus on restoring profitability and offsetting rising operational costs, which have been persistently squeezing margins and overshadowing the promise of future growth from new products and sustainability efforts.

However, investors should also pay close attention to ongoing currency headwinds and how a weaker dollar versus the Swedish krona could further impact margins if...

Read the full narrative on Electrolux Professional (it's free!)

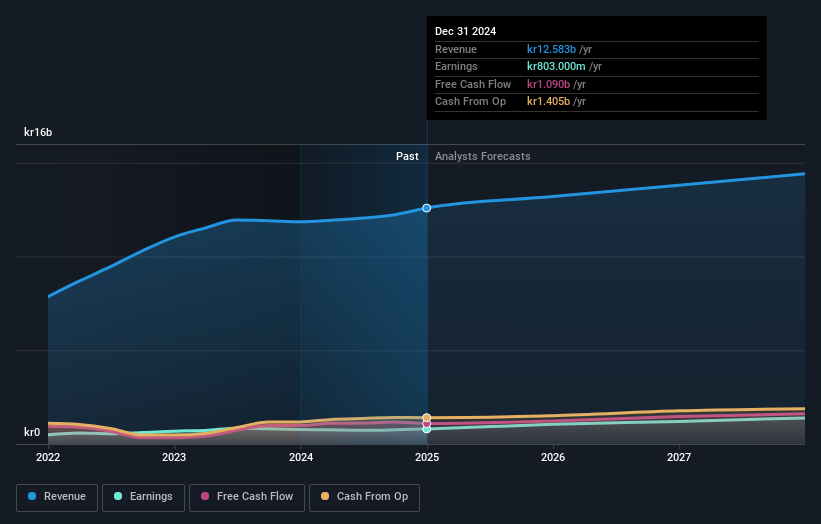

Electrolux Professional’s outlook anticipates SEK 14.2 billion in revenue and SEK 1.4 billion in earnings by 2028. This projection is based on a 4.2% annual revenue growth rate and an earnings increase of SEK 582 million from the current SEK 818 million.

Uncover how Electrolux Professional's forecasts yield a SEK75.00 fair value, a 13% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members have shared just two fair value estimates for Electrolux Professional, ranging from SEK75 to SEK109.94. With margin pressures resurfacing, it is clear that market participants weigh risks and rewards differently, so you may want to review several perspectives before deciding where this company stands for you.

Explore 2 other fair value estimates on Electrolux Professional - why the stock might be worth just SEK75.00!

Build Your Own Electrolux Professional Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Electrolux Professional research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Electrolux Professional research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Electrolux Professional's overall financial health at a glance.

Searching For A Fresh Perspective?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Electrolux Professional might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:EPRO B

Electrolux Professional

Provides food service, beverage, and laundry products and solutions to restaurants, hotels, healthcare, educational, and other service facilities.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives