Electrolux Professional (OM:EPRO B): Evaluating Valuation Following Strategic Partnerships and New Sustainability Initiatives

Reviewed by Simply Wall St

Electrolux Professional (OM:EPRO B) recently rolled out a series of strategic moves, including teaming up with Mimbly on water-efficient technologies, shifting cooking production to Italy, and releasing new sustainability-focused product lines.

See our latest analysis for Electrolux Professional.

The recent pace of Electrolux Professional’s innovation and operational changes seems to have drawn mixed reactions from the market. The share price has given back 6% over the past month, even as the company outlines its next growth phase. Still, a positive 2.4% total shareholder return over the last year and more than 50% total return over three years suggest investors with patience have been rewarded. Momentum may be quietly building beneath the surface.

If you’re thinking about what types of companies are driving long-term growth, this is a good moment to broaden your horizons and discover fast growing stocks with high insider ownership

With shares trading at a notable discount to analyst targets despite solid long-term gains, investors now face a key question: is the market underestimating Electrolux Professional’s growth prospects, or is all the good news already priced in?

Most Popular Narrative: 14.9% Undervalued

With the most widely followed narrative suggesting fair value is 14.9% above the last close, Electrolux Professional’s current price looks inexpensive compared to future potential, considering bold forecasts and potential margin expansion.

Substantial investment in R&D (now approximately 5% of sales, up from around 3% three years ago) and the imminent rollout of new, higher-value, energy-efficient, and connected products is expected to expand gross margins and net earnings. This aligns with heightened customer focus on sustainability and efficiency.

Want to know why this premium is within reach? The main driver behind the narrative is a leap in margins paired with aggressive top-line projections. If you’re curious about which boundary-pushing assumptions are setting this target, you’ll want to explore the full narrative for the figures that could reshape how you value Electrolux Professional.

Result: Fair Value of $75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing currency headwinds and rising operational costs could strain margins. These factors may potentially undermine the optimistic outlook for Electrolux Professional's long-term growth.

Find out about the key risks to this Electrolux Professional narrative.

Another View: Market Ratios Tell a Different Story

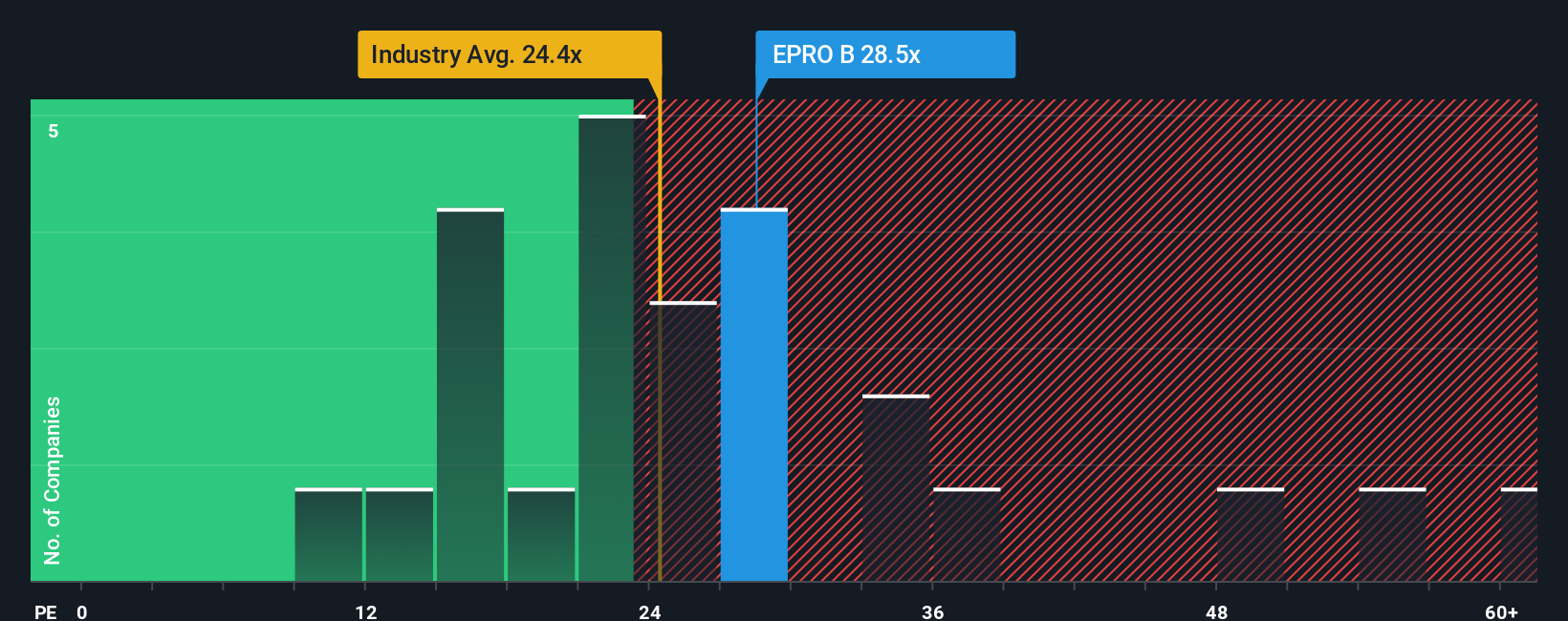

While fair value models hint at Electrolux Professional being undervalued, looking through the lens of its price-to-earnings ratio reveals a higher price than both the Swedish Machinery industry and peer average. At 27.3x earnings, the stock sits above the industry average of 23.3x and its peer group at 27.1x.

Compared to its fair ratio of 31.3x, there is scope for upside. However, any return toward the market’s average could also signal risk if growth expectations fall short. Are investors paying up for growth that is not guaranteed?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Electrolux Professional Narrative

If you see the story differently or want to chart your own path, you can dive into the numbers and build a narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Electrolux Professional.

Looking for More Investment Opportunities?

Smart investors know broadening your portfolio can mean catching the next big winner before everyone else. Don’t let these market-moving ideas pass you by. Put your money where growth and innovation are happening now.

- Tap into high-yield returns when you scan these 18 dividend stocks with yields > 3% that consistently outpace the market with stable payouts.

- Uncover the explosive potential in artificial intelligence by targeting these 27 AI penny stocks making waves in automation, data analysis, and machine learning.

- Seize the chance to grab strong value plays among these 901 undervalued stocks based on cash flows for compelling upside that others might overlook.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Electrolux Professional might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:EPRO B

Electrolux Professional

Provides food service, beverage, and laundry products and solutions to restaurants, hotels, healthcare, educational, and other service facilities.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives