Epiroc (OM:EPI A): Exploring Valuation After Recent Investor Interest and Share Price Momentum

Reviewed by Simply Wall St

Most Popular Narrative: 2.9% Undervalued

According to the most widely followed narrative, Epiroc is considered slightly undervalued based on current projections of future earnings, margins, and risk factors. This assessment reflects a consensus among analysts who see further upside for the stock if the company can deliver on key strategic initiatives.

Epiroc's record contract to supply fully autonomous and electric surface mining equipment, coupled with rising demand for electrified, low-emission machinery (as seen in the Boliden BEV project and the Assmang Black Rock Mine), positions the company to capture share as customers accelerate fleet modernization driven by tightening emissions regulations. This supports future equipment revenues and margins.

Curious about what’s fueling this premium price? There is one bold earnings projection behind the narrative, and a future profit multiple that signals a leap of confidence. Ever wonder what analysts are really betting on for revenue growth and margins? The answer might challenge what you thought about this sector’s valuation playbook.

Result: Fair Value of $208.5 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, unexpected weakness in the construction sector or sharp commodity price swings could quickly challenge analysts’ confidence in Epiroc’s growth trajectory.

Find out about the key risks to this Epiroc narrative.Another View: Valuation Through Industry Lens

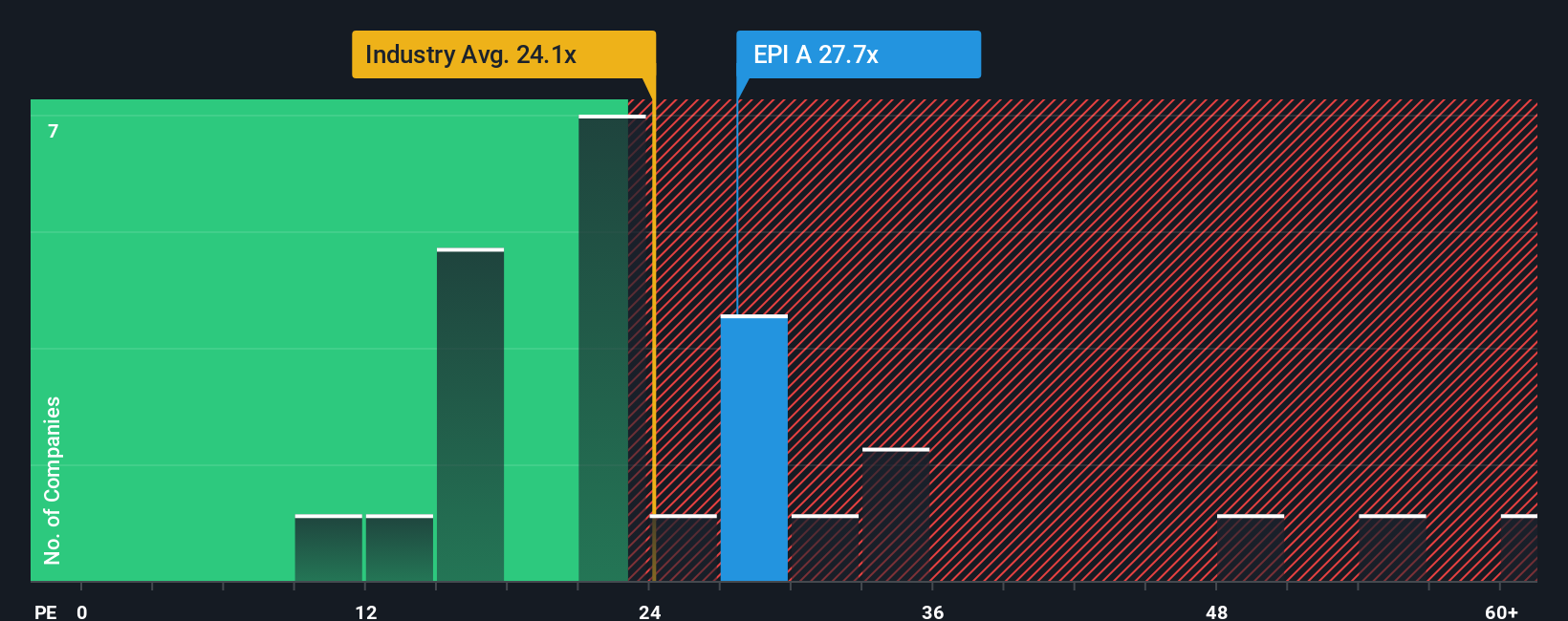

Looking from another angle, Epiroc appears expensive compared to the Swedish Machinery industry based on earnings. This measure highlights the premium the market is willing to pay for future growth. Does that premium really make sense?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Epiroc Narrative

If you see things differently or want to dive into the numbers on your own terms, you can build and share your own story for Epiroc in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Epiroc.

Looking for more investment ideas?

Ready to move beyond Epiroc? The market is packed with exciting opportunities just waiting for you. Don’t let the next big winner slip by. Try these hand-picked searches and unlock fresh investment inspiration today.

- Tap into growth with companies at the forefront of artificial intelligence advancements through our handpicked list of AI penny stocks.

- Find steady income potential by browsing businesses offering attractive yields, easily accessed in our dedicated section on dividend stocks with yields > 3%.

- Uncover stocks the market may be underestimating with our expertly curated showcase of undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Epiroc might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About OM:EPI A

Epiroc

Develops and produces equipment for use in surface and underground applications in North America, Europe, South America, Europe, Africa, the Middle East, Asia, Australia, and India.

Excellent balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives