engcon's (STO:ENGCON B) Dividend Will Be Increased To SEK0.47

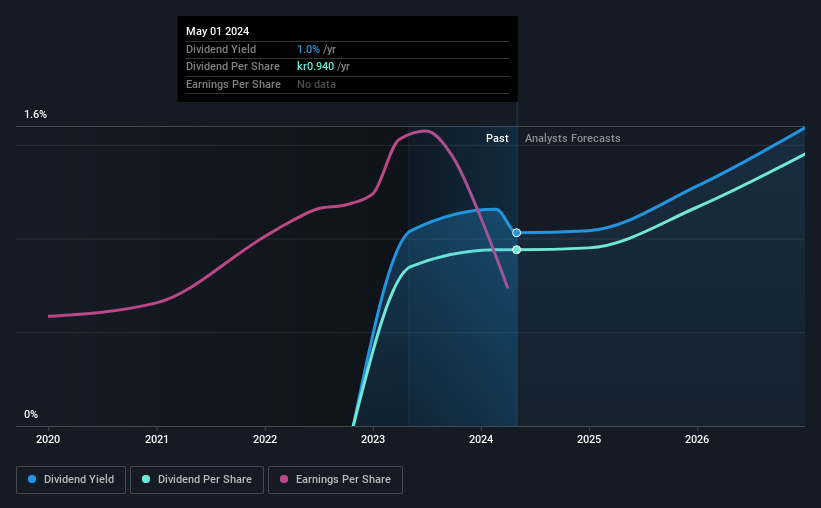

engcon AB (publ) (STO:ENGCON B) has announced that it will be increasing its dividend from last year's comparable payment on the 10th of May to SEK0.47. This takes the annual payment to 1.0% of the current stock price, which unfortunately is below what the industry is paying.

See our latest analysis for engcon

engcon's Earnings Easily Cover The Distributions

It would be nice for the yield to be higher, but we should also check if higher levels of dividend payment would be sustainable. Before this announcement, engcon was paying out 78% of earnings, but a comparatively small 37% of free cash flows. This leaves plenty of cash for reinvestment into the business.

Over the next year, EPS is forecast to expand by 154.9%. Under the assumption that the dividend will continue along recent trends, we think the payout ratio could be 24% which would be quite comfortable going to take the dividend forward.

engcon Is Still Building Its Track Record

It is tough to make a judgement on how stable a dividend is when the company hasn't been paying one for very long. This doesn't mean that the company can't pay a good dividend, but just that we want to wait until it can prove itself.

engcon May Find It Hard To Grow The Dividend

Investors could be attracted to the stock based on the quality of its payment history. However, engcon has only grown its earnings per share at 4.6% per annum over the past five years. engcon's earnings per share has barely grown, which is not ideal - perhaps this is why the company pays out the majority of its earnings to shareholders. When a company prefers to pay out cash to its shareholders instead of reinvesting it, this can often say a lot about that company's dividend prospects.

In Summary

Overall, this is probably not a great income stock, even though the dividend is being raised at the moment. In the past, the payments have been unstable, but over the short term the dividend could be reliable, with the company generating enough cash to cover it. We would probably look elsewhere for an income investment.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. However, there are other things to consider for investors when analysing stock performance. For example, we've picked out 1 warning sign for engcon that investors should know about before committing capital to this stock. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:ENGCON B

engcon

Engages in the design, production, and sale of excavator tools in Sweden, Denmark, Norway, Finland, rest of Europe, North and South America, Japan, South Korea, Australia, New Zealand, and internationally.

Exceptional growth potential with flawless balance sheet.

Market Insights

Community Narratives